Upside-Down Car Loans

Just so we are on the same page from the get-go, this is not a scenario that you find yourself to be strapped upside-down in your car. Although that is a bad scenario, that is a topic for another day! When we talk about being upside-down in your car, we are referring to the balance of your loan verses the value of your vehicle. Upside-down car loans are a result of the devaluation of a car over time.

The What, The Why and The How to Avoid Upside-Down Car Loans

THE WHAT? – What are Upside-Down Car Loans?

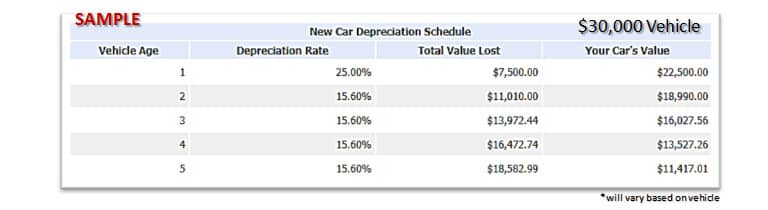

Unlike houses, automobiles decrease value, also known as depreciation. This is normal and is something you should factor into your car purchasing decisions. This article will help you plan for your car purchase so you are protecting yourself as much as possible from getting too over-extended in this financial situation.

So why is being upside-down in your vehicle a bad thing? You will drive it until you get the itch to get something new and then you trade it in and move on. What’s the big deal? Well, how about this scenario, you have your shiny red truck parked in the driveway. You go to bed for the night and wake up to an empty driveway the next morning. Your beautiful Gertie is GONE, STOLEN! You call your insurance company to file the claim, you wait the required minimum waiting period, and the insurance issues the payoff to your financial institute. Then it happens, you get a letter from the finance company. You didn’t get the GAP Insurance and now you owe the difference, $6,824.

Being upside-down in a car typically only affects people when it comes time to trade in a vehicle, but there are a couple life altering scenarios that can have a greater negative impact. If your car is totaled, stolen or if you have a financial crisis that you need to get rid of some of your expenses, you can be severely hindered because of the status of your loan.

THE WHY

So lets be honest, majority of us have been here before. Actually, unless you have outright purchased a vehicle with cash, or had a really big down payment, you have been in this situation at one time or another. You see, the moment you sign a financial obligation and drive off the lot, the value of your shiny new vehicle drops as much as 11%.

So unless you put down 11% and didn’t finance any additional costs (like tax, title, or dealer fees), congratulations, you are already upside-down in your vehicle within an hour of owning it.

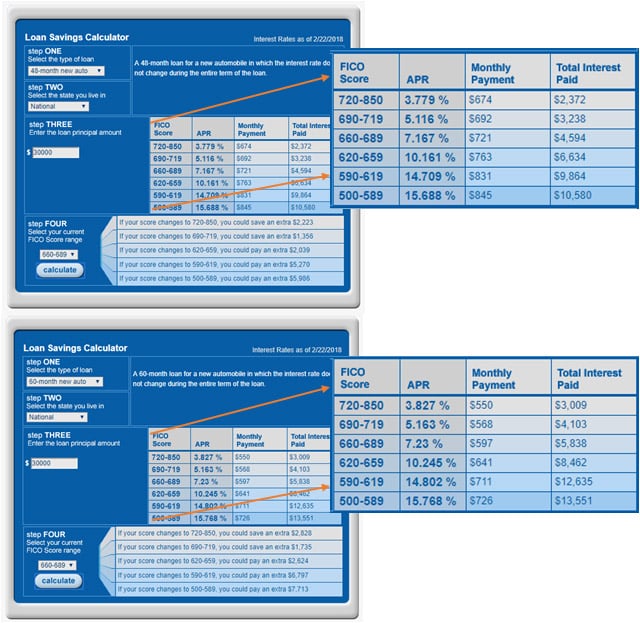

So we’ve determined that depreciation is one of the culprits that causes you to be upside-down in your car loan, now lets discuss some of the others. The next major issue that affects your value vs payoff is the terms of the loan. In today’s society, we like to make our payments as small as possible so we can pay for more things at once. Come on, you all know we do it. The sales guy brings you the numbers, the monthly payment circled in red pen, shock sets in. $597 a month!?! Don’t worry, if that stretches the budget too much the sales guy has a solution! We will just push these payments over 72 months and get you closer to your budget. That’s better, now you can feel more comfortable signing your ‘John Hancock’ to the 20 financial pages that need signed.

