Top Rated Credit Repair

McAllen, Texas

Five star reviews

With thousands of happy clients on Google, Facebook, TrustPilot, and more, you will not find a stronger reputation. See how we are different!

Customized Plan

We don't just send out dispute letters like other companies. We customize our approach with personalized audits for maximum results.

One on One

You'll work with the same credit expert for the duration of the program. They will update you, coach you, and answer your questions.

Attorney Managed

Our attorney-managed, 4-round process is personalized for each client by an Investigative Research team, all at a reasonable cost.

Schedule your Free Consultation & Analysis

We protect your privacy. Your information is not shared with third parties.

By submitting this form, you agree to receive texts from White Jacobs and Associates. Ongoing communication before, during, and after the program will be initiated by our credit analysts and their assistants. Msg & data rates may apply. Msg frequency varies. Unsubscribe at any time by replying STOP or clicking the unsubscribe link (where available). Privacy Policy

Meet the team

How We're Different

See what our customers are sayingWe can help with...

- Charge-Offs

- Collections

- Bankruptcy

- Late Payments

- Repossessions

- Foreclosures

- Student Loans

- Dispute Code Removal

- Credit Coaching

- Re-establishing Credit

- Debt Settlement

Aggressive Credit Repair McAllen TX

Being the retail center of South Texas and Northern Mexico has certainly done wonders for McAllen’s economy. However, on an individual level, people have seen a decline in their buying power. It’s time to take control of your financial situation by getting the best credit repair McAllen TX has to offer.

People lose grip on their finances for a multitude of reasons only few of which could have been prevented. More often than not, outside factors such as unforeseen events and economic downturns bear all the responsibility for your financial troubles. All that matters is what you do to get your buying power back.

The Most Efficient Credit Repair Service in McAllen

White, Jacobs and Associates offers the most efficient credit repair you’ll ever get. Unlike other run-of-the-mill McAllen credit repair services, we don’t just drown your creditors in automated dispute letters. Sure, dispute letters have a role to play in communication with creditors, but they can’t be the only thing you do.

Credit repair services that promise to improve your credit score by only sending dispute letters are literally scamming you. You can send dispute letters yourself! You don’t need to pay an ungodly sum of money to some “expert” to do that for you.

At WJA, we approach credit repair seriously and pull no punches. We use every tool and every method at our disposal to get your credit reports back in order and your creditors to back off. Some of our methods are fairly aggressive but completely legal. There’s simply no other way to talk to financial institutions.

Our willingness to do what it takes is the key to the efficiency of our credit restoration measures.

How to Know If You Need Credit Repair?

Whether you need credit repair or not depends on your credit score and the model that the lenders look at to determine if they’ll give you a loan or not.

