Top Rated Credit Repair

Phoenix, Arizona

Five star reviews

With thousands of happy clients on Google, Facebook, TrustPilot, and more, you will not find a stronger reputation. See how we are different!

Customized Plan

We don't just send out dispute letters like other companies. We customize our approach with personalized audits for maximum results.

One on One

You'll work with the same credit expert for the duration of the program. They will update you, coach you, and answer your questions.

Attorney Managed

Our attorney-managed, 4-round process is personalized for each client by an Investigative Research team, all at a reasonable cost.

Schedule your Free Consultation & Analysis

We protect your privacy. Your information is not shared with third parties.

By submitting this form, you agree to receive texts from White Jacobs and Associates. Ongoing communication before, during, and after the program will be initiated by our credit analysts and their assistants. Msg & data rates may apply. Msg frequency varies. Unsubscribe at any time by replying STOP or clicking the unsubscribe link (where available). Privacy Policy

Meet the team

How We're Different

See what our customers are sayingWe can help with...

- Charge-Offs

- Collections

- Bankruptcy

- Late Payments

- Repossessions

- Foreclosures

- Student Loans

- Dispute Code Removal

- Credit Coaching

- Re-establishing Credit

- Debt Settlement

Best Credit Repair Phoenix

Phoenix is the Valley of the Sun but everyone experiences shady times when it comes to credit. Strong credit is a critical part of a bright financial present and future. Just like finding an oasis in the Arizona desert, working with the best company for credit repair Phoenix has to offer is a real blessing. But be careful. Most companies do nothing but send out monthly disputes – and they’ll leave you burned and dry.

But here’s the thing: You can send dispute letters yourself!

At White, Jacobs and Associates we take things to another level instead of doing what 99% of credit repair companies do.

Traditional companies offer traditional credit repair (the 100-bucks-a-month guys) for Phoenix inhabitants, but White, Jacobs & Associates (WJA) offers an aggressive alternative to the traditional credit repair methods with our unique process.

We take pride in the expertise of our investigative research team, which allows us to tackle even the trickiest credit issues with a high level of customization. Throughout the entire program, you’ll work one-on-one with an expert credit analyst who will answer your questions and keep you updated on your progress.

Past Financial Problems. You May Need Phoenix Credit Repair

Life comes with ups and downs. With credit scores, the downs can have a severe impact. Losing your job. Going through a divorce. Experiencing a major illness or medical emergency. Issues with your student loans. Poor financial decisions from the past. Identity theft. Incorrect profile information being reported at the credit bureaus.

All of these show up on a credit report and impact your credit score. And it’s a domino effect from there. Bad credit scores can keep you from getting approved for a mortgage, refinance, and big purchases. Low credit scores will also restrict your ability to secure good interest rates on loans, credit cards, and other investments. Given that a small increase in interest rates can mean thousands of dollars in the long run – having bad credit is literally costing you way too much.

What Negative Credit Marks Do You Deal With?

In short, we deal with pretty much everything. The most common items we see are collections, charge-offs (delinquent credit card balances), late payments, repossessions, late student loan payments, inquiries, incorrect profile information, identify theft – and public records like bankruptcies, foreclosures, tax liens, and more.

Chances are, any combination of the items mentioned above is hurting your scores. By taking a close look at your credit report, we can help you figure out if credit repair is a good option or not. That’s one thing about our program. We don’t want you to sign up unless we feel there’s a great chance for success.

Is Credit Repair a Scam? Is This Legal?

All actions we take to remove negative and inaccurate items from your credit report are legal. Unlike a run-of-the-mill company, we approach this process more aggressively. By leveraging laws that protect you, the consumer, we challenge everything on all three of your credit reports. Our methods involve using the Fair Credit Reporting Act (FCRA), Fair Debt Collection Practices Act (FDCPA), Fair Credit Billing Act (FCBA), Fair and Accurate Credit Transactions Act (FACTA), and HIPAA laws.

Our priority is to get your buying power back by removing negative/inaccurate items from your report. It’s that simple. And yes, we do other things to improve your credit situation, but our mission is, and will always be, to change your life through credit.

2 Methods to Increase Credit Scores

Our investigative research team (IR) is the driving force behind our method of using custom audits to remove negative or inaccurate items from your credit report. Once we determine that you are a good candidate for the program, we immediately start addressing everything on your credit reports.

