Top Rated Credit Repair

Savannah, Georgia

Five star reviews

With thousands of happy clients on Google, Facebook, TrustPilot, and more, you will not find a stronger reputation. See how we are different!

Customized Plan

We don't just send out dispute letters like other companies. We customize our approach with personalized audits for maximum results.

One on One

You'll work with the same credit expert for the duration of the program. They will update you, coach you, and answer your questions.

Attorney Managed

Our attorney-managed, 4-round process is personalized for each client by an Investigative Research team, all at a reasonable cost.

Schedule your Free Consultation & Analysis

We protect your privacy. Your information is not shared with third parties.

By submitting this form, you agree to receive texts from White Jacobs and Associates. Ongoing communication before, during, and after the program will be initiated by our credit analysts and their assistants. Msg & data rates may apply. Msg frequency varies. Unsubscribe at any time by replying STOP or clicking the unsubscribe link (where available). Privacy Policy

Meet the team

How We're Different

See what our customers are sayingWe can help with...

- Charge-Offs

- Collections

- Bankruptcy

- Late Payments

- Repossessions

- Foreclosures

- Student Loans

- Dispute Code Removal

- Credit Coaching

- Re-establishing Credit

- Debt Settlement

Savannah has a long and rich history, like few other U.S. cities do. It has always stood tall in the face of adversity and overcome all challenges. It’s only natural that the best credit repair Savannah offers should try to emulate the pride with which it has existed since the beginning.

There’s no reason sugar-coating it – times are rough and you need to have the best credit you can. Your credit rating affects the loans you can take and the interest rates you can get. Even just a few points higher can provide you with significant financial benefits.

We are Not a Traditional Repair Company in Savannah

At White, Jacobs and Associates we know you would rather not ask for help, but sometimes a little nudge in the right direction is needed to come out victorious. We are here to offer assistance in dealing with negative items on your credit reports in these trying times.

The reason you have bad credit is unimportant – we don’t believe one hasty choice made years ago, a lost job, failed investment, or divorce should interfere with the rest of your life. Often, the creditors themselves made a mistake on your credit report, but don’t want to admit it. WJA has developed a quick and efficient 4-round process that will let you take back control of your life.

What is an Average Credit Score?

The most widely used models by which credit score is rated are called FICO and VantageScore, and they go from 300 to 850. The average varies state by state and city by city, but in 2020 it was 682 for Georgians. All things considered, that is a good average, as any score above 660 is decent. If your score is close to that, you shouldn’t have much trouble getting a loan.

However, getting a good deal is another matter. Just a few points up or down can increase the interest rates you get. A simple 0.5 % increase on a long-term loan can save you tens of thousands of dollars during the life of a loan or mortgage. Wouldn’t you want to maximize your benefit when buying (refinancing) a home? That is why you should always have experts analyze your credit report before getting a loan.

What is a Negative Item on Your Credit Report?

There are a large number of items that could be considered a negative on your credit report. From late payments to bankruptcies, and even mistakes by the credit bureaus themselves, we’ve seen it all. By analyzing a tri-merge credit report, we can analyze your specific situation and outline a game plan so you know exactly how we can help.