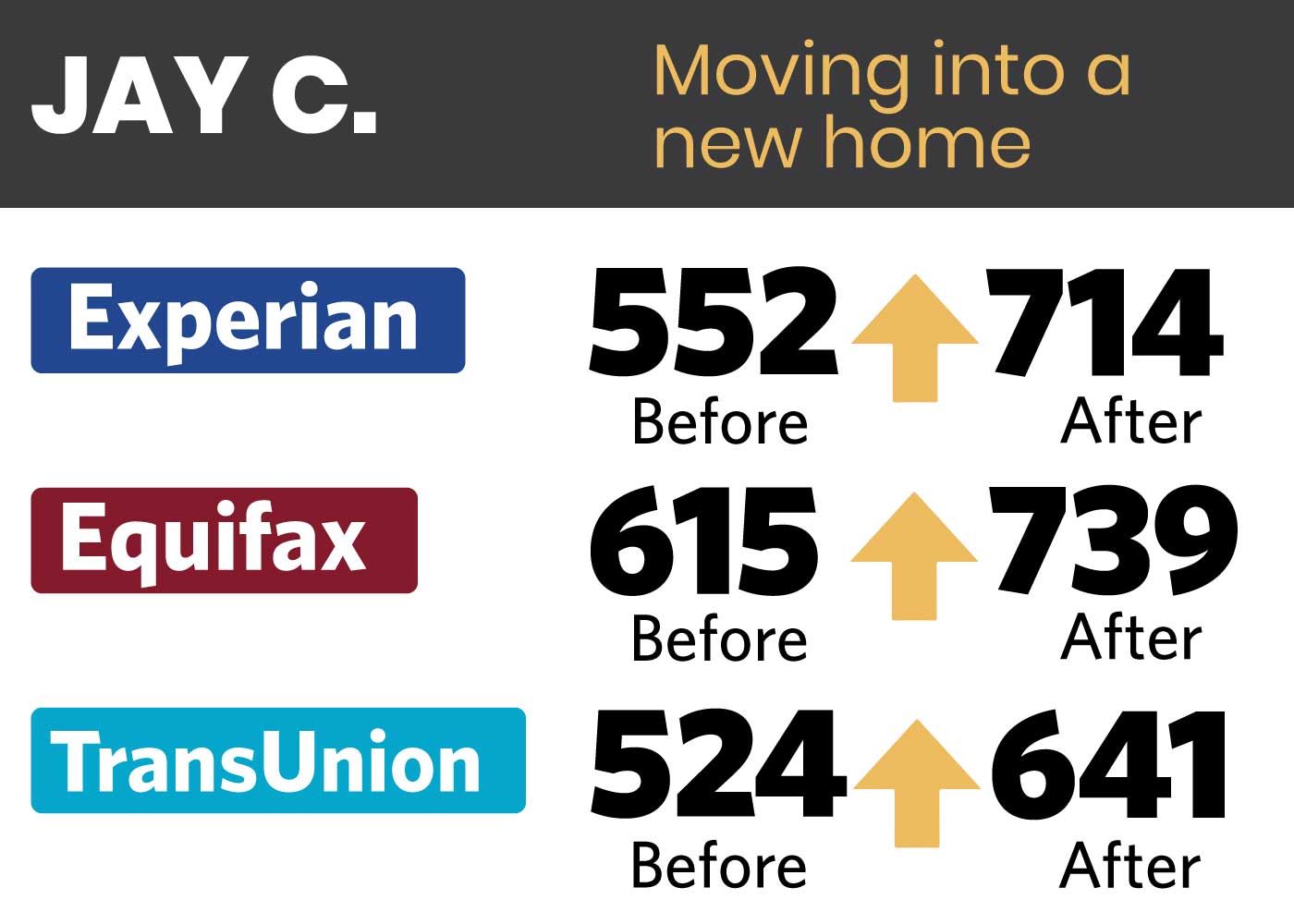

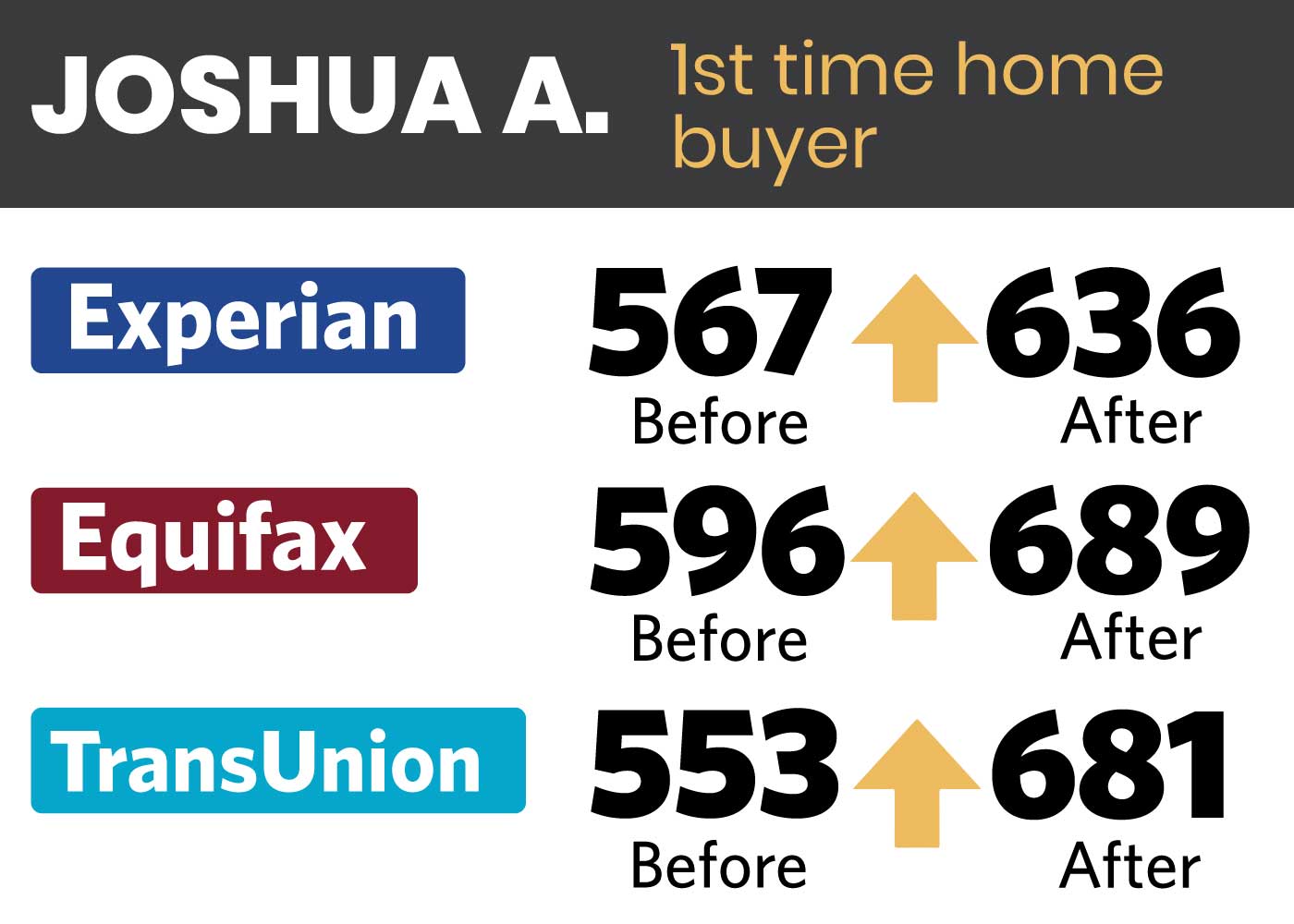

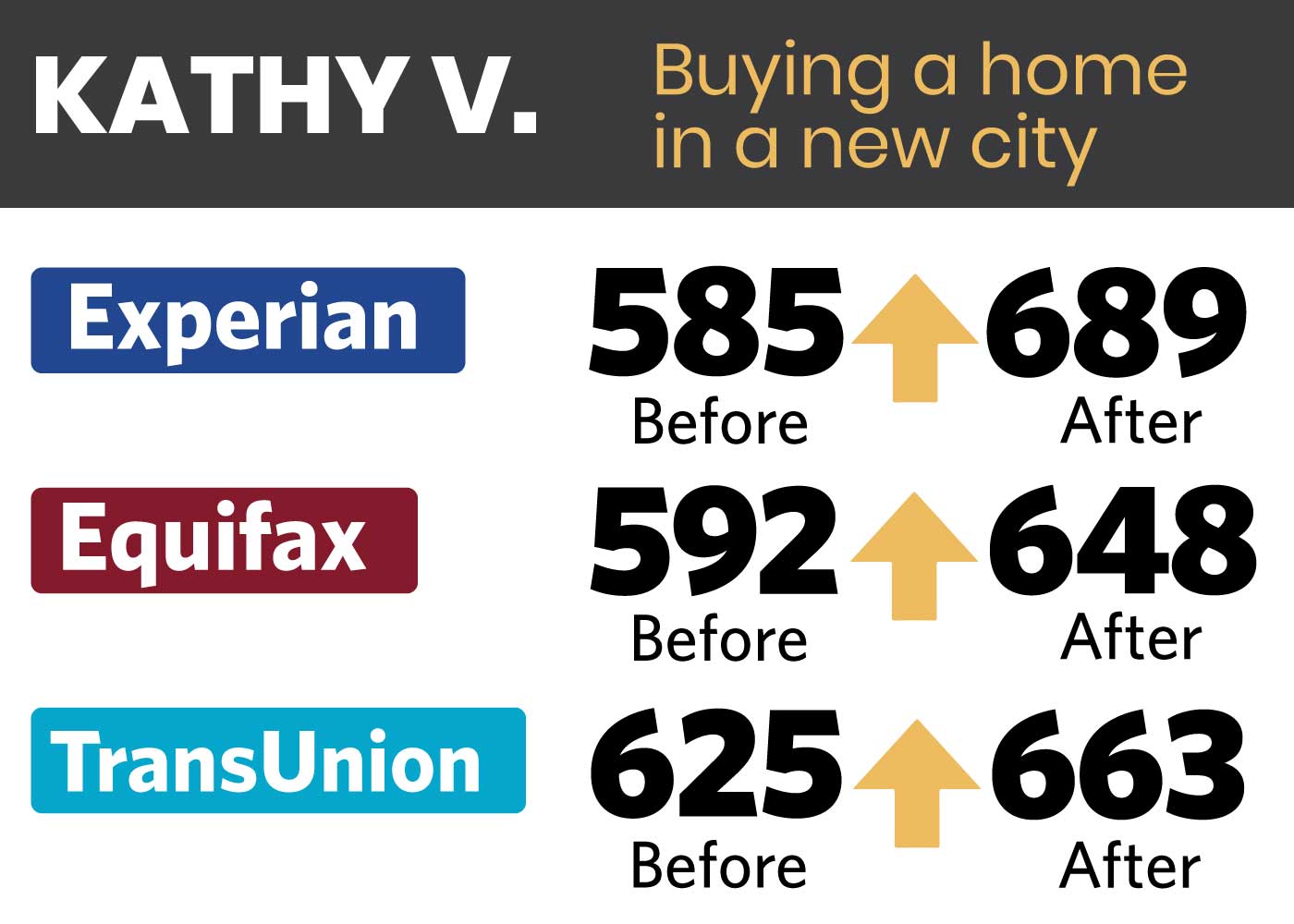

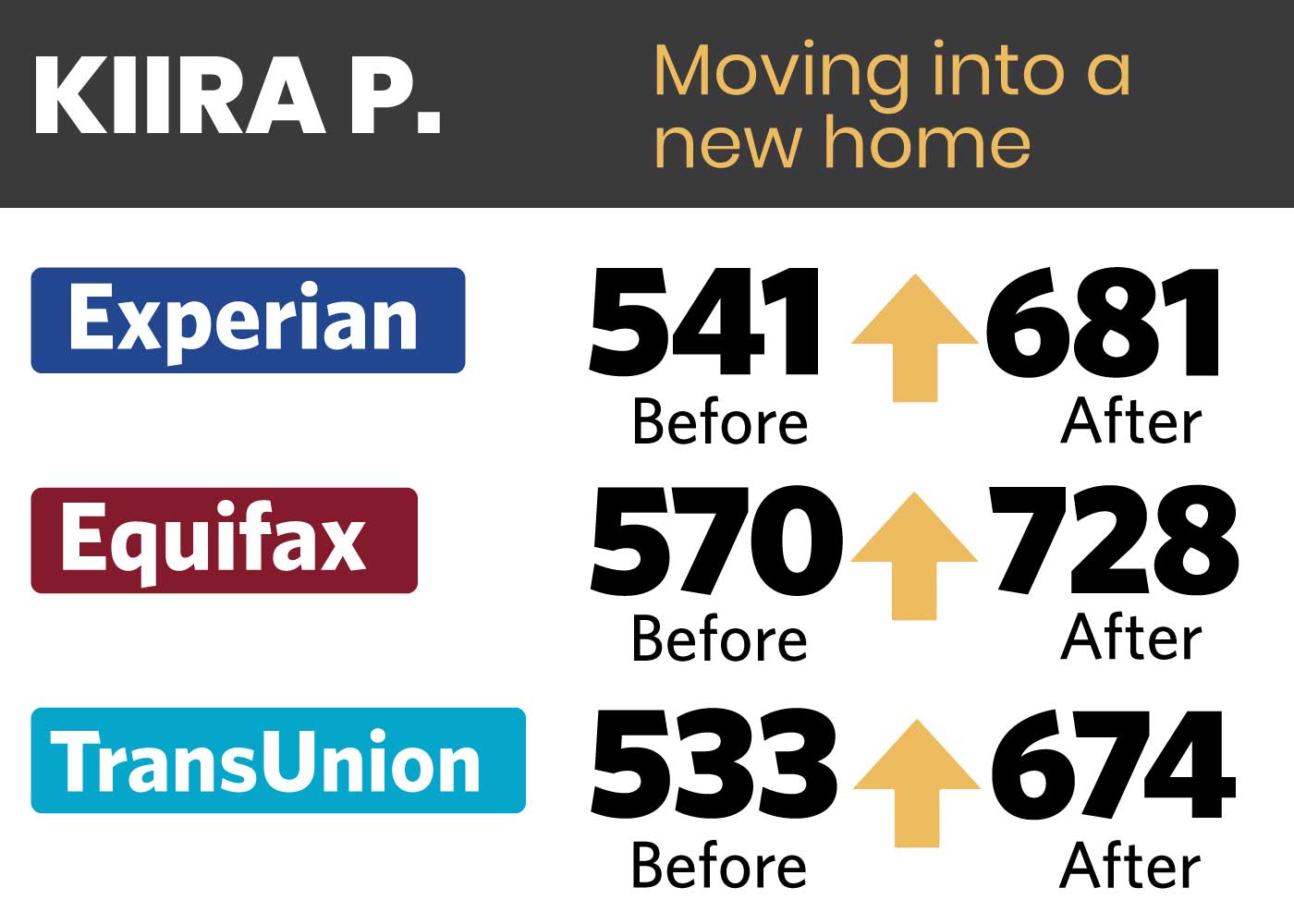

The most commonly used scoring model is FICO where scores range from 300 to 850. FICO created different scoring models for all major credit bureaus — Experian, TransUnion, and Equifax. It’s safe to say that improving your FICO credit score will influence your buying power.

Having a score between 670 and 739 is considered good. Anything lower than that, and your chances of getting a loan diminish significantly. Not only that, even if you get a loan, the lenders are likely going to offer you abysmal interest rates.

