Top Rated Credit Repair

Princeton, Texas

Five star reviews

With thousands of happy clients on Google, Facebook, TrustPilot, and more, you will not find a stronger reputation. See how we are different!

Customized Plan

We don't just send out dispute letters like other companies. We customize our approach with personalized audits for maximum results.

One on One

You'll work with the same credit expert for the duration of the program. They will update you, coach you, and answer your questions.

Attorney Managed

Our attorney-managed, 4-round process is personalized for each client by an Investigative Research team, all at a reasonable cost.

Schedule your Free Consultation & Analysis

We protect your privacy. Your information is not shared with third parties.

By submitting this form, you agree to receive texts from White Jacobs and Associates. Ongoing communication before, during, and after the program will be initiated by our credit analysts and their assistants. Msg & data rates may apply. Msg frequency varies. Unsubscribe at any time by replying STOP or clicking the unsubscribe link (where available). Privacy Policy

Meet the team

How We're Different

See what our customers are sayingWe can help with...

- Charge-Offs

- Collections

- Bankruptcy

- Late Payments

- Repossessions

- Foreclosures

- Student Loans

- Dispute Code Removal

- Credit Coaching

- Re-establishing Credit

- Debt Settlement

Are you planning on leasing a car or looking to become a homeowner? Is your low credit score stopping you from taking out a loan or effectively dealing with bankruptcy? No matter the reason, the answer is clear – you need the best credit repair Princeton has. And at White, Jacobs and Associates, we take active measures to improve your credit score and help you get your life on track.

Our process is unique – not only do we hike up your score, we set you up for long-term success by educating you on how to keep that score high.

WJA Is Not Your Everyday Credit Repair Princeton Agency

At White, Jacobs and Associates, we carry out an aggressive and alternative tactic to credit restoration. We dissect your financial situation in detail and devise a personalized credit repair plan. As we get down to business, we keep you in the loop the whole time.

The same cannot be said for our competitors – these traditional credit repair agencies just don’t cut it anymore. They just send out automated dispute letters and sit around waiting for results. You can do that yourself for free. Such companies can take thousands of dollars out of your pocket. Their approach can lead to a slight improvement of your score, but nothing life-changing.

Meanwhile, we hold a success rate of 70-90%. We arrive at the battlefield with our investigative team, expert credit analysts, and in-house law firm.

How Does a Bad Credit Score Happen Anyway?

A poor credit score can happen to anyone. People see their financial freedom taken away from them either because of a series of unfortunate events, someone else’s error or because of their own uninformed decision. No matter the cause, no one deserves to be permanently marked in their credit report.

Just some of the reasons people see their credit score take a plunge are:

● Bankruptcies

● Repossessions

● Debt settlements

● Unpaid student loans

● Other missed payments

● A high credit utilization ratio

● Identity theft

Credit scores are three-digit numbers that we get from calculation models such as FICO and VantageScore. These models use the information found in your credit reports. If your credit number is under 660 (with 300 being the lowest and 850 being the highest possible credit score), then you’re just under the ‘good’ credit score category.

Even a few points can make a ton of difference, not just in regards to the category you’re in. They can also mean a difference in thousands of dollars. In other words, by having a poor score, you’re risking getting an unfavorable interest rate.

What Exactly Is Credit Repair?

Credit repair is the process of adding positive items to your credit reports and removing negative ones. That results in a higher score.

Credit bureaus are institutions that compile these items and list them in your credit reports. The three largest bureaus are TransUnion, Experian, and Equifax. They gather information on you and your payment history. The negative items they list often come from creditors, lenders, and collection agencies.

Your credit reports are vital because they tell others if you’re financially responsible. Buying a house, taking out a loan, getting a job – all of this depends on the score of your credit report.

