FICO Score vs VantageScore

It is important to know the difference between the two commonly used credit scoring models. These scores can vary greatly and knowing ‘why’ will help you be prepared whenever dealing with all decisions that are affected by your credit scores.

Should you Check your VantageScore or your FICO Score?

“If you’re going to pay for a credit score, get a FICO score,” says NerdWallet personal finance columnist Liz Weston. “It’s the one most likely to be used in big lending decisions.”

But if you simply want to track your credit score over time, a VantageScore will do the trick just as well as a FICO, Weston says. The same behaviors influence them both.

FICO is favored by the law in one crucial spot: home mortgages. Right now, it’s the only tool to evaluate credit risk that is approved for use by government-sponsored enterprises such as Fannie Mae and Freddie Mac. And the version being used is FICO 4, which came out in 2004.

But FICO’s effective monopoly on this front could soon be over. A bill was introduced in the House in February 2017 that would allow Fannie and Freddie to look at alternatives to FICO in evaluating credit.

In the meantime, VantageScore is already being used for some auto loans, credit cards and mortgages, and is gaining wider acceptance. And when you apply for credit, you don’t get to choose which score will be used, so it’s good to keep an eye on both your FICO and VantageScore.

How VantageScore calculates your credit score

VantageScore isn’t nearly as specific as FICO when it comes to how it determines your credit score using its scoring model. It provides a rough outline of factors it considers important and those it considers less important.

Extremely influential — payment history. Just like FICO Score, VantageScore puts payment history at the top of the list. It won’t say how much it weighs it in factoring your overall score, though.

Highly influential — age & type of credit, credit utilization. It’s unclear if VantageScore weighs credit mix or credit length more or less than FICO because it lumps both of them into one category it deems “highly influential.” Credit utilization is weighed heavily in both the VantageScore and FICO Score models.

Moderately influential — total balances. VantageScore separates out total balances from the credit utilization factor, but it’s only moderately influential. That seems similar to how FICO factors in credit utilization, putting a larger emphasis on lower utilization than it does on lower total balances.

Less influential — available credit, recent credit behavior & inquiries. VantageScore may benefit consumers with less available overall credit, suggesting you only open credit you need. Similar to FICO Score, VantageScore likes to see fewer hard inquiries on your report.

More differences between FICO and VantageScore

Beyond the big scoring differences, there are a few more subtle differences between FICO and VantageScore:

VantageScore affords consumers 14 days to rate shop new loans. FICO provides 45 days.

VantageScore includes rent, utility, cable, and phone bill payments in your score. FICO doesn’t include those factors in its scoring model.

VantageScore weighs a late mortgage payment more heavily than late payments on other debts.

VantageScore doesn’t factor in paid collections. FICO Score 9 also drops paid collections, but the more popular FICO Score 8 still does.

FICO Dominates but Vantage is still Useful

If you’re looking to get a good idea of what potential lenders will see when they check your credit, you’ll want to get a FICO score. Preferably, you’ll get a score based on data from each credit bureau. 90% of lending decisions are based on some form of the FICO scoring model.

Using VantageScore as part of your decision making for loan or credit card applications can provide a false sense of confidence depending on your credit history. It also might suggest you apply for an inferior loan or product because it has a lower score than your FICO Score.

VantageScore is still useful for keeping an eye on trends. It’s very likely changes in your VantageScore will correlate with changes in your FICO Score. If you can’t access one of your FICO scores, a VantageScore is certainly better than nothing.

Legislation of this nature has been circulating in Congress for years. In February, a bipartisan group of congressmen reintroduced the Credit Score Competition Act, which contains the same language as the Senate bill. Also in February, the Consumer Financial Protection Bureau put out a call for feedback on the benefits and risks of alternative credit data. The CFPB has estimated that 26 million people in the U.S. are “credit invisible,” meaning they don’t have a credit history with a consumer reporting agency, while another 19 million consumers don’t have an extensive enough credit history to get a credit score.

https://www.myfico.com/crediteducation/brochures.aspx#uycs

https://www.myfico.com/Downloads/Files/myFICO_UYFS_Booklet.pdf

As of 2017, 10 states go even further than that, limiting the degree to which employers can use credit checks in making employment decisions.

For example, California prohibits employers from gathering credit information for the purposes of making hiring decisions, unless it’s for specific jobs, including managerial roles, law enforcement jobs, or positions with the state department of justice.

Potential red flags include:

Liens – Any type of lien against you could be a sign of irresponsibility. It suggests to employers that you weren’t responsible enough to pay off your debt or negotiate a settlement.

