Top Rated Credit Repair

Lafayette, Louisiana

Five star reviews

With thousands of happy clients on Google, Facebook, TrustPilot, and more, you will not find a stronger reputation. See how we are different!

Customized Plan

We don't just send out dispute letters like other companies. We customize our approach with personalized audits for maximum results.

One on One

You'll work with the same credit expert for the duration of the program. They will update you, coach you, and answer your questions.

Attorney Managed

Our attorney-managed, 4-round process is personalized for each client by an Investigative Research team, all at a reasonable cost.

Schedule your Free Consultation & Analysis

We protect your privacy. Your information is not shared with third parties.

By submitting this form, you agree to receive texts from White Jacobs and Associates. Ongoing communication before, during, and after the program will be initiated by our credit analysts and their assistants. Msg & data rates may apply. Msg frequency varies. Unsubscribe at any time by replying STOP or clicking the unsubscribe link (where available). Privacy Policy

Meet the team

How We're Different

See what our customers are sayingWe can help with...

- Charge-Offs

- Collections

- Bankruptcy

- Late Payments

- Repossessions

- Foreclosures

- Student Loans

- Dispute Code Removal

- Credit Coaching

- Re-establishing Credit

- Debt Settlement

Lafayette maintains its economic influence to this day. With an average income higher than the US average, The Hub City remains the pride of Louisiana. Its remarkable recovery after the recession keeps drawing more people into its fold. That’s why we – White, Jacobs and Associates – strive to give you the best credit repair services in Lafayette.

It’s up to you, the citizens of Lafayette, to make sure the economy continues to grow. And what better way to achieve that than with strong buying power. To stay truly independent and free of high-interest rates, you need your buying power back. You will need the most professional and the highest-quality credit repair Lafayette, Louisiana has to offer – White, Jacobs and Associates.

Why White, Jacobs and Associates?

It’s completely possible you already tried to get credit repair at some point in your life. You were probably tired of lenders trying to gouge as much as they can out of you just because your credit score wasn’t in tip-top shape.

Then you came across this credit repair company in Lafayette that promised to make your score excellent. Their strategy – send automated dispute letters. It looks good at first, they promise they’re giving your creditors hell. Then a few months pass by. No results. You keep paying your monthly fees to the company, they keep sending automated disputes, your financial situation keeps deteriorating, and the credit report stays pretty much the same.

At WJA, we call those types of companies $100-a-month guys. Because that’s what they do, they just want your monthly fee. There’s nothing in it for them if they solve your problem quickly. It’s much better to keeping milking away until you’re either broke or – you find a better solution.

White, Jacobs and Associates was founded in response to all the inefficiency in the credit repair industry. We were sick and tired of all the leeches looking to capitalize on your bad luck. And that’s exactly what might have caused your financial downturn – just bad luck. To be honest with you, it does not matter how you got to where you are now. We’re not here to judge. We’re here to figure out how you can move forward.

With WJA, you have an entire force of dedicated people on your side. An investigative research team and expert credit analysts at your disposal. But expertise and professionalism are not the only two things we have that our competitors lack. What makes us truly different is we set time frames when you can expect results. It’s not an indefinite process. Traditional credit repair goes on and on, month over month, year over year. That’s not how we do things.

How Does “Traditional” Credit Repair Work?

What credit repair usually entails varies from one company to another. The less successful ones usually just send automated dispute letters. Their goal? To send enough letters to clog your creditor’s mail. The credit bureaus have to process the dispute within 30 to 45 days.

If they don’t respond within that time window, Fair Credit Reporting Act (FCRA) dictates that the account be deleted. It’s not very efficient and usually yields poor results. At best, this is usually a temporary solution – not a permanent fix.

How We Repair Your Credit

At WJA, we don’t fool around with automated dispute letters. Our approach is aggressive and methodical, yet entirely within the law. Our strategy is more refined than simply trying to jam your creditor’s mailbox.

