Top Rated Credit Repair

Rockford, Illinois

Five star reviews

With thousands of happy clients on Google, Facebook, TrustPilot, and more, you will not find a stronger reputation. See how we are different!

Customized Plan

We don't just send out dispute letters like other companies. We customize our approach with personalized audits for maximum results.

One on One

You'll work with the same credit expert for the duration of the program. They will update you, coach you, and answer your questions.

Attorney Managed

Our attorney-managed, 4-round process is personalized for each client by an Investigative Research team, all at a reasonable cost.

Schedule your Free Consultation & Analysis

We protect your privacy. Your information is not shared with third parties.

By submitting this form, you agree to receive texts from White Jacobs and Associates. Ongoing communication before, during, and after the program will be initiated by our credit analysts and their assistants. Msg & data rates may apply. Msg frequency varies. Unsubscribe at any time by replying STOP or clicking the unsubscribe link (where available). Privacy Policy

Meet the team

How We're Different

See what our customers are sayingWe can help with...

- Charge-Offs

- Collections

- Bankruptcy

- Late Payments

- Repossessions

- Foreclosures

- Student Loans

- Dispute Code Removal

- Credit Coaching

- Re-establishing Credit

- Debt Settlement

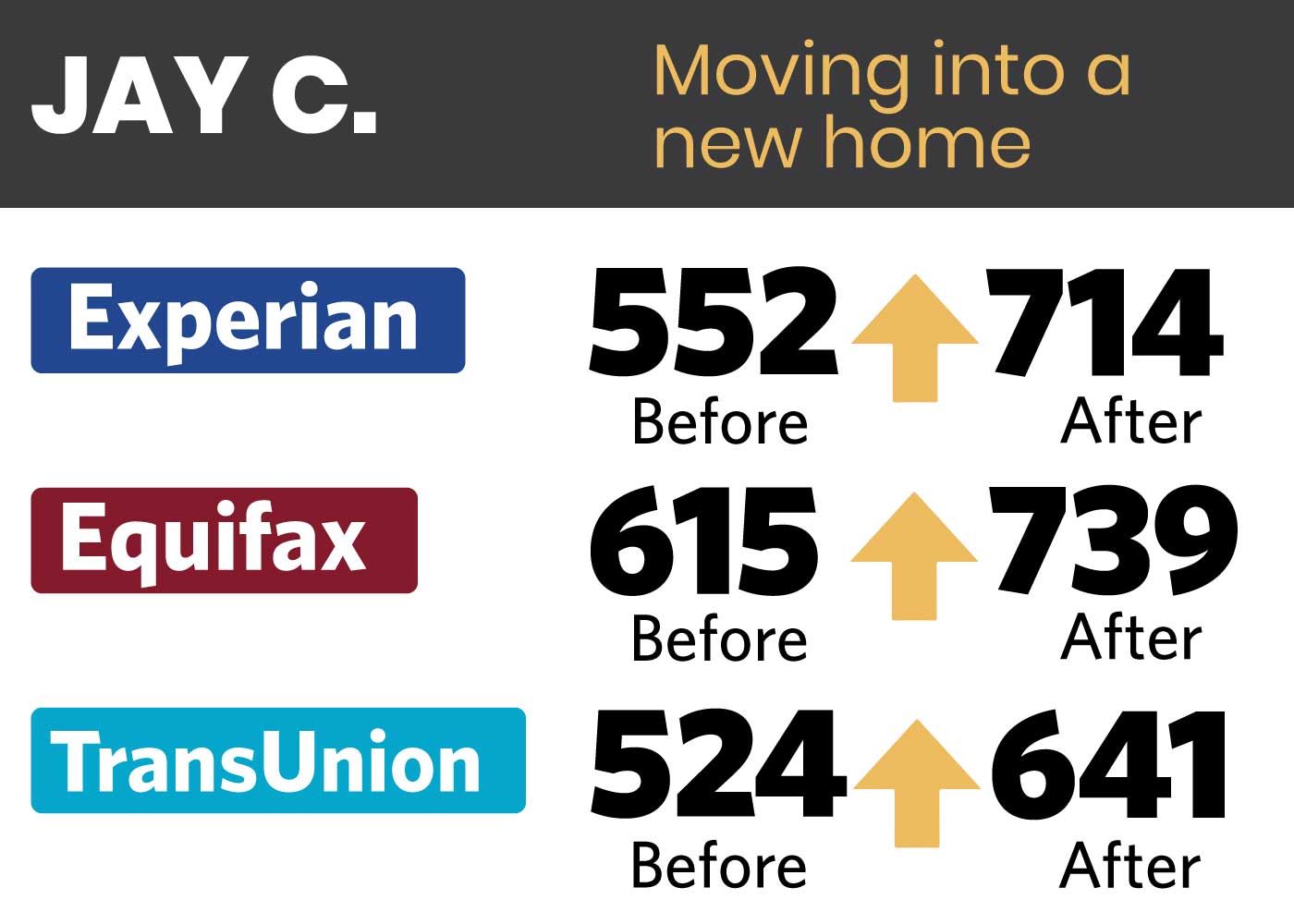

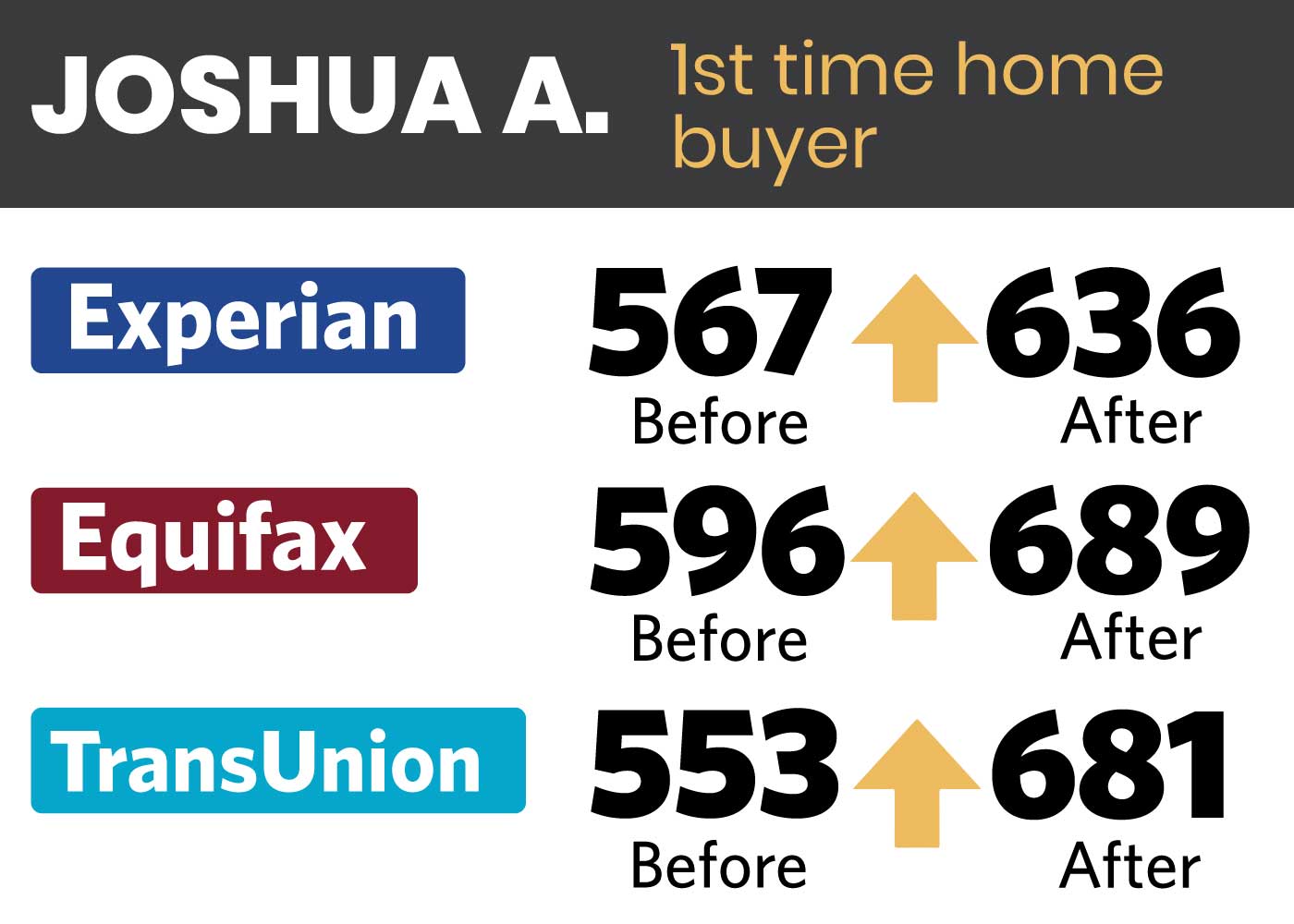

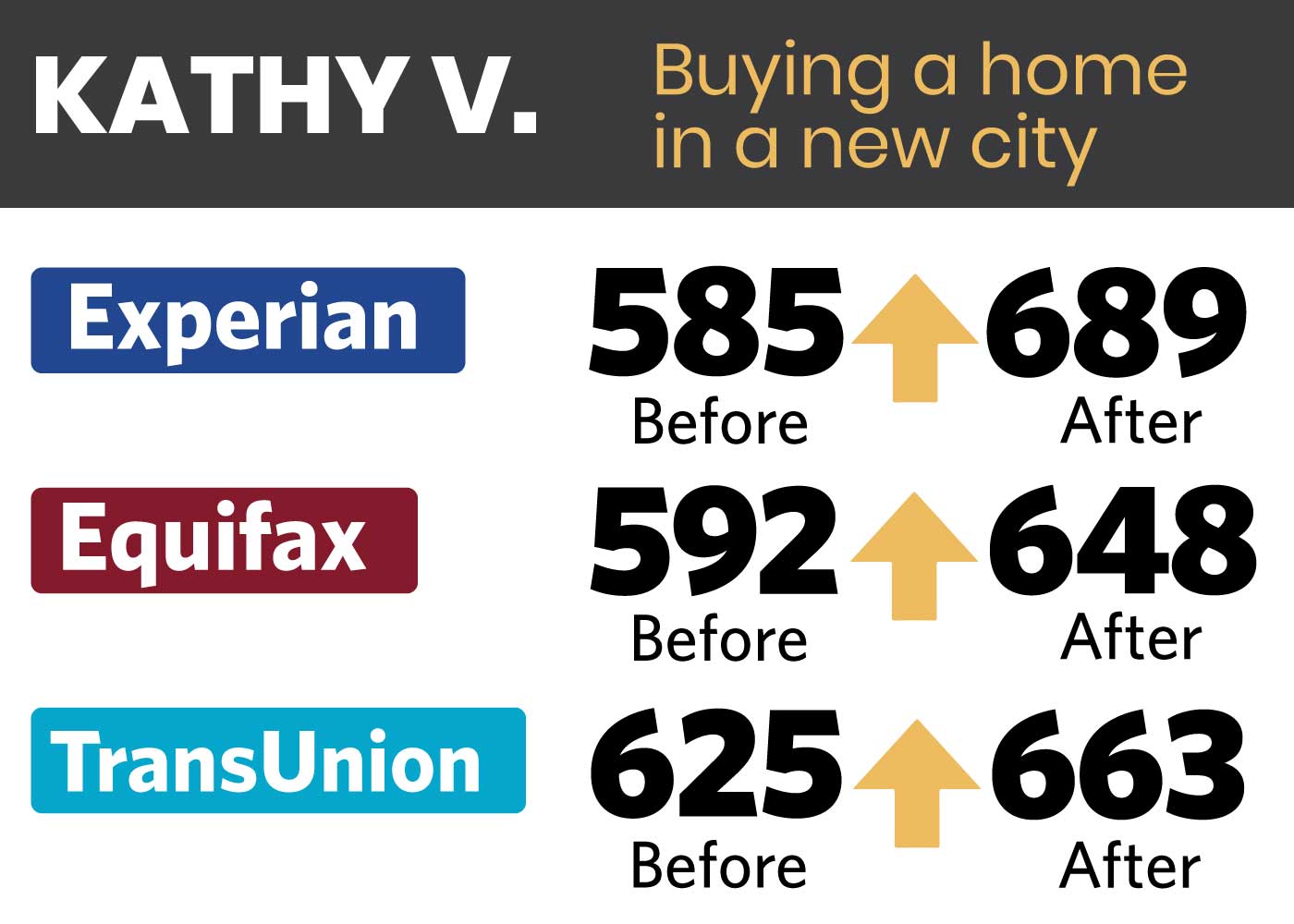

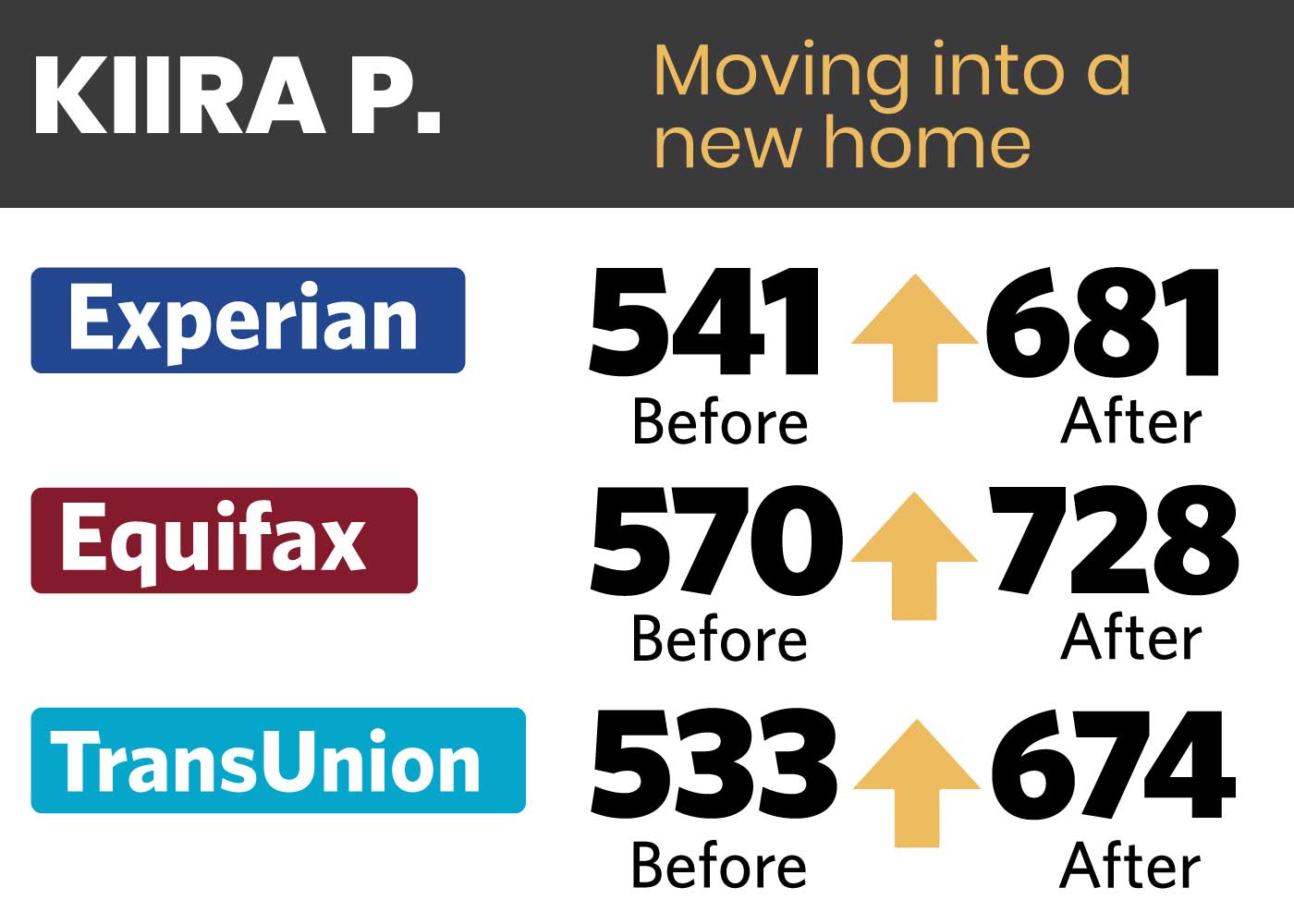

Looking for the best credit repair service in Rockford, IL? At White, Jacobs and Associates, we’re ready to help Illinoians get the credit repair Rockford deserves. Don’t miss out on important milestones such as becoming a homeowner, purchasing a car, or getting that job you want. And don’t deal with collections, identity theft, and late payments on your own – get your buying power back with the service WJA offers.

WJA is Not a Traditional Credit Repair Company

The credit repair industry tends to get saturated with amateur credit repair agencies. We’re not one of them. Traditional companies have a generic approach to all of their cases. Meaning, they send out generic letters disputing negative entries in your credit report and hoping for the best. They drag out the process for months so they can take as much money from you as possible.