100 Percent Credit Utilization – This shows employers that you’re in over your head and can’t stick to a budget.

Bankruptcy/Foreclosure – Again this shows a lack of responsibility for things you’re committed to. To an employer, this could suggest that you’ll bail on large projects and aren’t resourceful enough.

Recent Late Fees – Recent 30-, 60-, or 90-day late fees show finances are causing you significant stress. This activity may appear as more of a red flag for financial positions because it suggests you have trouble budgeting.

Significant Activity – A recent opening of several new accounts or closing of several accounts could appear as a red flag. Significant new activity may trigger employees to think you are desperate and need extra credit because you are in over your head. Closing several accounts could appear as a sign that you aren’t good with money and don’t know how to avoid charging up a large sum of debt.

It’s simple: We want to make sure you’re not overpaying for car insurance.

While the reasons why are less than crystal clear, research shows that credit scores can accurately predict accident potential. Statistical analysis shows that those with higher credit scores tend to get into fewer accidents and cost insurance companies less than their lower-scoring counterparts.

In 2003, The University of Texas conducted an analysis based on 175,647 policies. They found that those with lower credit scores tended to incur more car insurance losses and higher claims payout, and thus posed greater risk to auto insurers.

The Federal Trade Commission also undertook an independent study to understand the relationship between credit history and risk. Like The University of Texas, they found that credit-based insurance scores are effective predictors of risk.

Given these findings, the use of credit-based insurance scores to determine risk and insurance premiums makes a lot of sense.Esurance uses LexisNexis®, a leading provider of consumer reports, to obtain your credit-based insurance score. LexisNexis looks at the information on your credit history from credit bureaus like Experian to compute your insurance score, meaning that your credit score will impact your credit-based insurance score.

Favorable factors might include:

- Long-established credit history

- No late payments or past-due accounts

- Open accounts in good standing

Unfavorable factors might include:

- Past-due payments

- Accounts in collection

- A high amount of debt

- A short credit history

- A high number of credit inquiries

FICO Score History and Specifics

- Developed 1989 / Sold by Fair Isaac Corp. Partnered with Equifax and LexisNexis

- Various versions available for use. 8.0 most widely used – Score Range 300-850

- Looks back 6 months for activity.

- No score for consumers with limited credit history.

- Weighs late payments all the same.

- Allows 45 days for rate shopping (Inquires)

- Only credit scoring allowed by govt sponsored loans – Freddie Mac & Fannie Mae

- Calculates Mortgage, Auto and Student Loans only as Hard Inquires.

- FICO 8 ignores all collection accounts with original balance less than $100.

- FICO sells their scores –

2017 FICO Net Income $932.16M

VantageScore History and Specifics

- Developed 2006 / sold by the credit bureaus.Experian, Equifax and Transunion.

- Various versions available for use.

3.0 most recent – Score Range 300-850 - Looks back 24 months for activity.

- Scores consumers with limited credit history using recurring pmt: Utilities, Rent, Phone Bill

- Weighs mortgage late payments heavier than other late payments

- Allows 14 days for rate shopping (inquires)

- Not allowed to be used by govt sponsored loans – Freddie Mac & Fannie Mae

- Calculates All Types of Credit as Hard Inquires

- Vantage 3.0 ignores paid collection accounts no matter the original balance.

- Marketed and Sold independently by EQ, EX and TU through licensing agreements

What does my Credit Score Impact?

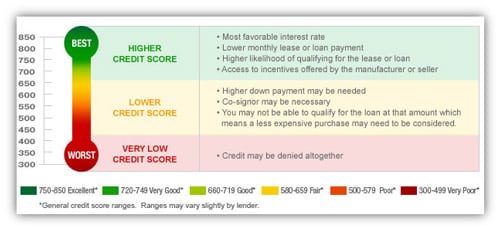

Most of us don’t learn about credit scores until we are well into our 20’s. And honestly, most of us don’t understand the impact a credit score can play in our lives until we are even older. We all hit that age that we start ‘handling’ our personal finances. We start paying bills, going to the grocery store and trying to stick to a budget. It’s at this point in life that you need to start paying attention to the scores calculated from your credit history. Your credit score can mean the difference between being approved or denied for a loan, it can be the difference between a low or high interest-rate and it can be the difference between accepting the job offer or being passed up for another candidate. A good score can help you qualify for an apartment and even can help you get utilities connected without putting down $100s in deposits.