We apply a four-step process that has the goal of dismantling your creditor’s file. We look for even the slightest of inaccuracies and use them to our advantage. During the first two rounds of our process, we go after all the negative items on your credit report. That’s when creditors and collection agencies will try to get you to validate all the items, but you leave all correspondence with them to us.

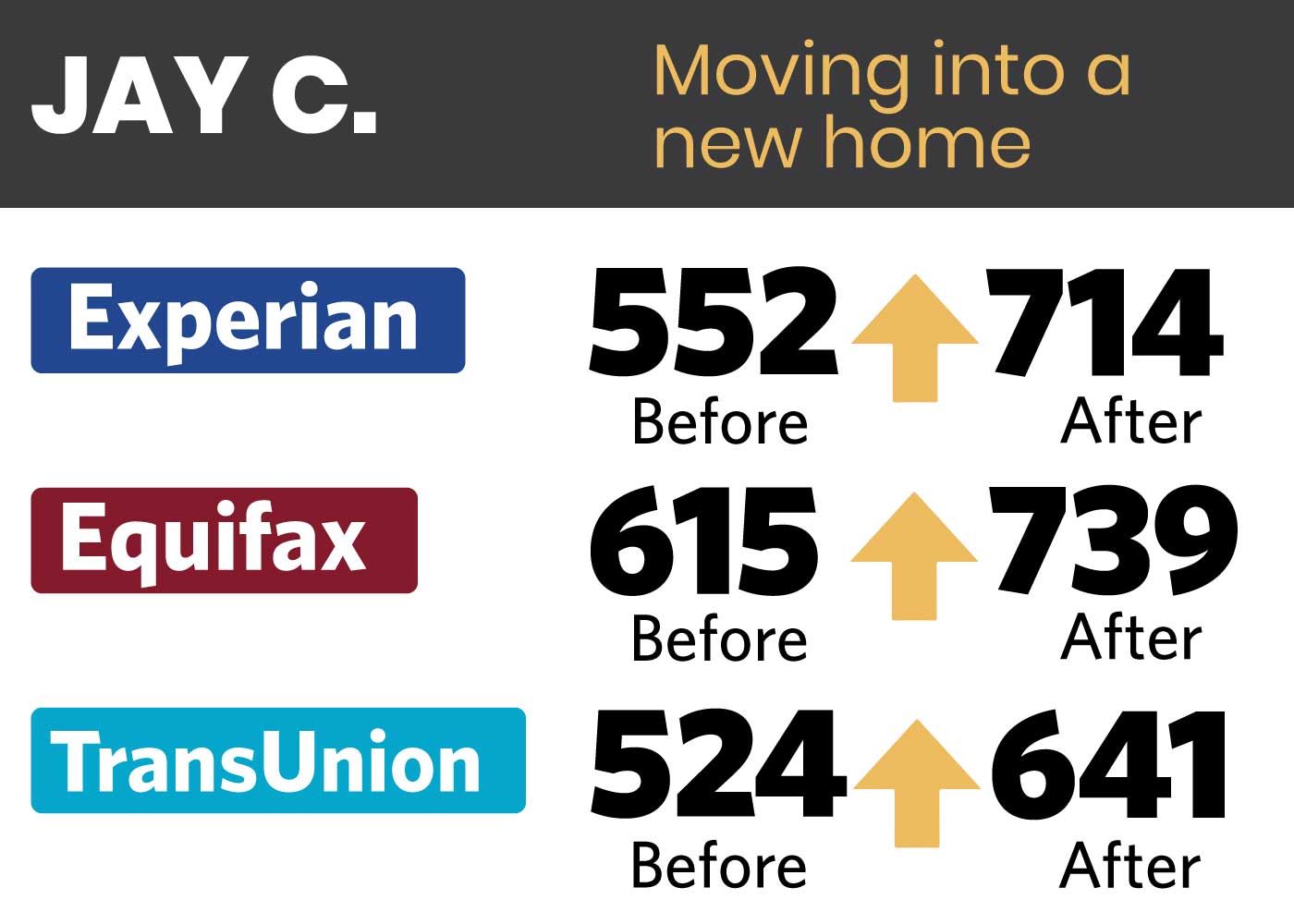

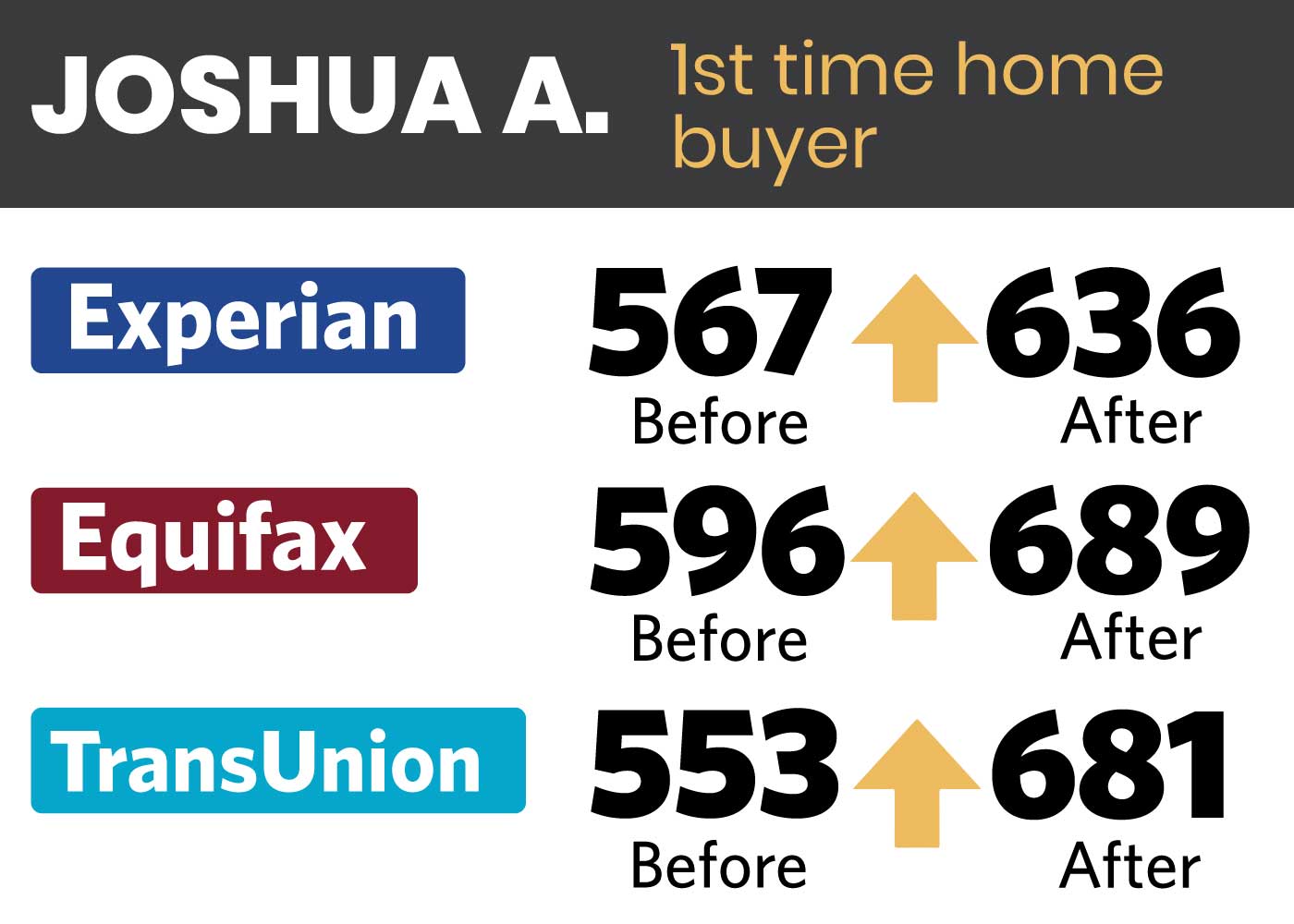