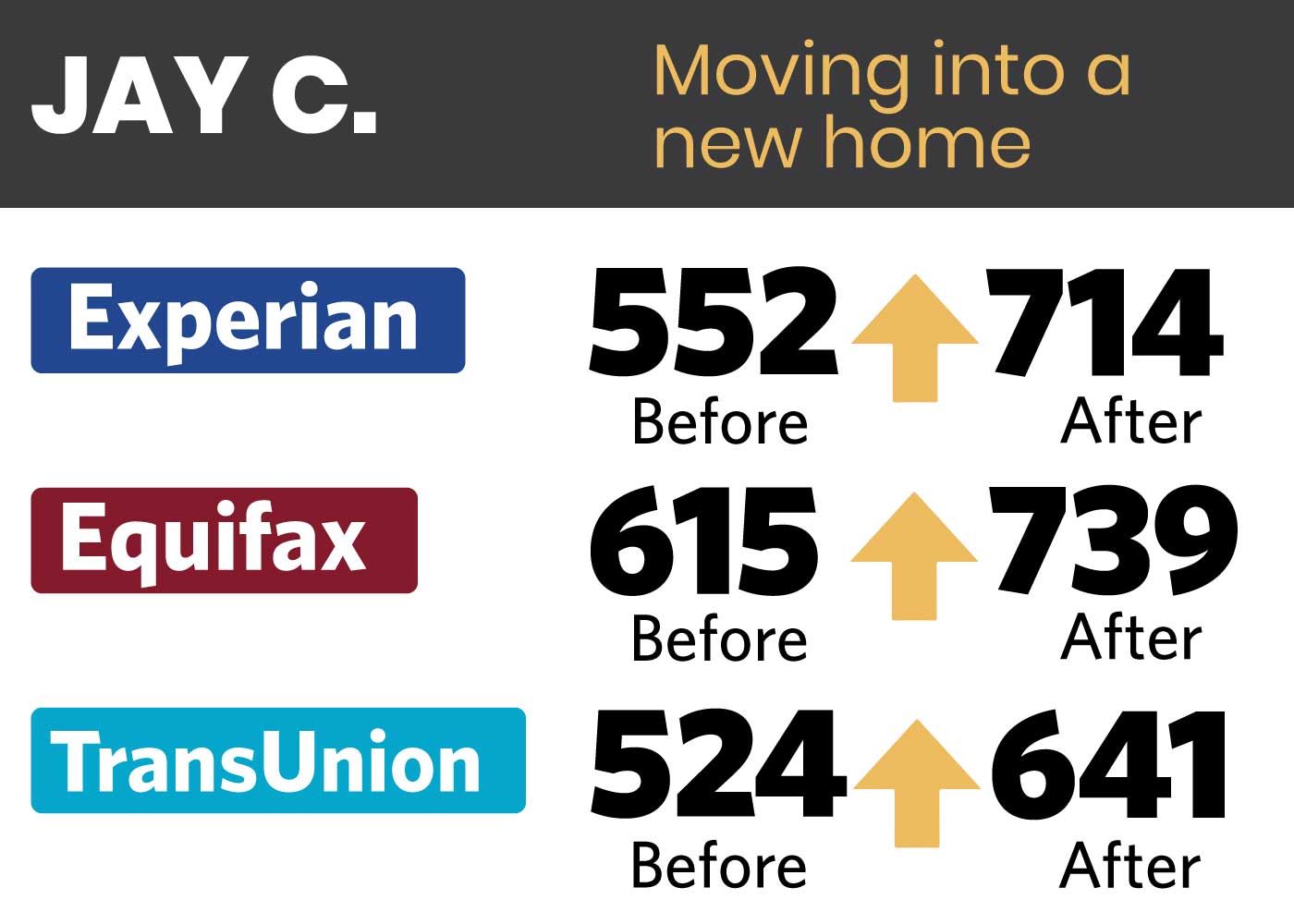

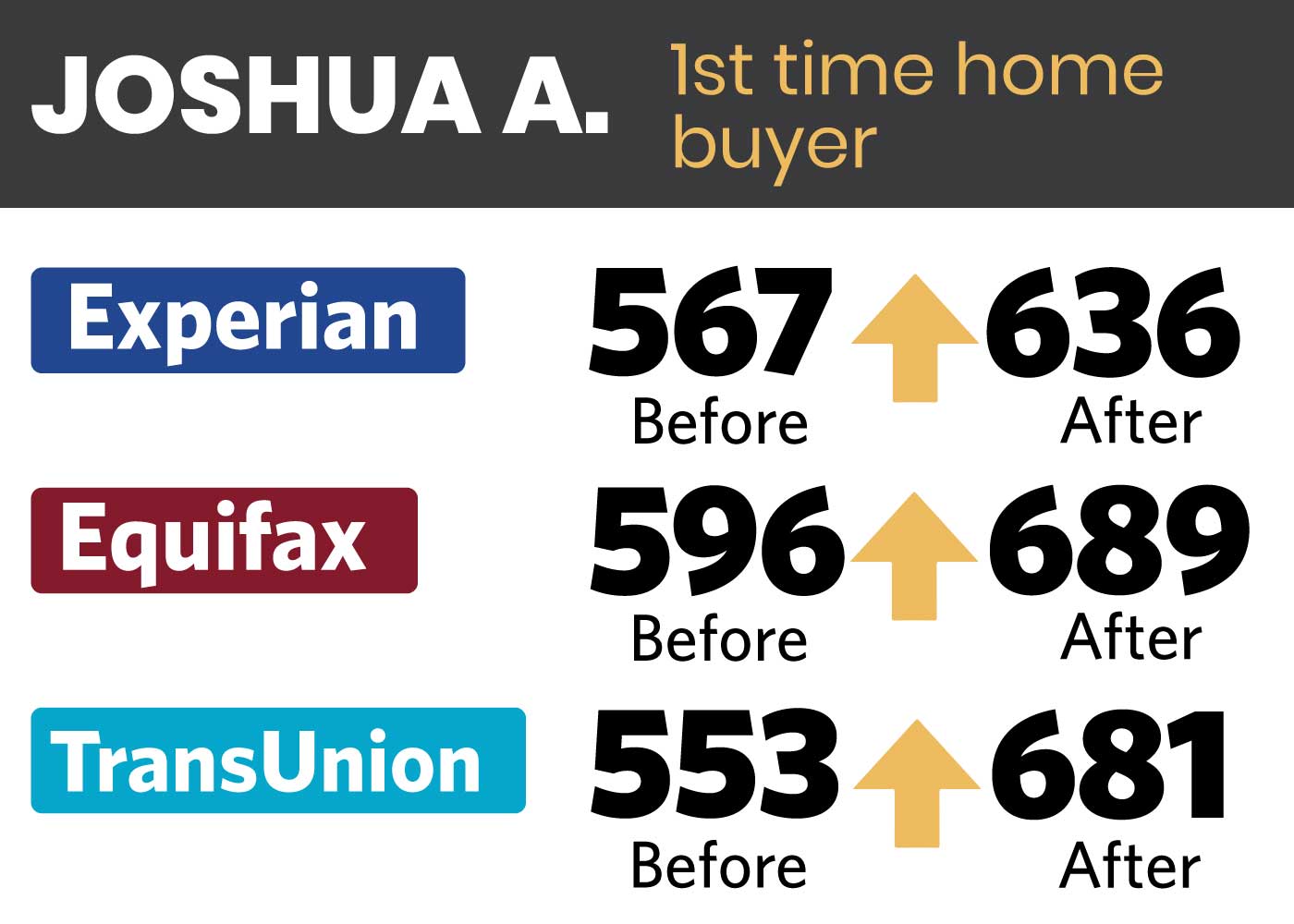

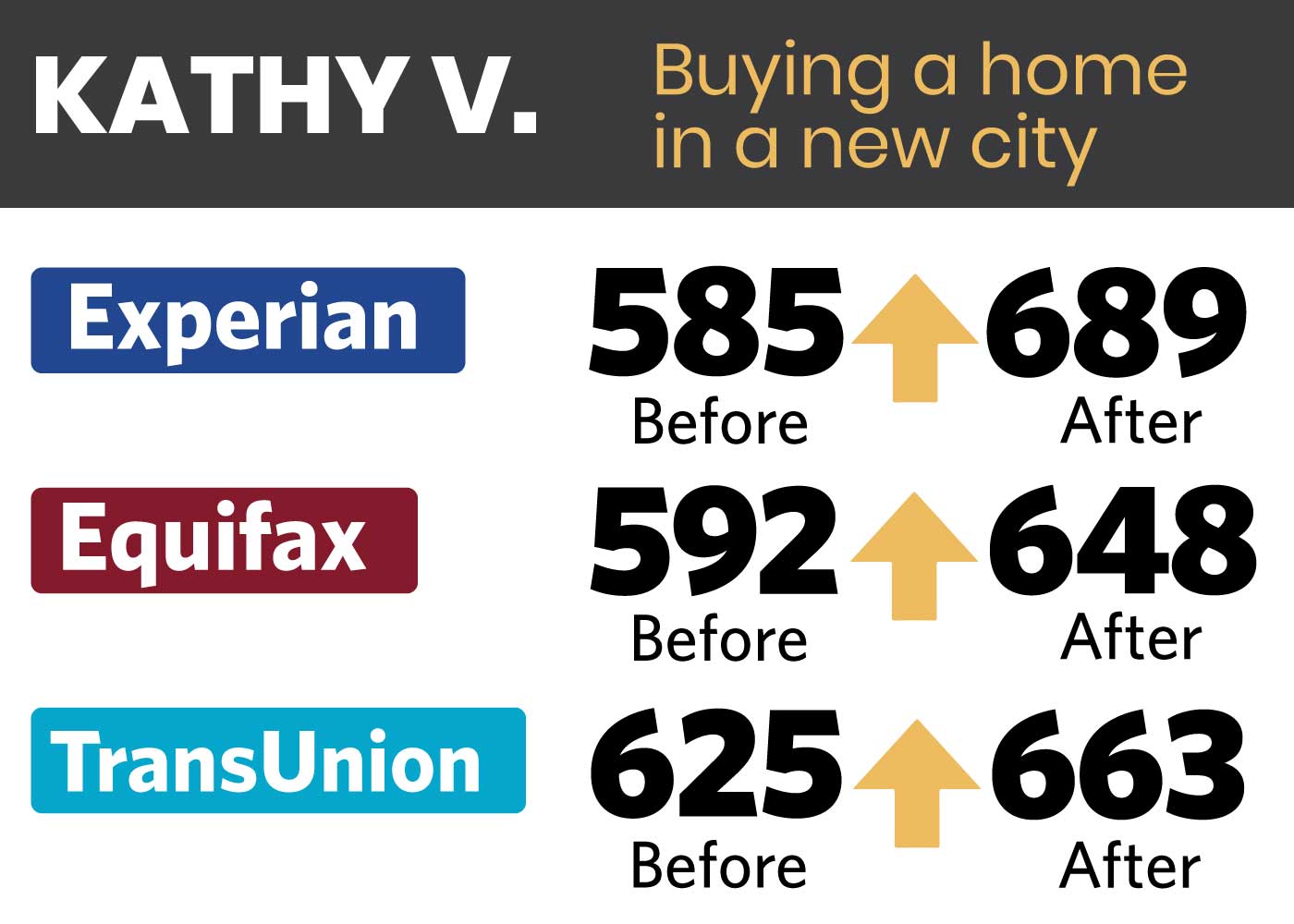

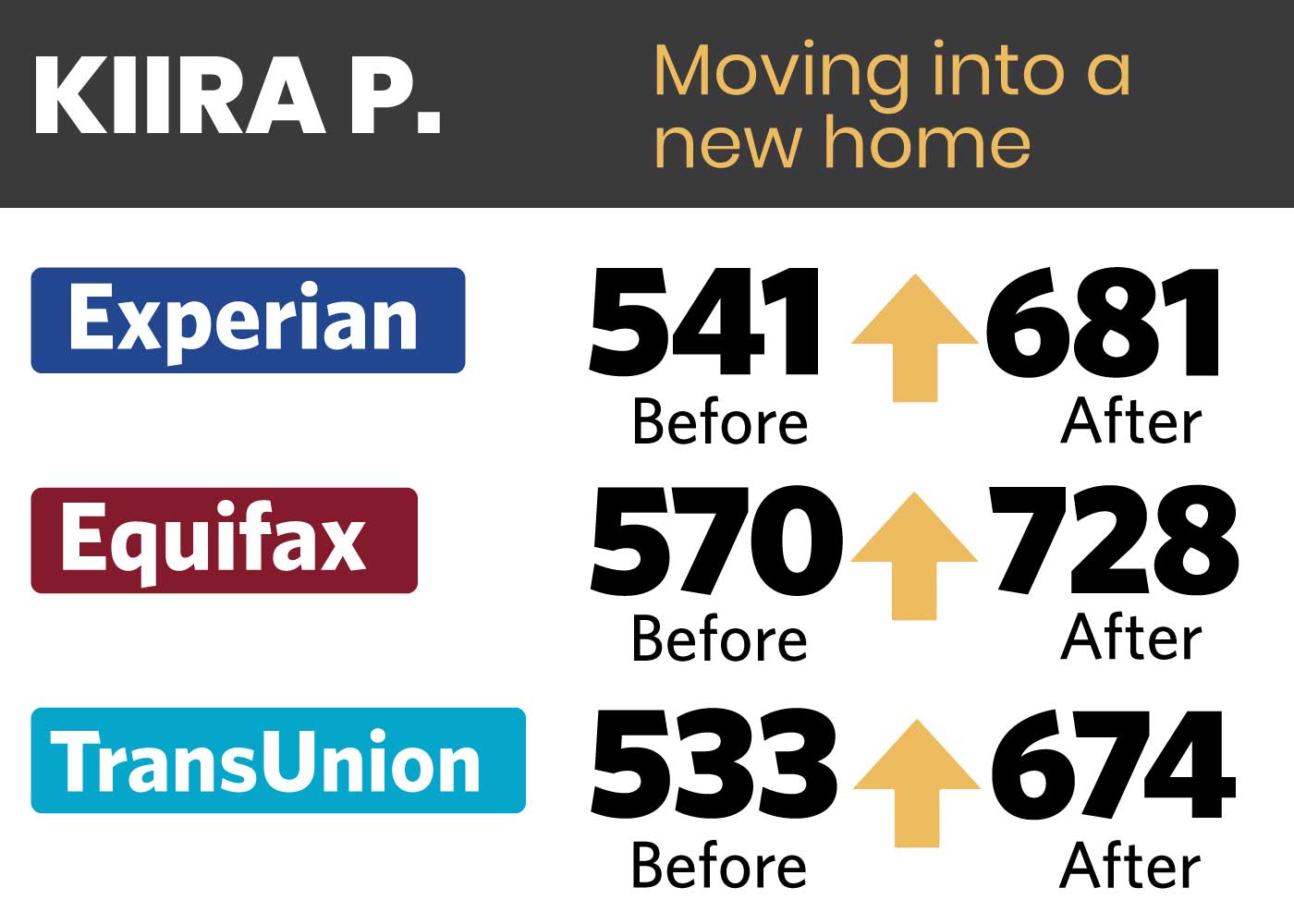

That is why we offer the best credit repair in Princeton. At White, Jacobs and Associates, we aim to bring up your trustworthiness in the eyes of others – and not just by a few points.

The White, Jacobs and Associates Credit Restoration Method in Princeton, TX

At WJA, we’ve developed a 4-round approach for boosting your credit health. We already mentioned our star team of in-house lawyers. They come into the picture during the 3rd and 4th rounds.