The second way to increase your credit score is by adding positive credit. Your personal credit analyst will coach you on adding positive trade lines. Doing this can increase your score significantly. A combination of credit strategies is the best way to approach credit restoration so that’s exactly what we do.

Credit Repair in Phoenix – the Aggressive Option

You may be curious about how we’re different from other companies.

If you go online and start looking for credit repair, you’ll be overwhelmed with options. Most of these companies are doing the same thing – which is sending out a few dispute letters on a monthly basis. Again – you could do this yourself! These companies lack the urgency to get results because the longer you pay the ongoing monthly fee, the more money they make! They don’t care about what’s on your credit report.

They do not take the time to thoroughly audit creditors in the 3rd and 4th rounds. Restoring credit is a complex process, but we work hard to simplify it. Our Investigative Research (IR) team is dedicated to strategically responding to creditor replies. Additionally, other companies lack the specialized resources we offer.

How Quickly Will You See Results From Credit Restoration?

Traditional credit repair companies (we call them the “100-bucks-a-month” guys) will keep you on the hook for as long as possible – with poor to mediocre results. We often get clients who come to us from companies like Lexington Law because they are looking for a more aggressive approach.

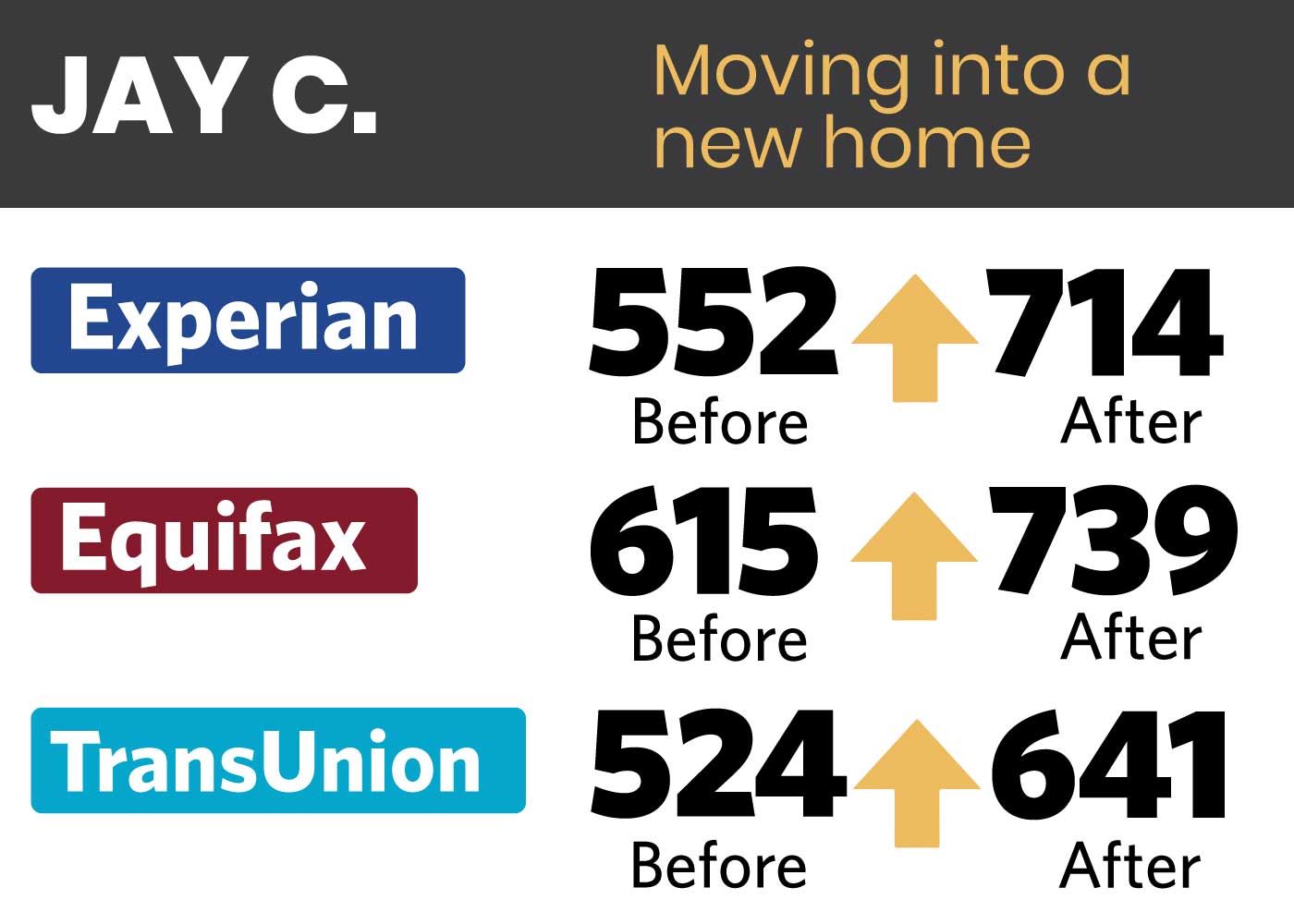

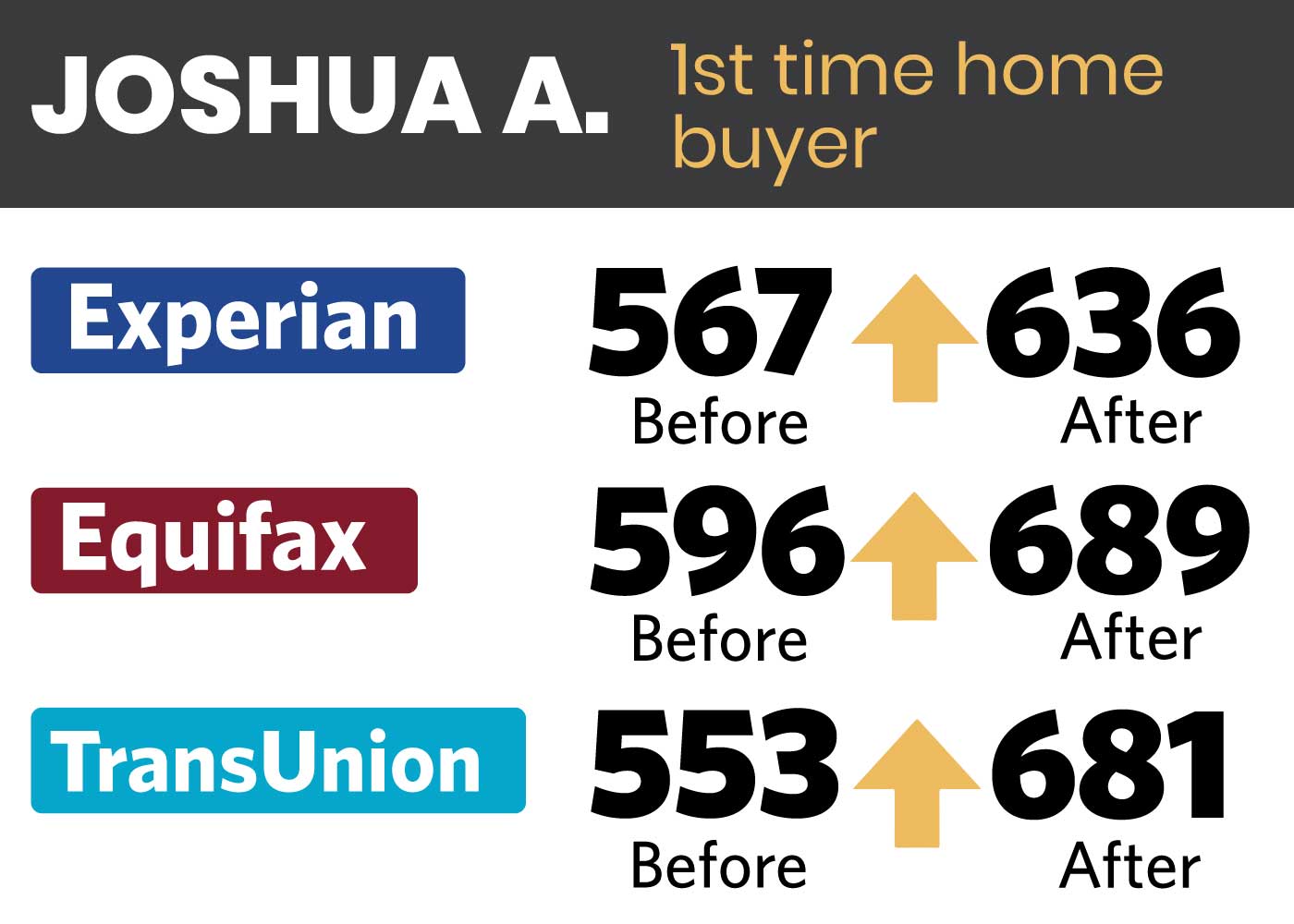