- Loan Approval

- Interest Rates

- Credit Cards

- Insurance Rates

- Employment (determined by your credit report)

- Your credit score can mean the difference between being denied or approved for credit, and a low or high interest rate. A good score can help you qualify for an apartment rental and even help you get utilities connected without a deposit

No matter what you do in life, your credit score can help your journey or hinder your dreams. It’s just a shame we aren’t taught more about it until we have already had an opportunity to cause damage.

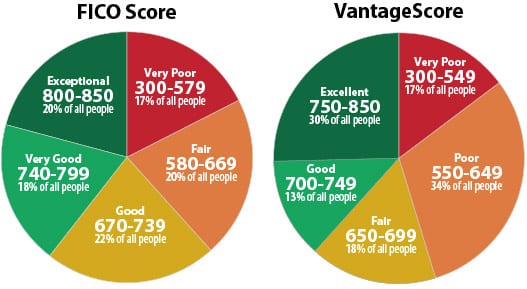

What is a Credit Score?

Credit scores are always thought of as a 3-digit number between 300-850. In reality, we all have dozens of 3-digit numbers tied to our credit. These variations are based on the different scoring models, which version is being utilized and of course the various inconsistencies reporting on the three credit bureaus. When your credit is pulled, you normally will see three credit scores returned, one from each bureau. Because each bureau reports slightly different information on your credit file, the three scores will be different. Most lenders will typically review your three scores and use your median score to determine your creditworthiness.

Who determines my Credit Score?

The two most popular credit scoring models are FICO 8 and VantageScore 3.0. FICO is the most well known; developed in 1989 by Fair Issac Corporation. FICO, in partnership with Equifax and LexisNexis, has monopolized the credit scoring field for over 20 years. Sure there have been other small-time credit scoring models that tried to get into the market, but none have had much success until 2006 when VantageScore was launched by the three major credit bureaus. Although Vantage has a footing in the market, FICO still monopolizes the mortgage lending industry. Most likely, when you have your credit pulled, it will be one of these two models that are used to calculate your scores, but there are others that could potentially be utilized by your specific lender.

Why so many Different Scores?

So there are two main scoring models, FICO and VantageScore , using information from the three different credit bureaus. So you have at least 6 different numbers at this point alone.

Now, let’s add in the different ‘Versions’ of the scoring models.

FICO has 9 different versions, FICO 8 is currently the most widely used. bureaus times 9 versions = 27 numbers

VantageScore is going to be releasing version 4.0 in 2018, that will give them 4 versions. 3 bureaus times 4 versions = 12 numbers

So that is 39 different numbers that could be pulled based on these two scoring models.

27 FICO numbers 12 VANTAGESCORE numbers

That’s 39 different credit score variations that can be pulled from FICO and VantageScore algorithms.

Are you thoroughly discouraged from trying to understand how your credit scores are calculated? Yes, this is a very complex topic and honestly, I could never attempt to explain it in a simplistic way. However, I’m going to hit on the key elements so hopefully, you can understand why your Credit Karma scores are different than the scores your lender pulled and what you should do about it.

Credit Karma vs Lender Scores

If you use Credit Karma to monitor your credit, well done! Now, don’t get ahead of yourself, I’m applauding the fact that you care enough about your credit to monitor it. I’m not saying Credit Karma is bad, but I will tell you it’s not 100% accurate AND the score provided is a VantageScore number. If you have been paying attention this far, you know that means this number is highly unlikely to match a number pulled from a creditor, especially a mortgage lender.

So what does this mean? Should you not trust Credit Karma? Should you never check Credit Karma? That is not at all what I am saying! Credit Karma is a free option that provides you a snapshot of your credit from the viewpoint of the least popular of the two most popular scoring models. This means it has a value, but you have to be careful of how much weight you put on that value.

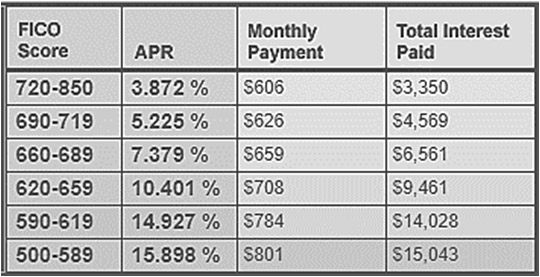

For instance, you’ve been monitoring your credit with Credit Karma for about 8 months. You’ve been working to improve your score and congratulations, you hit your goal number! Now that you’ve hit your number, it’s time to go get that new car you’ve been eyeing. The test drive is a dream and you cannot wait to take your new baby (you call her Sheila) home to show off to your friends. You’re sitting in the sales office waiting to sign the paperwork. You’ve shared the pictures of Sheila on social media, you couldn’t be more excited.