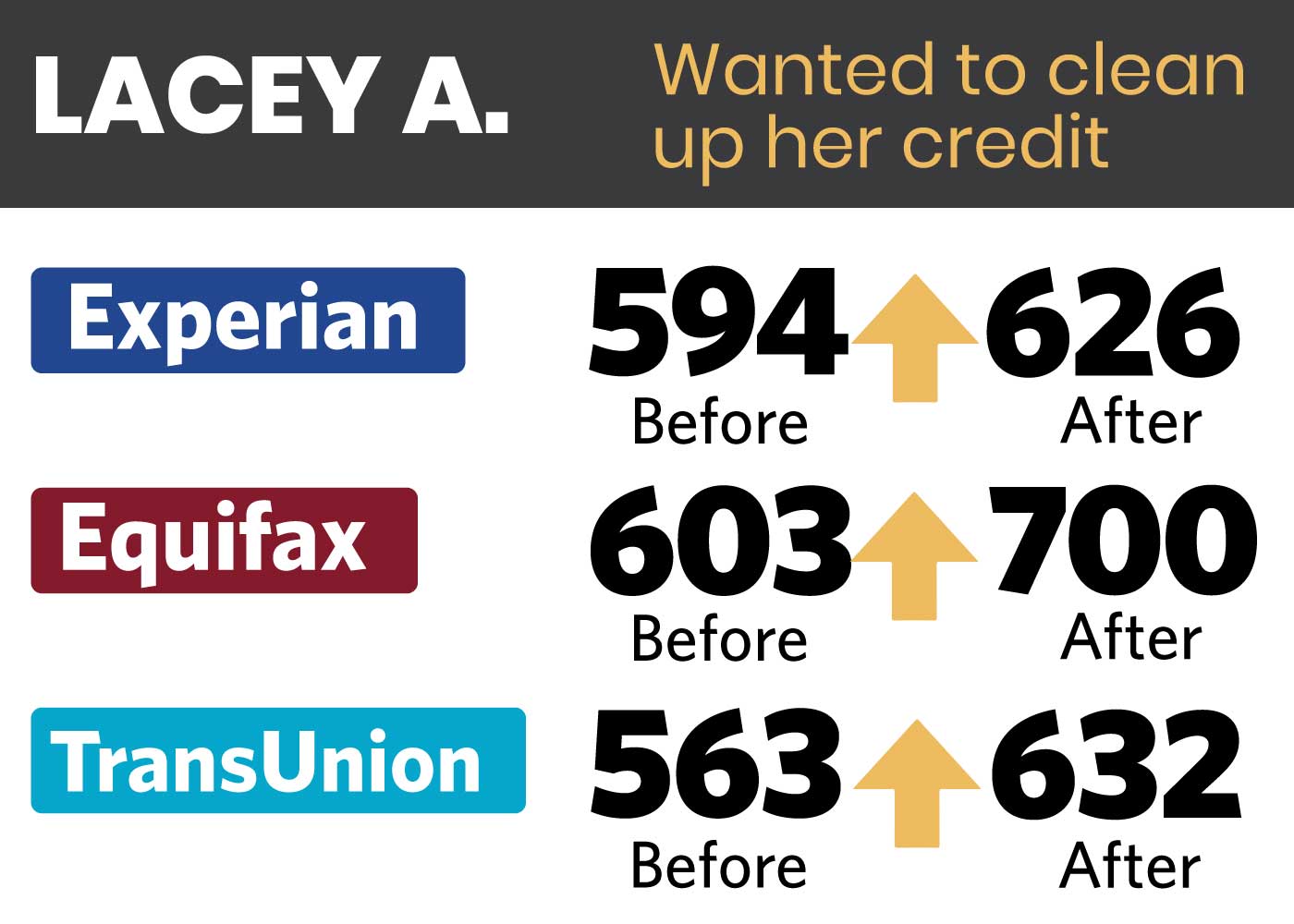

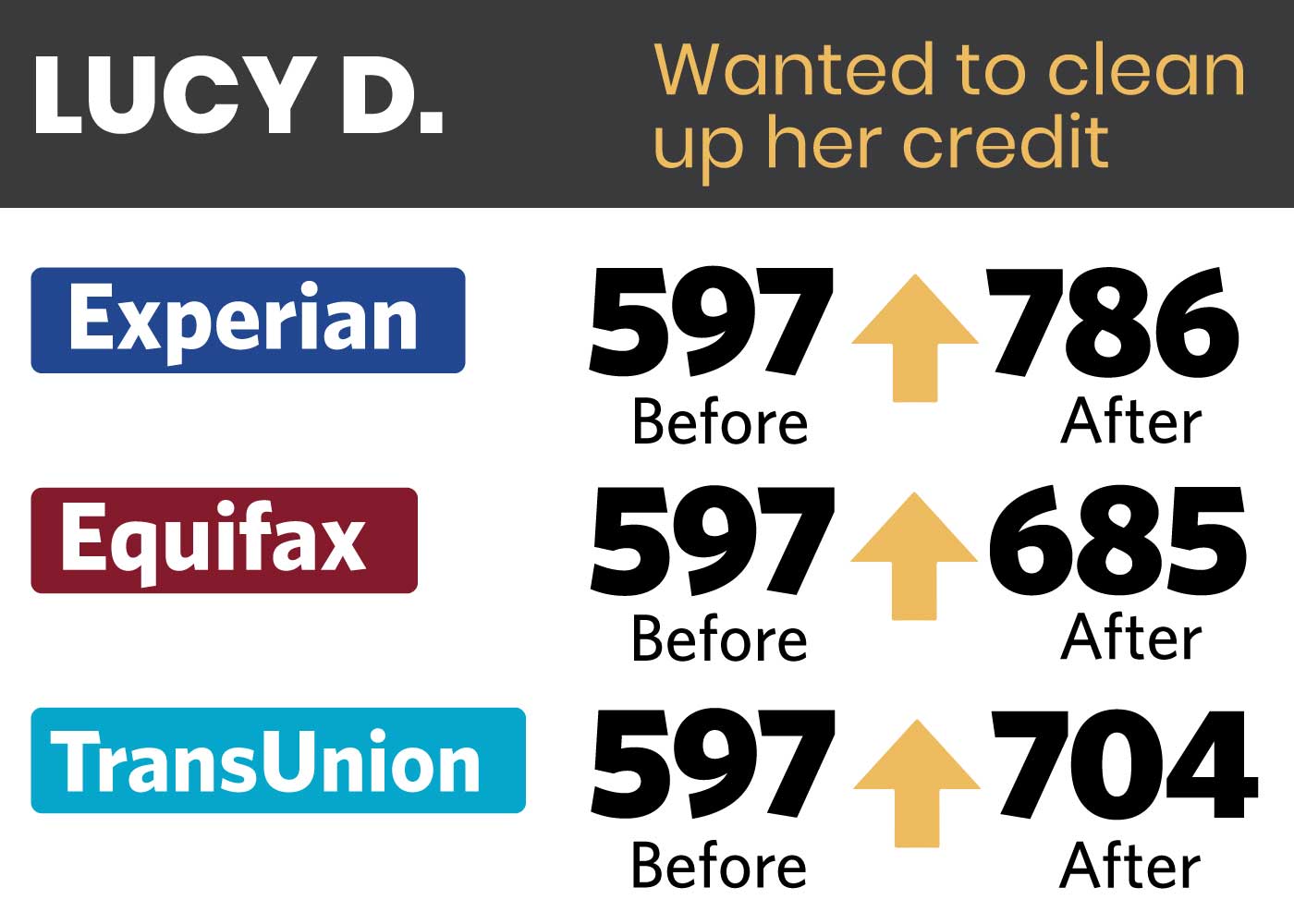

At White, Jacobs and Associates, we assess your case, develop a tailor-made plan, and then take an aggressive and alternative approach to help boost your credit score back into the ‘good’ category.

But for you to better understand our expert method, first we’ll go through the causes of poor credit scores.

What’s a Poor Credit Score?

Anyone can have a bad credit score at some point in their adult life. There are different reasons why people get classified in the lower credit score categories. Maybe you fell victim to turbulent economic times, perhaps your family was struck by tragedy. Or maybe the credit bureau made an error.

When you have a poor credit score, that means that the numerical value of your credit reports is under the desired number of 660. The lowest possible credit score is 300, while the highest one is 850.

How are these scores calculated? Usually, credit bureaus use the VantageScore and FICO grading models to calculate your three-digit score.

Here are some of the factors these scoring models take into consideration:

● Payment history

● The ratio of your used and available credit

● Length of credit history

● Hard inquiries

● Types of credit accounts you have (such as revolving debt and installment loans)