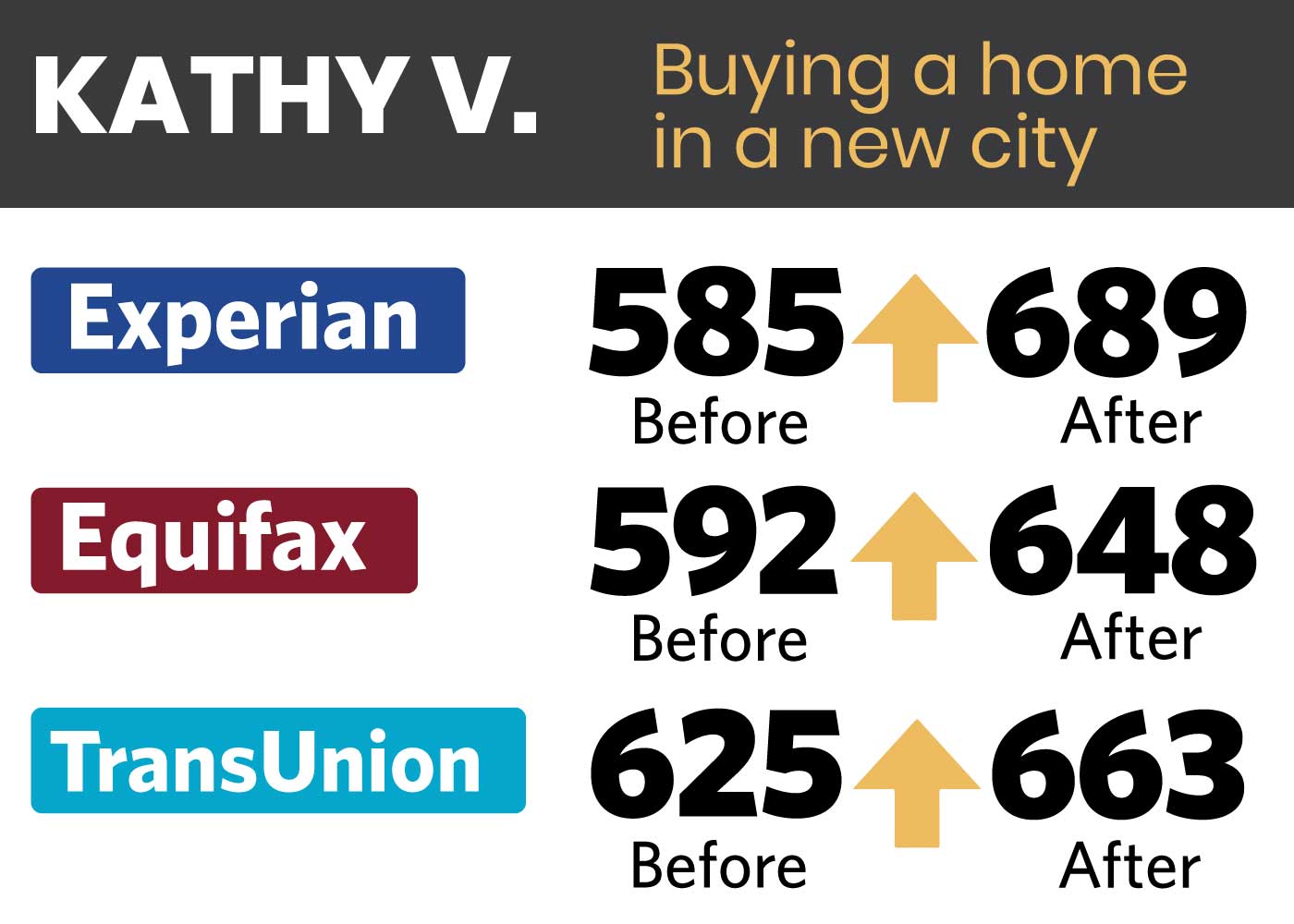

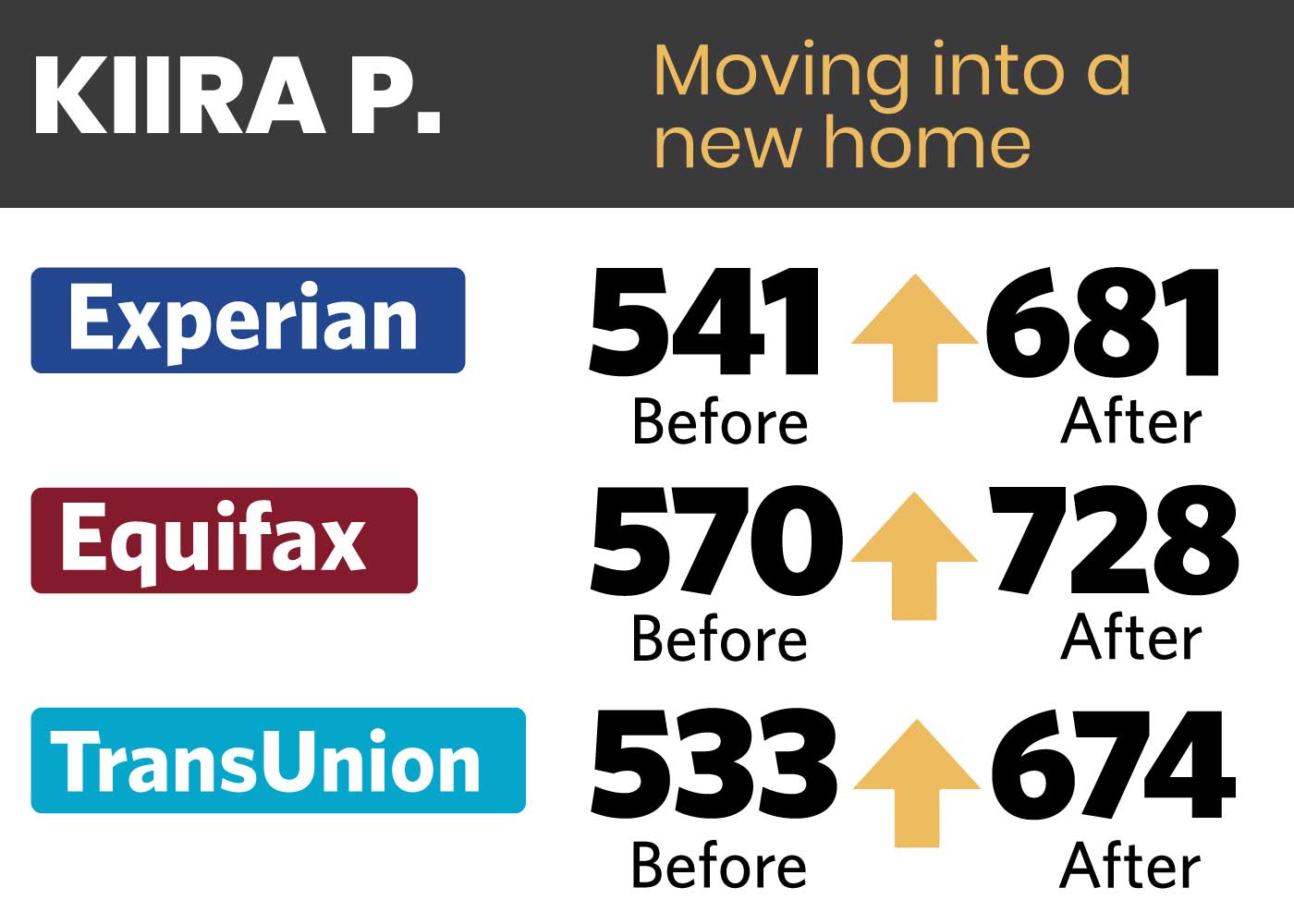

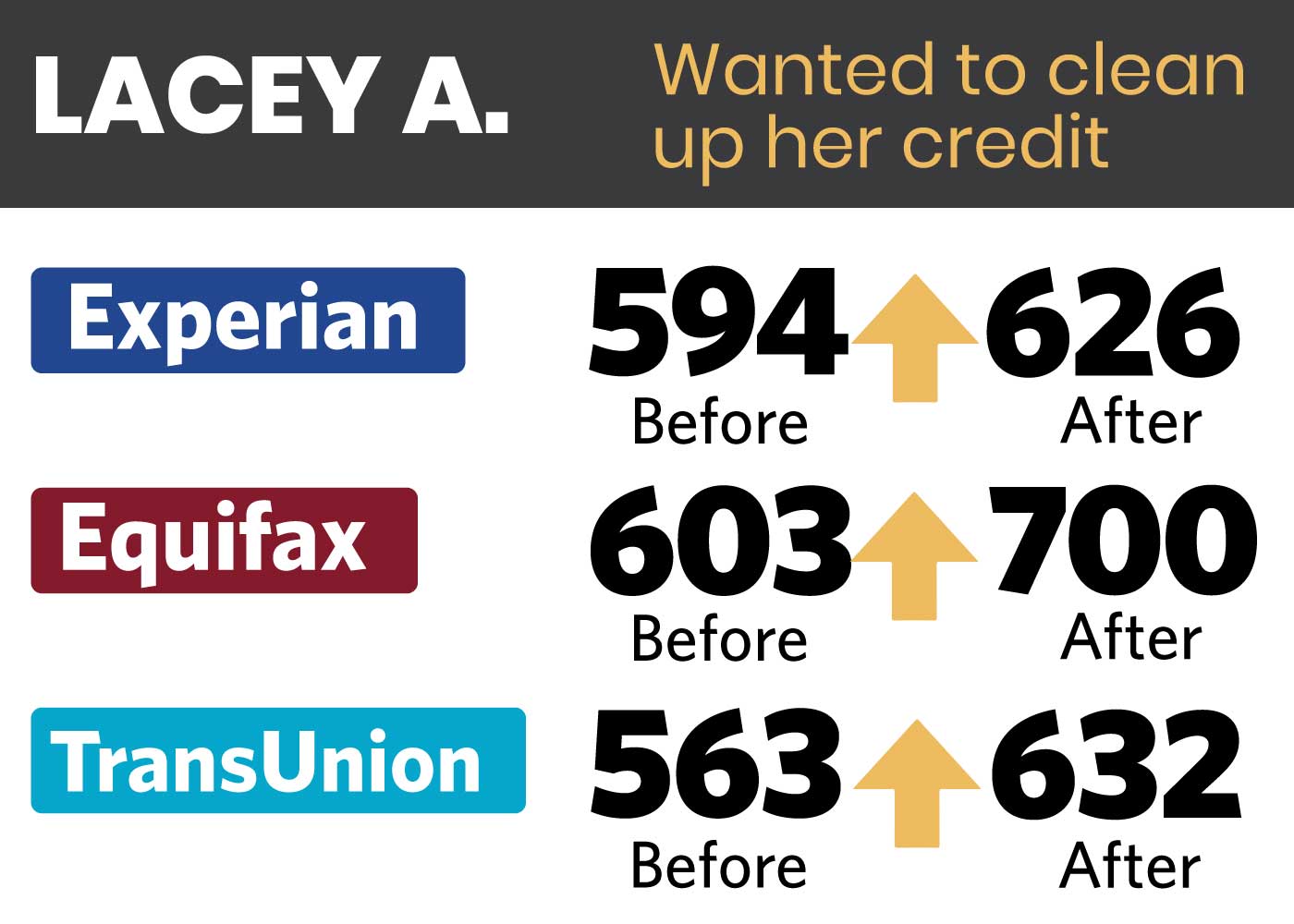

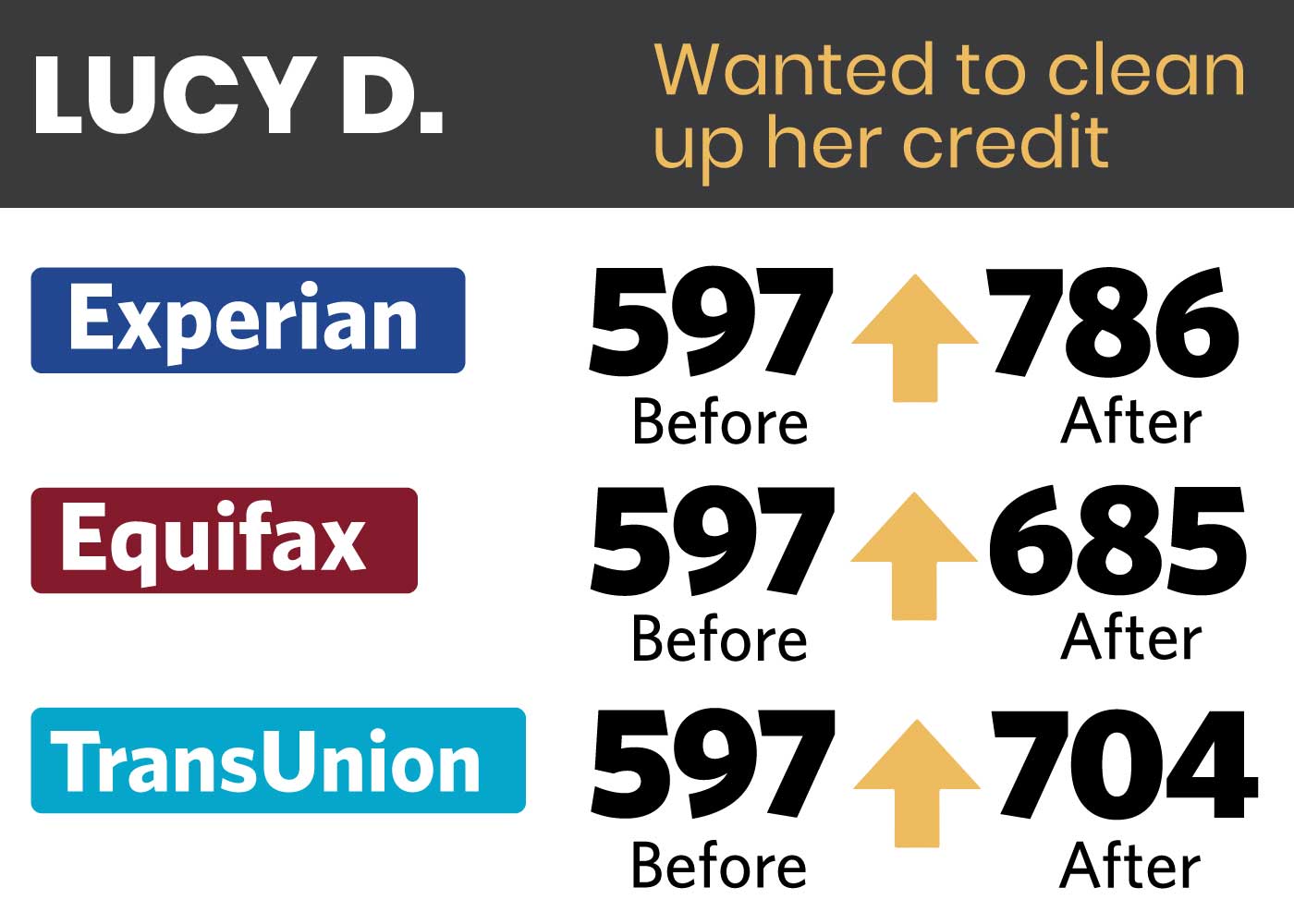

Our program lasts a maximum of 6 months. Clients typically start to see results on a credit report as soon as 45-60 days into the process. If you want a better idea of what to expect for your specific situation, just give us a call. We offer a no-cost credit review and consultation.

We’re Easy to Talk To. Let’s Get Started

Right from the start, you’ll speak with one of our professional credit analysts and they’ll be your guide through the entire program. For whatever reason, your credit score is not where it needs to be. It’s time to call in the professionals, as you can’t keep living the way you do.

You need a knowledgeable company with a team of experts to help you with creditors that will not listen to the little guy. You need more than generic dispute letters to the bureaus, which you can do yourself. WJA knows the ins and outs of Phoenix credit repair and will work with you to reach your short-term and long-term financial goals.

You need your buying power back. We want to help you. Let’s get the conversation started.

Local Resources: Consumer Laws

Surprise Real Estate – Your Surprise Specialist

- FCRA (Fair Credit Reporting Act)

- FDCPA (Fair Debt Collection Practices Act)

- FACTA (Fair and Accurate Credit Transaction Act)

- HIPAA (Health Information Portability and Accountability Act)

- E OSCAR (Online Solution for Complete and Accurate Reporting)

Schedule your Free Consultation & Analysis