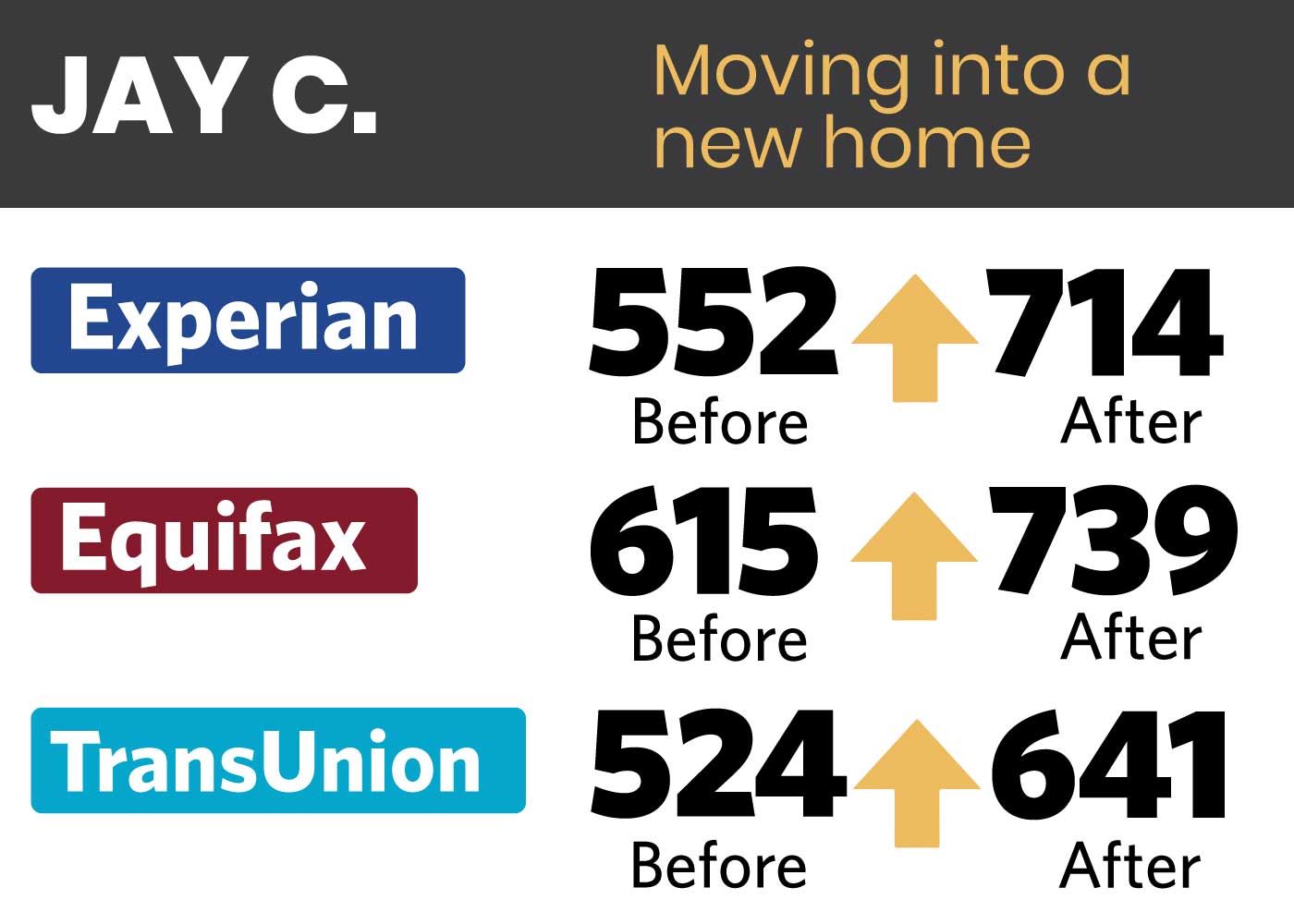

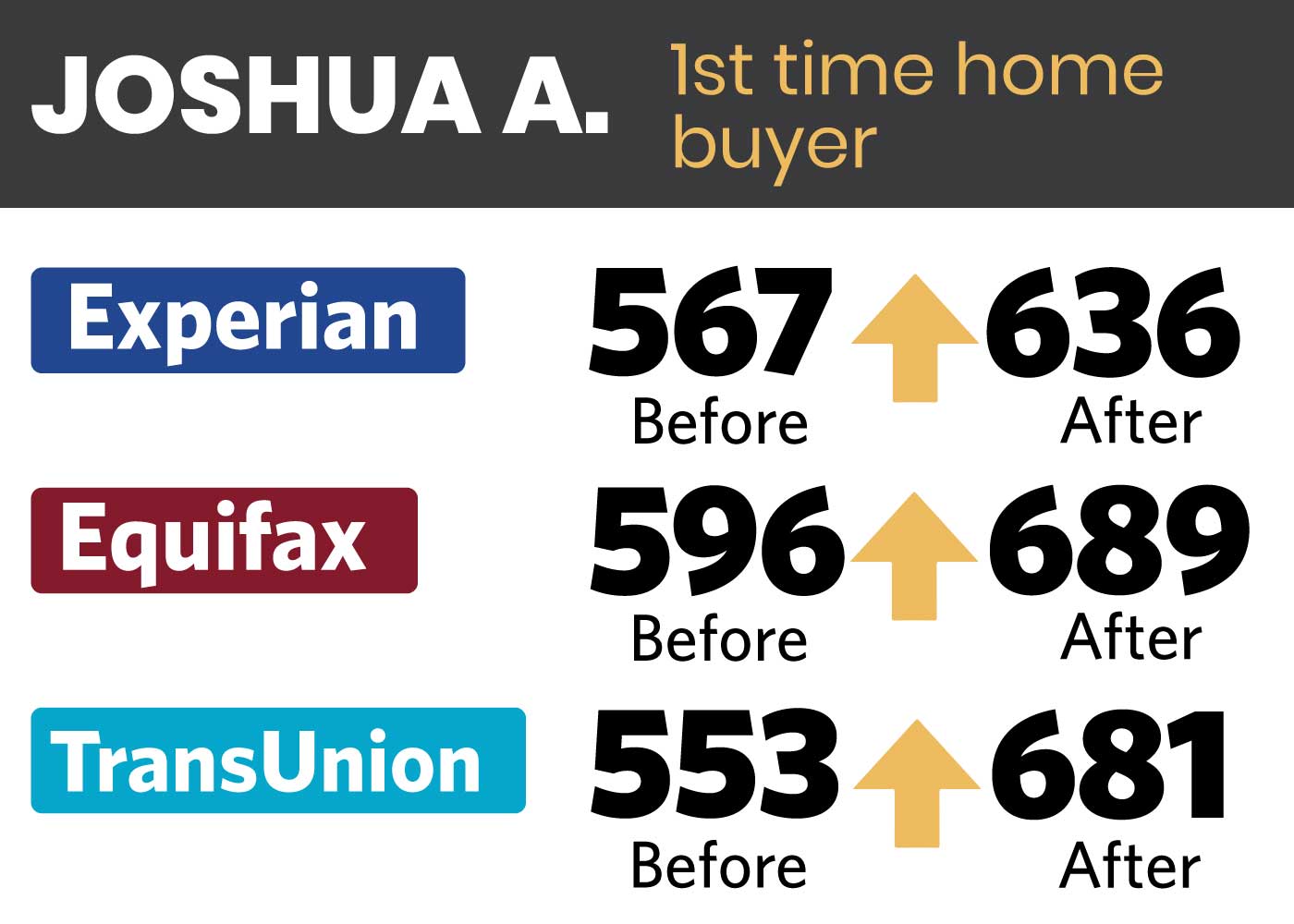

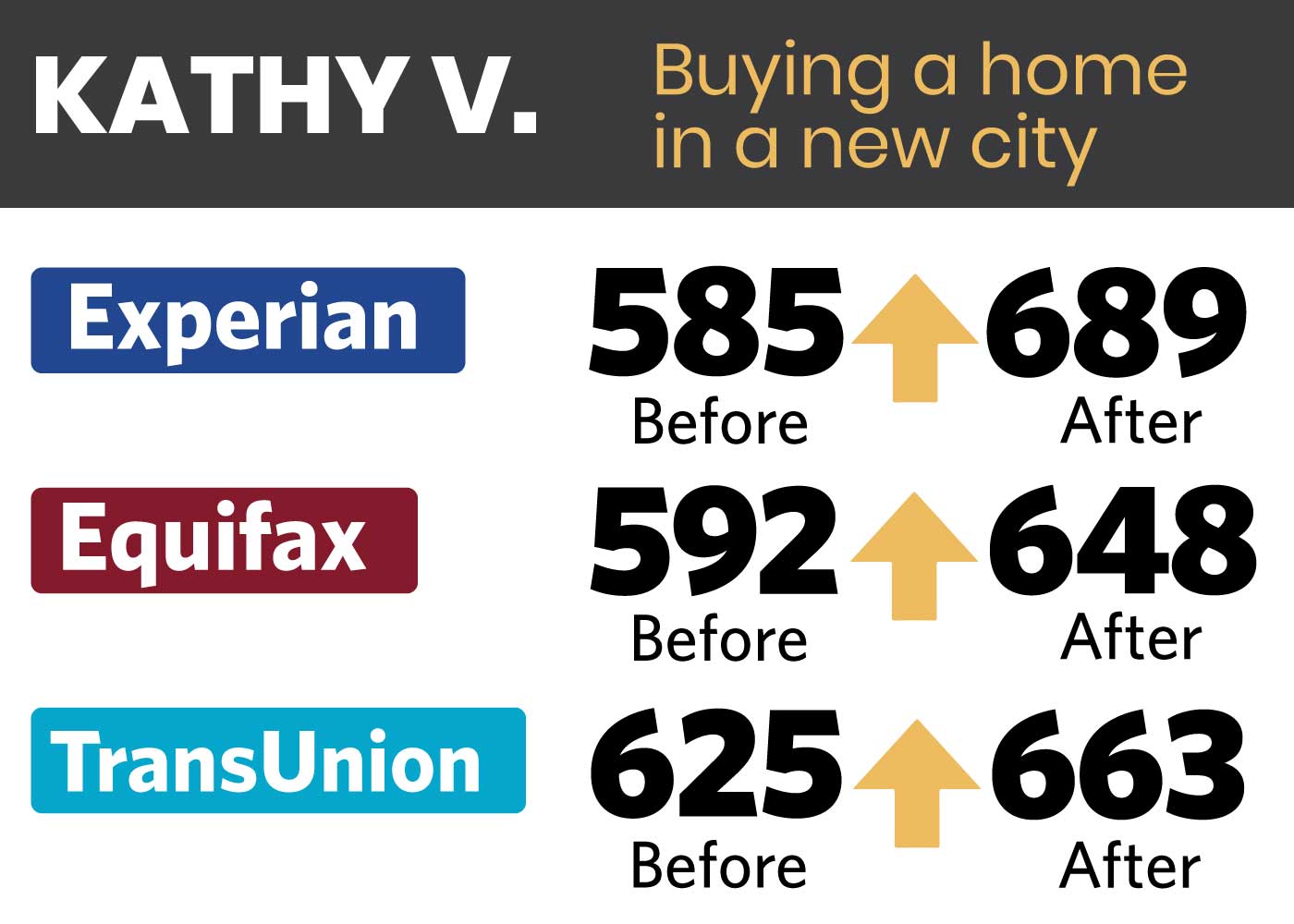

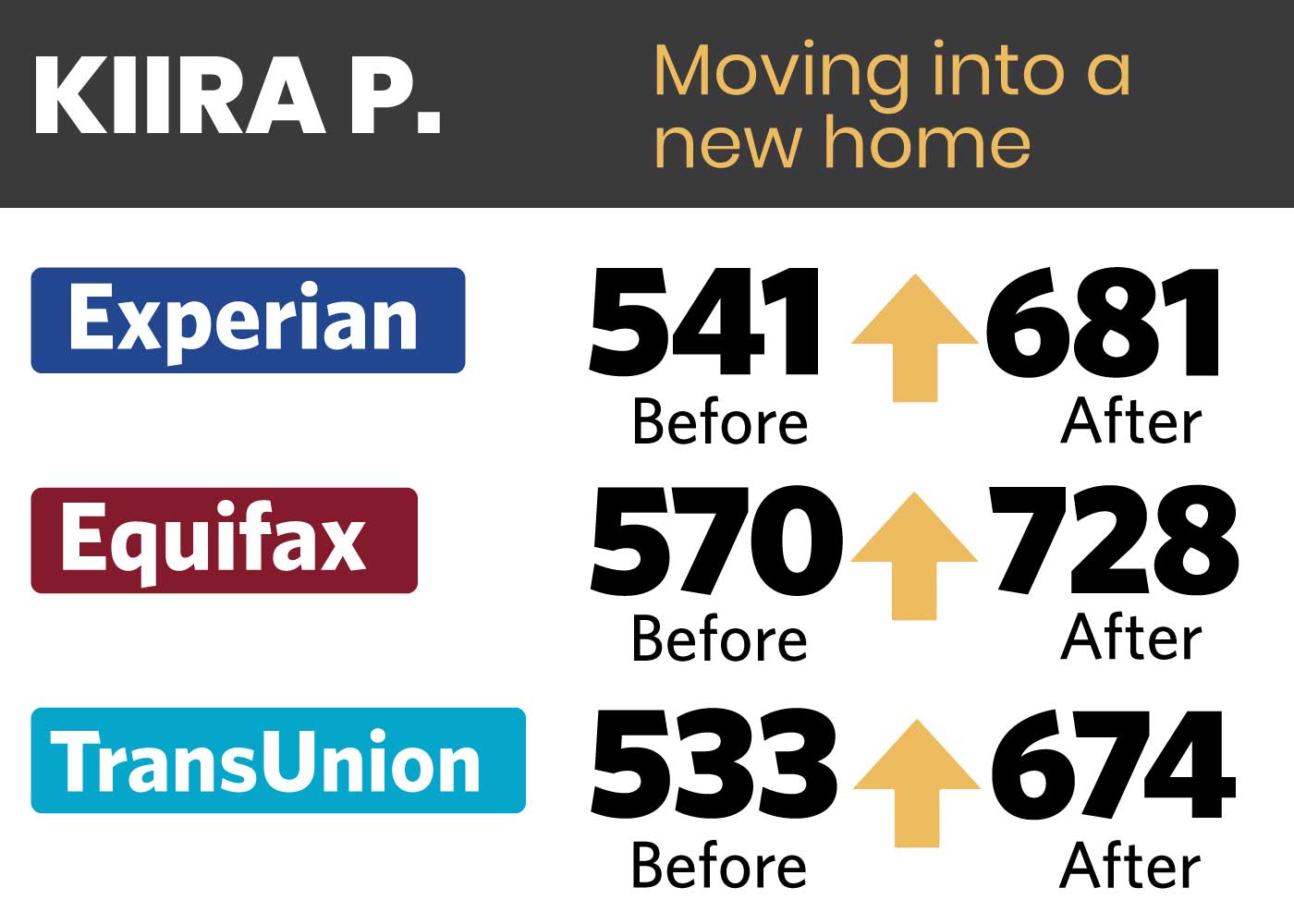

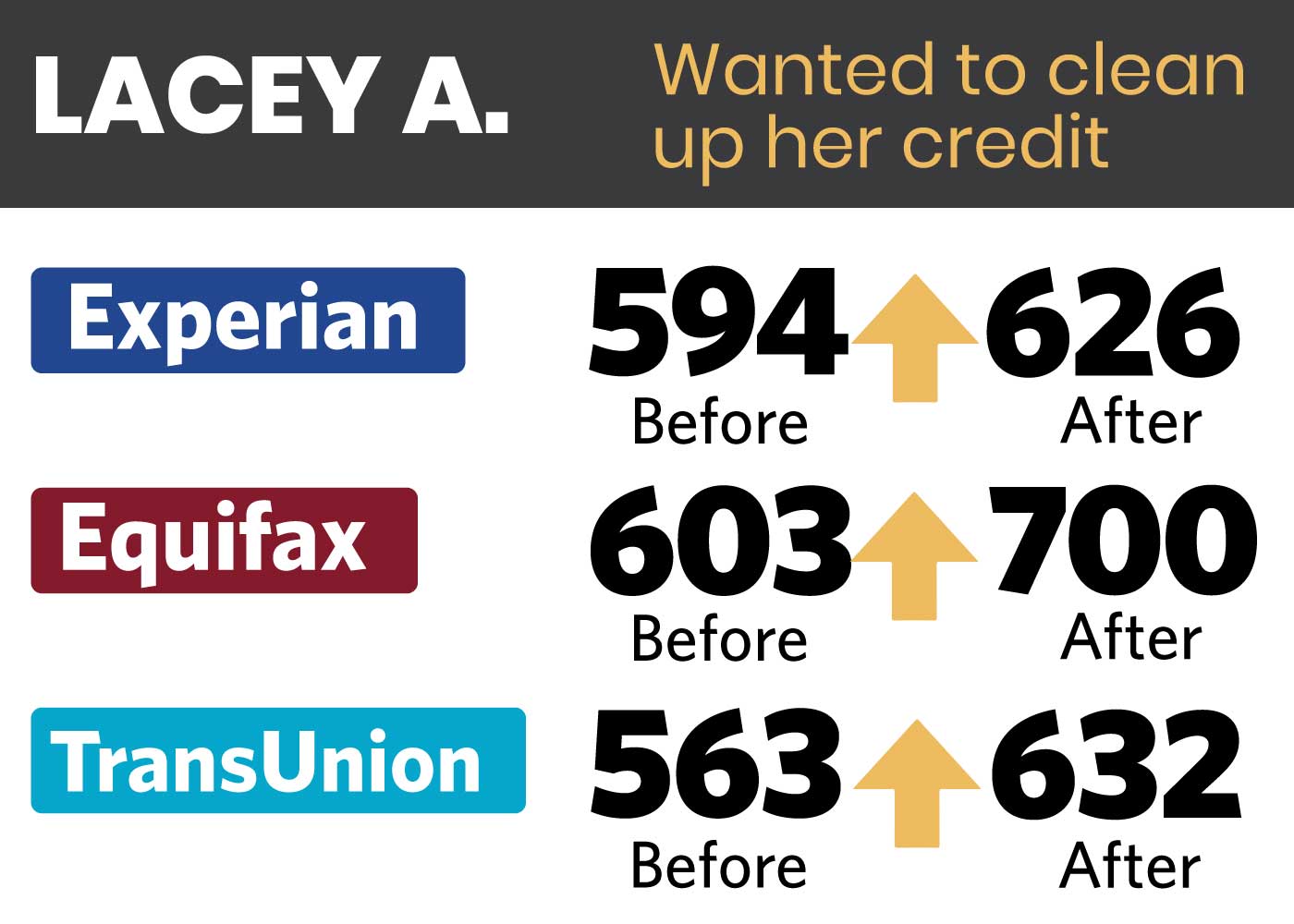

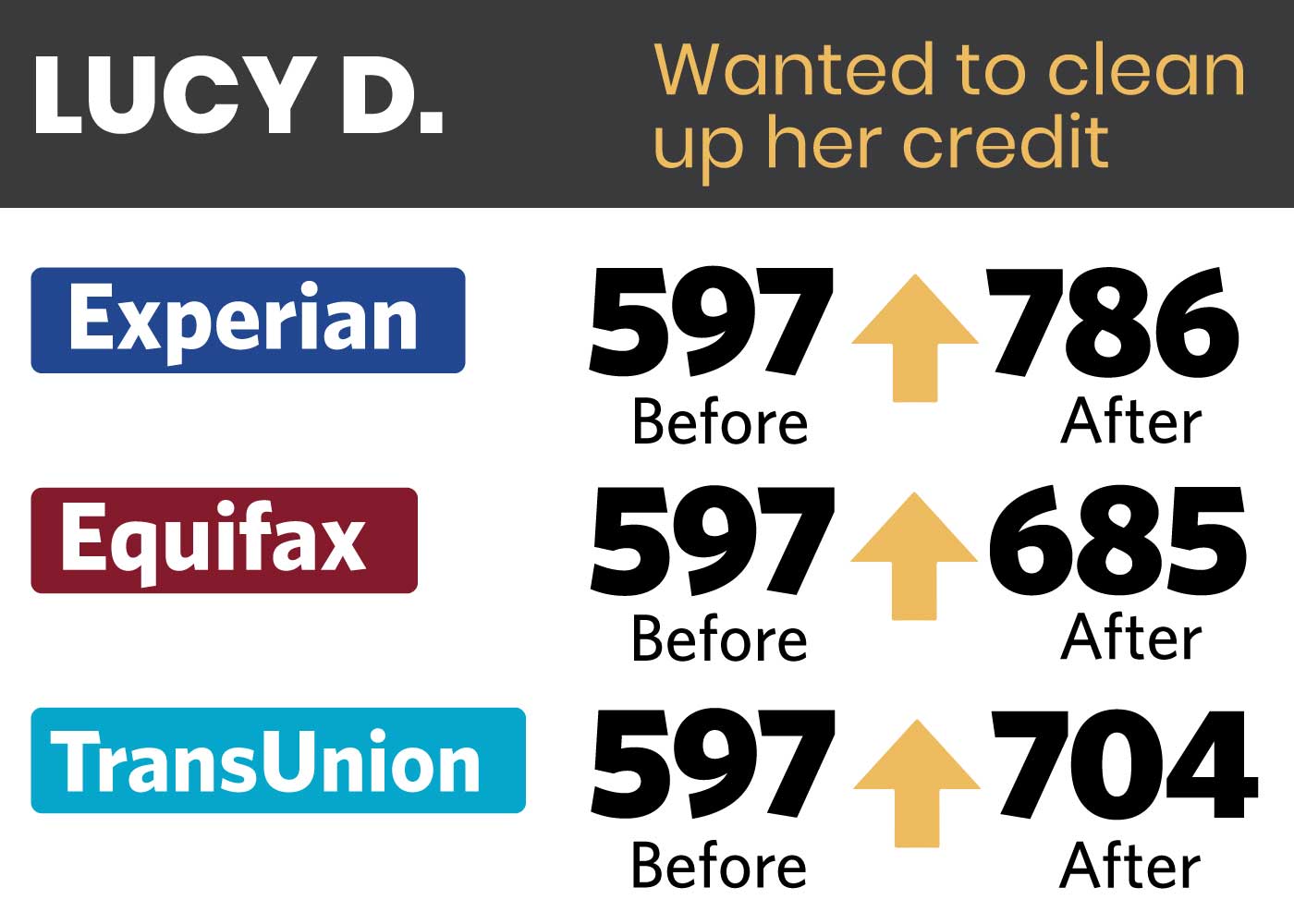

How WJA Improves Your Credit Rating

By adding positive credit and removing negative items from your report. We will coach you on how to add positive credit, while negatives are removed by our 4-round process. This is a process we have developed that is fully customized for each person’s specific needs.