Your credit reports, as you can see above, consist of both positive and negative entries. Traditional credit repair companies typically don’t bother with the former. During the credit restoration process with WJA, part of our value comes from the credit coaching we’ll provide. That includes mentoring you on how to build positive credit while we work on removing the negative.

And that’s not the only thing that makes us the agency offering the best credit repair in Rockford.

WJA’s 4-Round Credit Repair Process

Our unique process begins with you speaking one-on-one with our expert credit analyst. Together with you, they go through your credit reports, singling out those items that are questionable and could be removed from your credit report.

That is a vital step because removing negative items means a higher credit score.

Next, we develop a tailor-made credit restoration game plan for you. Only then do we start the process of sending out dispute letters to collections agencies and creditors. Some of them answer us, some of them don’t. And some of them erase from your reports the negative entries that they’re responsible for, and some of them don’t. We’re not phased by those who don’t act immediately. We just double down. We perform audits. We demand to see proof that these collection agencies and creditors have full rights to report the negative items to credit bureaus, who are in turn responsible for including these entries in your report.

Around this time is when our partnered attorneys come in. If they find out that some of these financial players are not respecting federal consumer laws, they threaten legal action.

Our investigative team is also on hand to evaluate the responses we get from creditors during our first two rounds. It’s imperative that you send in any postal mail that you receive during this time. Only then can we formulate the best response possible.

We go through this meticulous process because we know that not all creditors and bureaus are used to being called out time and time again. At White, Jacobs and Associates, we know that hard work (and being well-versed in consumer laws!) brings results.

Is Credit Repair Legal in Rockford, Illinois?

Our in-house legal team acts aggressively because it knows the law is on its side.

Our federal system has many laws that protect consumers. Some of these are the Fair Credit Reporting Act (FCRA), the Fair and Accurate Credit Transactions Act (FACTA), the Fair Debt Collection Practices Act (FDCPA), the Fair Credit Billing Act (FCBA), and HIPPA laws.

Restore Your Buying Power in Just Six Months

While other agencies will drag out your case for a year or more, we get the job done in 6 months. And the first results come rolling in in just 45-60 days! So no matter if you’re struggling with foreclosure, chasing a student loan, or vying to buy your first family home, we got your back. Seize back your buying power with White, Jacobs and Associates. Book your free consultation today and find out why we’re the best agency when it comes to credit repair in Rockford.

Schedule your Free Consultation & Analysis