Sigh! It’s becoming common for car shoppers to sign for loans between 61 – 72 months. Even more alarmingly, In recent years, Experian data showed 27.5% of car consumers signed for loans that had 73 – 84 month terms. This really sets you up to drown in car debt. You just bought a new vehicle that will be potentially 7 years old before it’s paid off. Not only are you paying astronomical amounts in interest, you risk having to roll a large amount of debt into the next vehicle if you want to trade it in. Or, if you keep it the 7 years, pay it off and then try to trade it in, at that point it will be worth such a small fraction you will have lost any equity you could have hoped to have. And the nasty upside-down cycle starts again.

The next villain, Credit Scores! Credit Credit Credit…this 6 letter word can be your best friend, or worst enemy. If you have good credit, use it and don’t squander its positive contributions by getting into a long term loan that ultimately renders it useless. If you have ‘meh’ credit, you need to be even more on-guard against long term loans. Depending on how bad the interest rate is and how long you push the loan out, you could end up paying almost half of the cars worth in interest. OUCH!

Another contribution to over extending your car loan is putting zero down and adding the extras. So we already know that at least 11% down is what you should shoot for when buying a car, but in todays world, we prefer to spend that money elsewhere. So when you put zero down, you are already starting on the wrong foot. And think about your last car buying experience, what happens when you get in the finance guy’s office? Would you like to add the Interior Protection Package? How about Nitrogen in the Tires? We also offer our special Paint Protection Package. And the most accepted, you really need to get our premium Extended Warranty.

You are bound to say yes to one or more of these “add–ons”. So you’ve done your due diligence to negotiate the price of the car while sitting with the sales guy and you are proud of yourself and feel good with the price. But the finance guy is now helping you increase that price back to and sometimes beyond the original cost. So now they print the 20 pages you need to sign and talk a mile a minute and you start seeing numbers and hearing terms you aren’t aware of. You try to question why they price is so high, but they daftly convince you these are standard fees and additions that you wanted and will be so happy you added.

Congratulations, all the negotiation you did on the price of the car and you are now paying $8000 over what the starting price of the car was. When you calculate the add-ons, the tax, title and dealer fees and the zero down, you are already 11% + $8000 over extended on your loan. If you get in a wreck on the way home and total your car, you are royally screwed!

The final icing on the cake will be interest vs principal. Unless you secure a 0% APR, you are going to pay interest. Principal is the price you agreed to pay for the vehicle and any additional fees or add-ons. So to ensure they get their cut in the quickest timeframe, lenders will charge the majority of the interest in the beginning of the loan and your principal is paid off at a slower rate. This means even your loan is working against you when it comes to paying down the price of the vehicle. If you have a lender that will allow you to pay more towards your principal, this isn’t a bad idea. You will want to confirm with your lender first that 100% of that additional payment is going to principal because with majority of lenders this additional payment is being allocated somewhat to interest.

THE HOW TO AVOID

All the scenarios we went over affect how long it will take to get right-side up with your car loan. Here are some helpful tips on how to avoid being upside-down:

Choose a car that holds its value better

– Most of us pick a car based on looks, which is great. But now you need to do your homework. Does the car hold its value or can you buy them used really cheap? If you can find 100s of that model, used, within a 25 mile radius, you might want to pass. Different makes and models hold their value better than others, this means they will depreciate at a slower rate and will condense the length of time you are upside-down in your loan. It’s so important that you do your research on the different vehicle types you are interested in to find one that isn’t flooding the market or found fairly cheap on the used car lot.

Do NOT finance the taxes and fees

– Financing taxes, fees and additional add-ons into your loan automatically puts you upside down, since you’ll be adding more than the car is worth.

Try to put down 15-20%

– Remember most dealers offer cash-back rebates from the manufacturer if you are buying a new car. These rebates as well as any equity that comes from your trade-in would count towards your down payment. Putting down around 20% will help you deter the initial depreciation hit you take in the first year of ownership.

Finance the length of time you want to keep the car

– If you try to trade-in a vehicle that is upside-down, the trade-in value minus the payoff difference will get rolled into your new loan. The best way to combat this is to not finance a vehicle for longer than you are willing to keep it. This way you have it paid off before you are ready to trade it in, therefore no negative equity gets rolled into your new loan. My suggestion is to not extend past 48 months, that’s 4 years of the same vehicle and about the point most people get the itch to get a new car.

Get the best Interest Rate possible on Upside-Down Car Loans

– Be sure your credit history is accurate. Know your credit score so you can get quotes without getting multiple inquires as you car shop. Do some interest rate shopping by researching online for any finance deals through dealers, banks and credit unions.

The most important thing is to do your homework. Be aware of the different scenarios and do your best to avoid them.