But first, we create a tailor-made credit restoration plan for your situation. After we pinpoint negative entries in your report that we feel should be disputed, we begin pursuing collection agencies and creditors for answers. We wait for their feedback and, regardless of whether it comes in or not, we move on to more aggressive measures.

And the aggressive measures start with personalized audits developed for maximum results. These are necessary to show creditors and collection agencies that we mean business. We demand they show us proof that they have the right to list those questionable entries in your reports.

If we find out they do not have these rights and don’t want to play nice, our team of attorneys comes into the picture and builds a case against these players.

So, it’s clear why you need professional credit repair in Princeton, TX. Credit bureaus, collection agencies, and creditors are used to dealing with dogs that bark but don’t bite. At WJA, we bite down hard.

WJA Educates You How to Add Positive Credit

Our goal isn’t just to fix your credit score and send you on your way. We aim to equip you for life.

So, after we erase negative entries from your credit report, we teach you how to add positive entries. We counsel and educate you on credit utilization ratio so you seem more trustworthy and favorable in the eyes of future lenders. We also teach you about handling credit card debt and dealing with installment debt.

How Long Until I See the First Results?

The first results come rolling in after 30-45 days already. By then, you may notice a positive change in your credit score, or you will begin getting panicked calls from creditors and collection agencies. Some of our clients start seeing changes after just 14 days!

We are transparent and upfront, and rather than dragging out the credit restoration process for months, we get the job done in no more than 6 months.

Nurse Your Credit Score Back to Health Now

Settle in Texas, with the help of White, Jacobs and Associates. Fix your credit score with the best credit repair in Princeton. Start that journey today by signing up for our free consultation with one of our credit analysts. Seize your buying power back in just 6 months.

Schedule your Free Consultation & Analysis