In other words, financial institutions are looking to capitalize on your lackluster credit score, and it’s paramount you don’t let that happen. If your credit score is fair or lower, you need credit repair. Moreover, it’s not a bad idea to think about your credit score even if it’s “good.” Remember, it can go up to 850!

Our Approach to Credit Repair

We will highlight what makes our credit repair approach unique. Our clients need to understand what we mean by “aggressive” and “efficient” credit repair. Let’s begin with the aggressive aspect.

Attorney Managed Credit Repair

Our 4-stage credit repair process relies on an in-house team of credit repair researchers who can crack even the most challenging cases.

We start by going after every item on your three bureau credit report. We dispute every item that we can legally challenge, and audit your creditors to get them to back down.

Our team of experienced credit analysts and investigative researchers steps in when creditors are uncooperative and unwilling to make concessions. It’s important for you to know that as a client, you have certain rights that no one can take away from you. These include the rights to fair credit reporting that lenders often neglect.

That’s why we have a team of experts on your side. They compile evidence against your creditors in an escalated process that often yields results. Some clients worry about legal complications, but there’s no need. Our team handles everything, including all communication with creditors, which usually results in a resolution before any further action is necessary.

It’s an aggressive, escalated process, but it’s what makes our service the best credit repair McAllen TX has to offer.

Your Rights as a Consumer

Here are just a couple of laws that guarantee your rights as a consumer:

- Fair Credit Reporting Act (FCRA)

- Fair Debt Collection Practices Act (FDCPA)

- Fair Credit Billing Act (FCBA)

- Fair and Accurate Credit Transactions Act (FACTA)

- HIPPA laws.

Our investigative research team will use this information to your advantage. They will work to prove there has been a violation of your rights and unfair treatment of you as a client.

Disputes vs Audits – What’s the Difference?

Disputes are all well and good, but only as a part of a broader credit repair strategy. On their own, they can’t achieve much and probably won’t fix your credit. That’s why we also audit your creditors.