Other credit restoration companies will take your money monthly (we call them the 100-bucks-per-month-guys) and send boiler-plate dispute letters. If these are the credit repair services you decide to hire, save some money and do it yourself instead.

We will analyze your credit report and come up with specific tactics that are tailor-made for your situation. We, including our in-house lawyers, will contact credit bureaus and lenders to remove all negative items that can be removed from your report. We don’t just send dispute letters, we audit the creditors.

Why are Audits Better Then Disputes?

First off, they are conducted quicker, and you need your buying power back as quickly as possible. Also, they are more effective. We don’t request that they remove negative items from your report, we demand creditors show us the proof that they have the right to forward the items to the bureaus.

They often make mistakes, and so are not allowed to report the items. Then, they are legally obligated to remove them from the report. But, you need to catch them doing it first, and that’s what WJA’s audits provide.

Is Credit Repair Legal in Georgia?

Yes, everything we do is in accordance with the law. Our in-house law firm is consulted every step of the way. That is why we can do the repair so aggressively. Knowing the laws is helpful information, but you need to know how to properly leverage the laws.

There are multiple consumer laws, like Fair Credit Reporting Act (FCRA), Fair Debt Collection Practices Act (FDCPA), Fair Credit Billing Act (FCBA), Fair and Accurate Credit Transactions Act (FACTA), and HIPPA laws, that are designed to protect you from illegal negative information on your report. Our experienced credit analysts will help you understand the protections you have.

When Can You Expect to See Results with Credit Repair in Savannah,GA?

Many of our clients report results within 45-60 days of the start of the process. This is the time frame when creditors are likely to start contacting you directly. We always advise our clients to forward all paper mail to us and let us determine how to proceed.

At the longest, WJA’s credit repair Savannah process will take a maximum of 6 months. Remember those 100-bucks-per-month-guys we talked about? They will keep you as their clients for as long as you are willing to pay, no matter the results they get. We won’t do that – we will tell you straight away if you are a good fit and what we can do for you, and it never takes longer than 6 months.

You Know What You Get With White, Jacobs and Associates

We are not a traditional credit restoration company. We want results and we want them now. Every month the creditors delay is taking you one step further from your desired future. WJA doesn’t play nice with creditors and we will straight-up tell you what we can do for you.

Our mission is to get you buying power back and to get it back as quickly as possible.

Schedule your Free Consultation & Analysis