Then the sales guy walks in, “Houston, we’ve got a problem”.

You see, Credit Karma shows you at 691, you should get a decent APR, keeping your payments right where you need them….ok, really you are pushing the limit with your payment, but who wouldn’t….look at Sheila! But, you see, the finance guy pulled your credit and you are at a 658 median score. WHAT?!? This means your interest rate and payment would be higher and that puts you over your debt to income ratio. Do you have $3500 to put down?

How did this happen? You monitored your credit. You worked so hard!

Welcome to Credit Karma vs Lender Scores! This will not always be the scenario. And honestly, there have been some changes that have allowed these two scoring models to become a little more similar. But because of the variances we discussed in the “So many Different Scores” section, you will always have a difference between the two scoring models.

Obviously, this can go the other way too. You use something to monitor your FICO score and the lender you go through uses VantageScore. But typically, Vantage is a lot more lenient and your score will most likely be higher with Vantage than with FICO.

Morel of the story, FICO is the most widely used scoring model for credit inquiries. So monitoring VantageScore does little to know where you will stand once a lender pulls your credit, especially since roughly 90% of lenders use the FICO scoring model.

So how should you monitor your credit and be prepared when having your credit pulled? That’s actually a simple answer. If you are willing to pay a monthly fee, there are a lot of options available to you. My favorite is the Experian App, Credit Tracker. It is an awesome app that keeps you updated on everything going on with your credit.

If you don’t want to pay, you will need to consistently seek ways to look at your FICO credit scores as well as your bureau reports. The first place you should start looking would be with your various credit card suppliers, creditors, banks and/or investment companies. A lot of these different institutes offer Free FICO Scores as a benefit to their services and you can monitor your credit reports from the various bureaus.

Obviously, Credit Karma is a tool you could utilize to monitor your credit, but you would need to go the additional steps to find your FICO scores and verify the information reported on the credit bureaus to ensure you are properly prepared when seeking credit.

Just remember, being prepared before applying for a loan is your best weapon. When you go in blind, you are putting your goals and your outcome in a strangers hands. Being prepared and asking the correct questions will help set you up for success instead of frustration and rejection.

https://www.fool.com/credit-cards/2017/11/20/whats-the-difference-between-fico-score-and-vantag.aspx

The two most popular credit scoring models can produce very different credit scores.

Your credit score can be one of the most important numbers in handling your personal finances. It can determine important interest rates like your mortgage or an auto loan, your insurance rates, and it can even be the deciding factor in a job application.

When most people think of their credit score, they think of just one three-digit number. In fact, every consumer has dozens of credit scores based on different scoring models. The two most popular scoring models are currently FICO Score 8 and VantageScore 3.0.

But depending on where you check your credit score, you’ll get either a FICO score or a VantageScore. And the two scores can be wildly different even if they both use data from the same credit reporting agency. That’s why it’s important to know the differences between a FICO score and a VantageScore.

Similarities in FICO and VantageScore

Both most commonly use a range of 300 to 850. Older versions of VantageScore (1.0 and 2.0) used a range from 500 to 990. Some FICO scoring models for specific industries have a broader range.

Both are derived from information on your credit report from Equifax, Experian, or TransUnion.

Both are used by lenders to determine credit risk of potential customers.

Even their similarities aren’t that similar. While both scoring models are used to determine credit risk, 90% of lenders rely on FICO scores instead of VantageScores to make those decisions. And while they both use the same data, the way they use that data differs drastically between the two scoring models.

How FICO calculates your credit score

FICO offers fairly explicit details on how its scoring model calculates your credit score. It uses five main factors with the following weights:

35% payment history. If you’ve always paid your bills on time, you’ll be one-third of the way to a perfect score. The more severe, recent, and frequent you’ve had any late payments, the greater the impact on your FICO Score.

30% credit utilization. FICO Score 8 considers the total of how much you owe across all of your accounts, but more importantly, it factors in what percentage of your available credit you use.

15% length of credit history. This includes the age of your oldest account, the average age of all of your accounts, and the age of specific types of accounts (credit, auto loan, etc.).

10% new credit. This factor considers the number of new accounts, how long it’s been since you opened a new account, and recent hard inquiries on your report.

10% credit mix. Having a variety of different types of credit accounts will improve your score.