That means we require that your auditors prove they had the right to report an item in the first place. As you’d expect, they can rarely provide the proof we demand. They are then legally obligated to remove the negative item from your reports.

Get Your Buying Power Back with Our Help

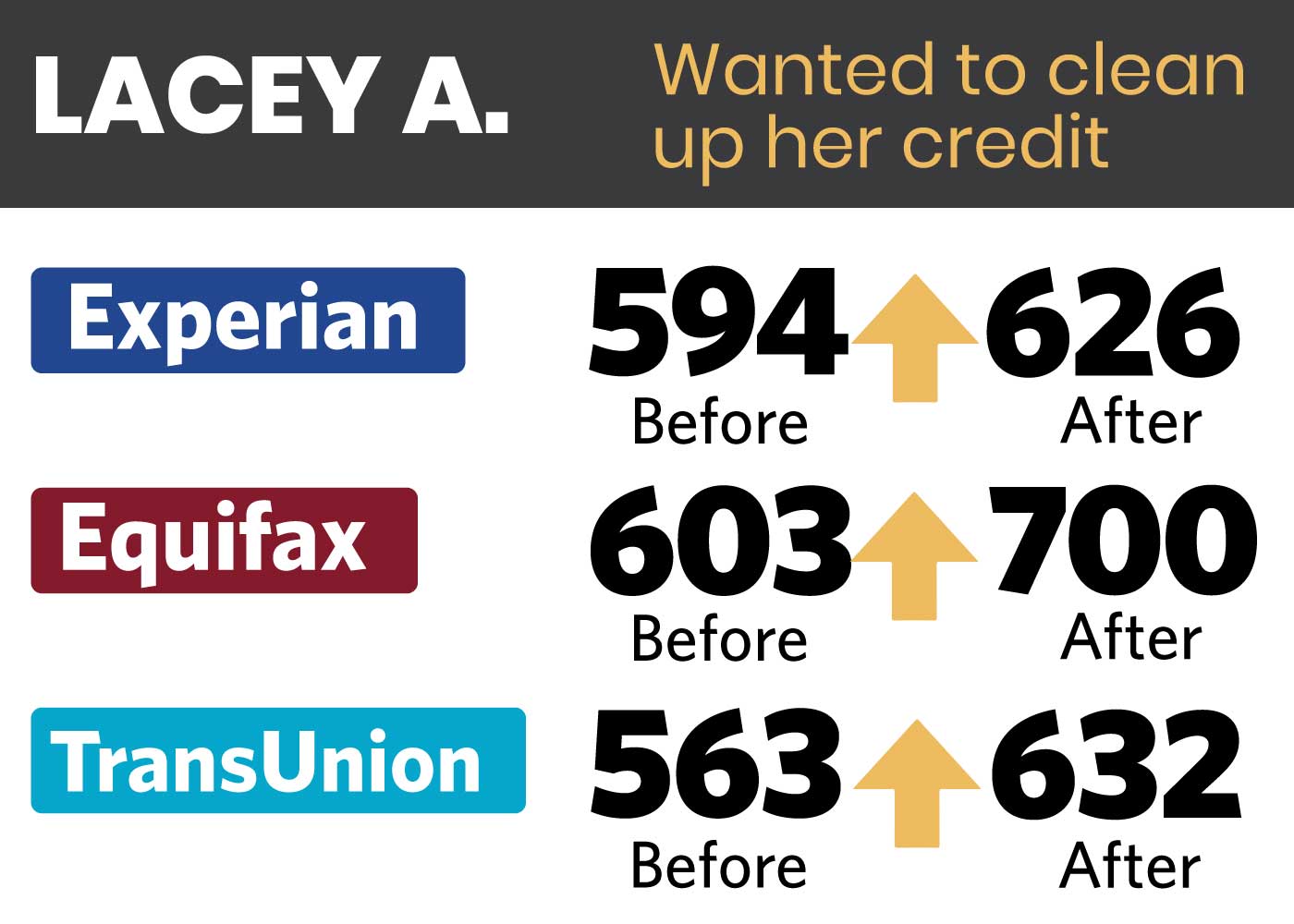

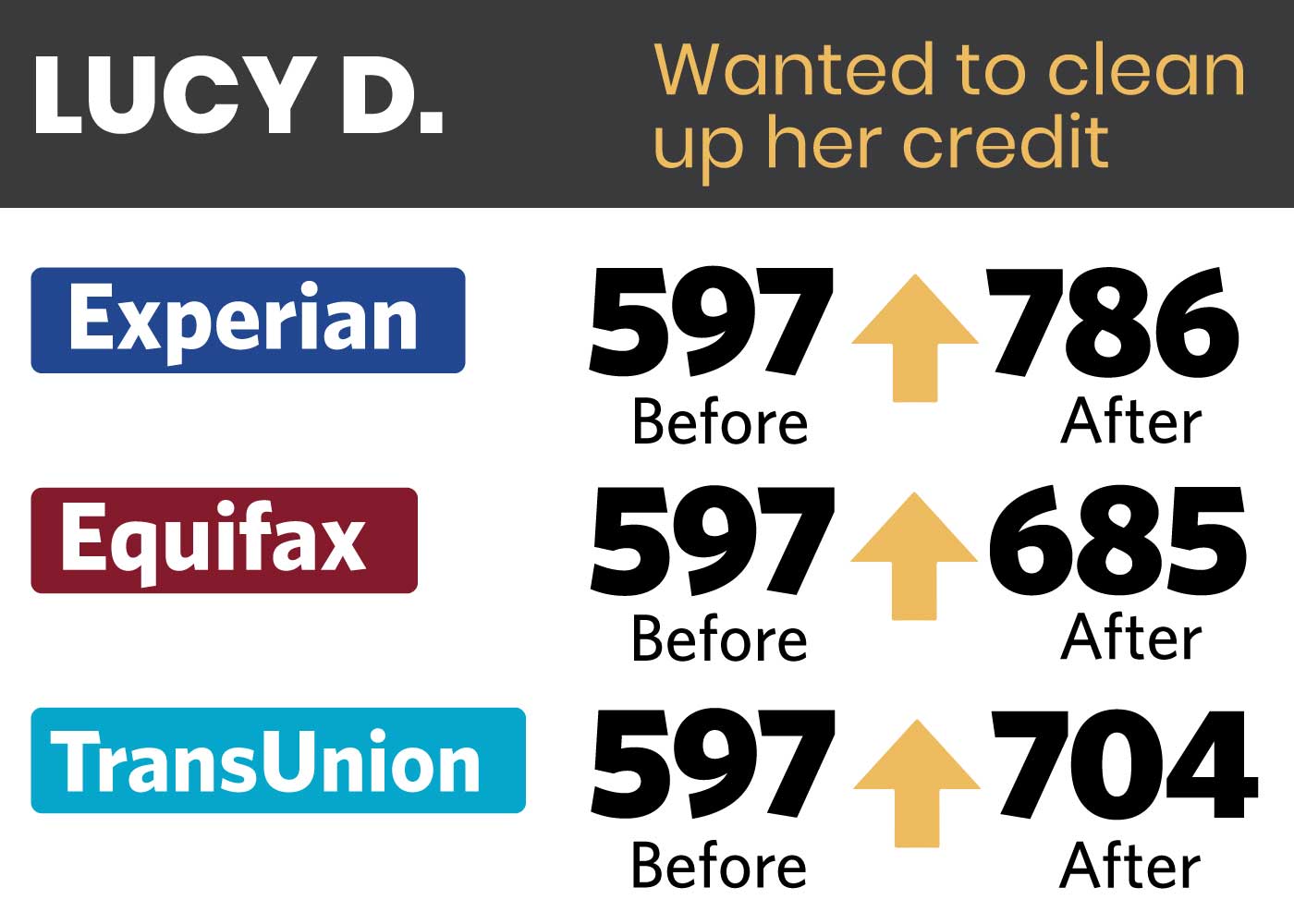

White, Jacobs and Associates gets real results thanks to our aggressive approach to credit repair. We don’t waste your time with automated dispute letters that never get anything done.

Call us today to get a free consultation with one of our expert credit counselors and start getting your buying power back.

Schedule your Free Consultation & Analysis