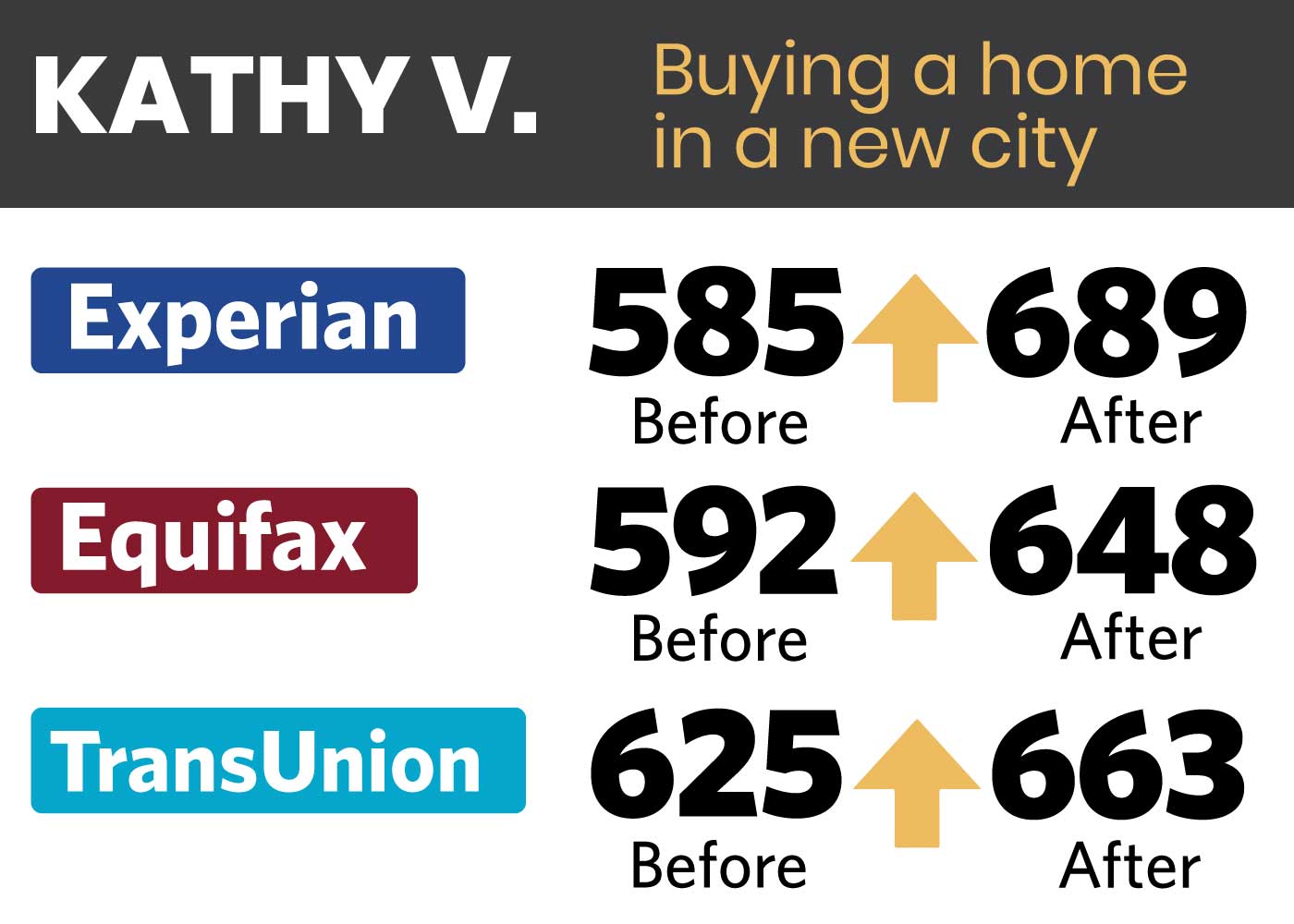

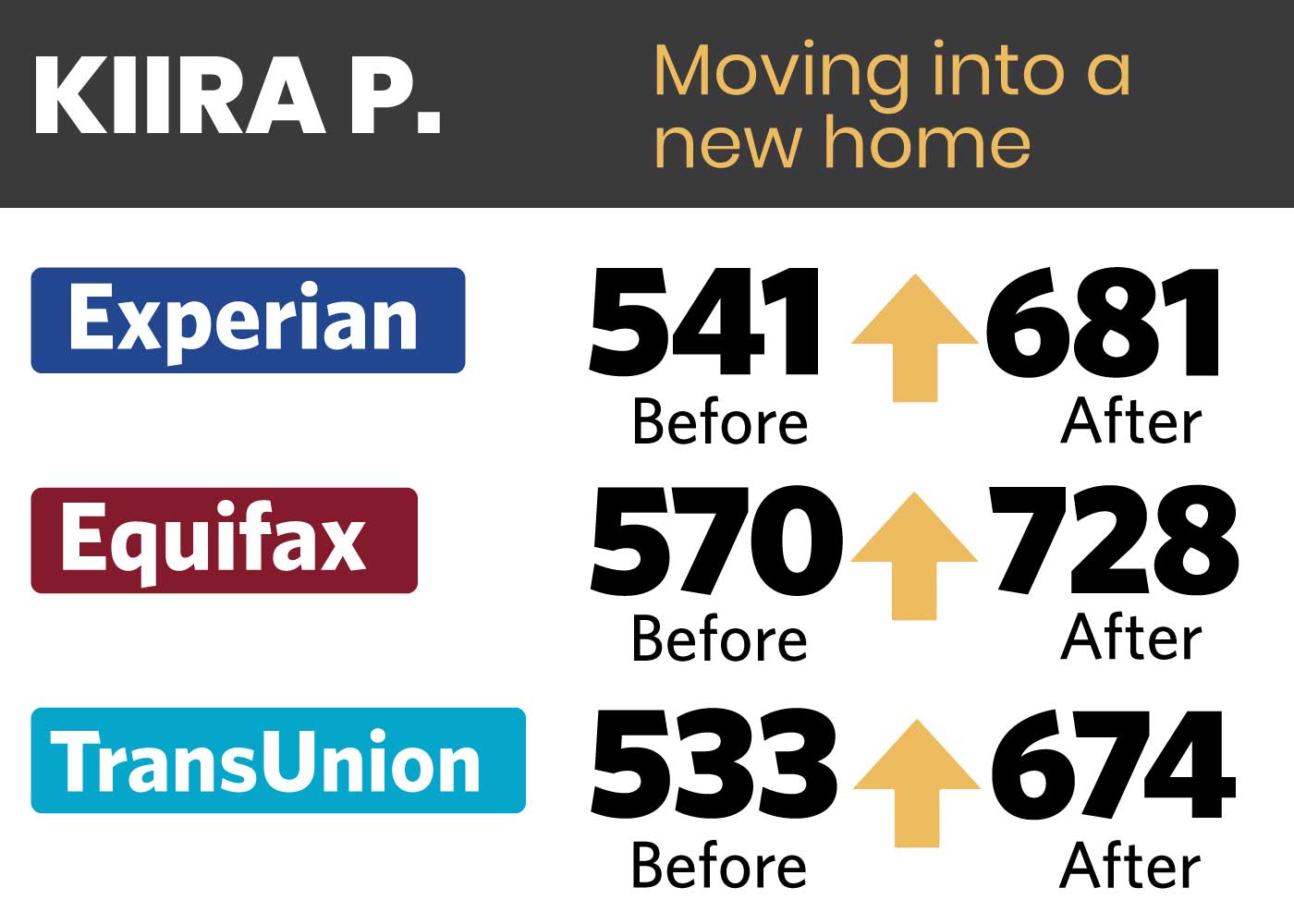

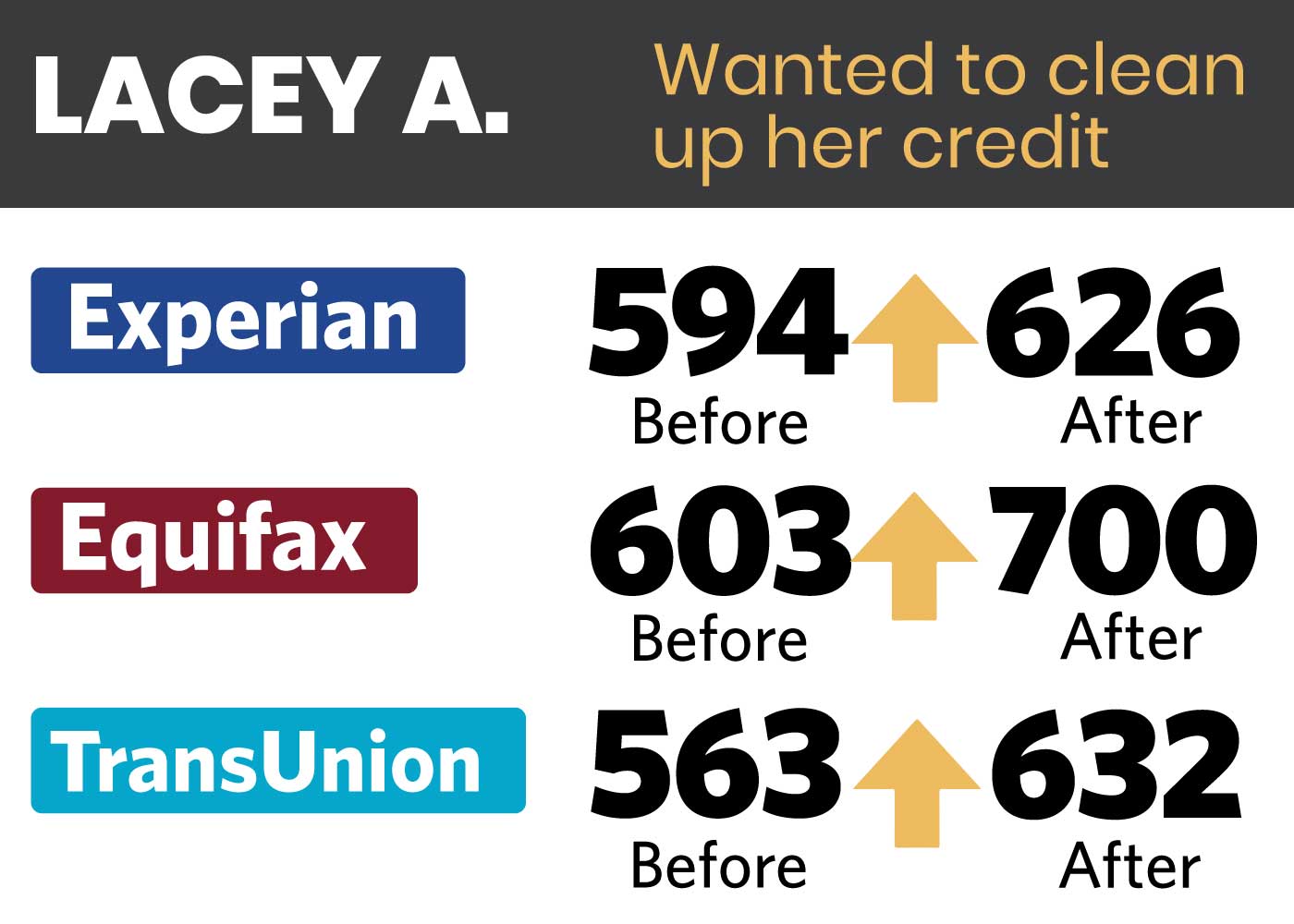

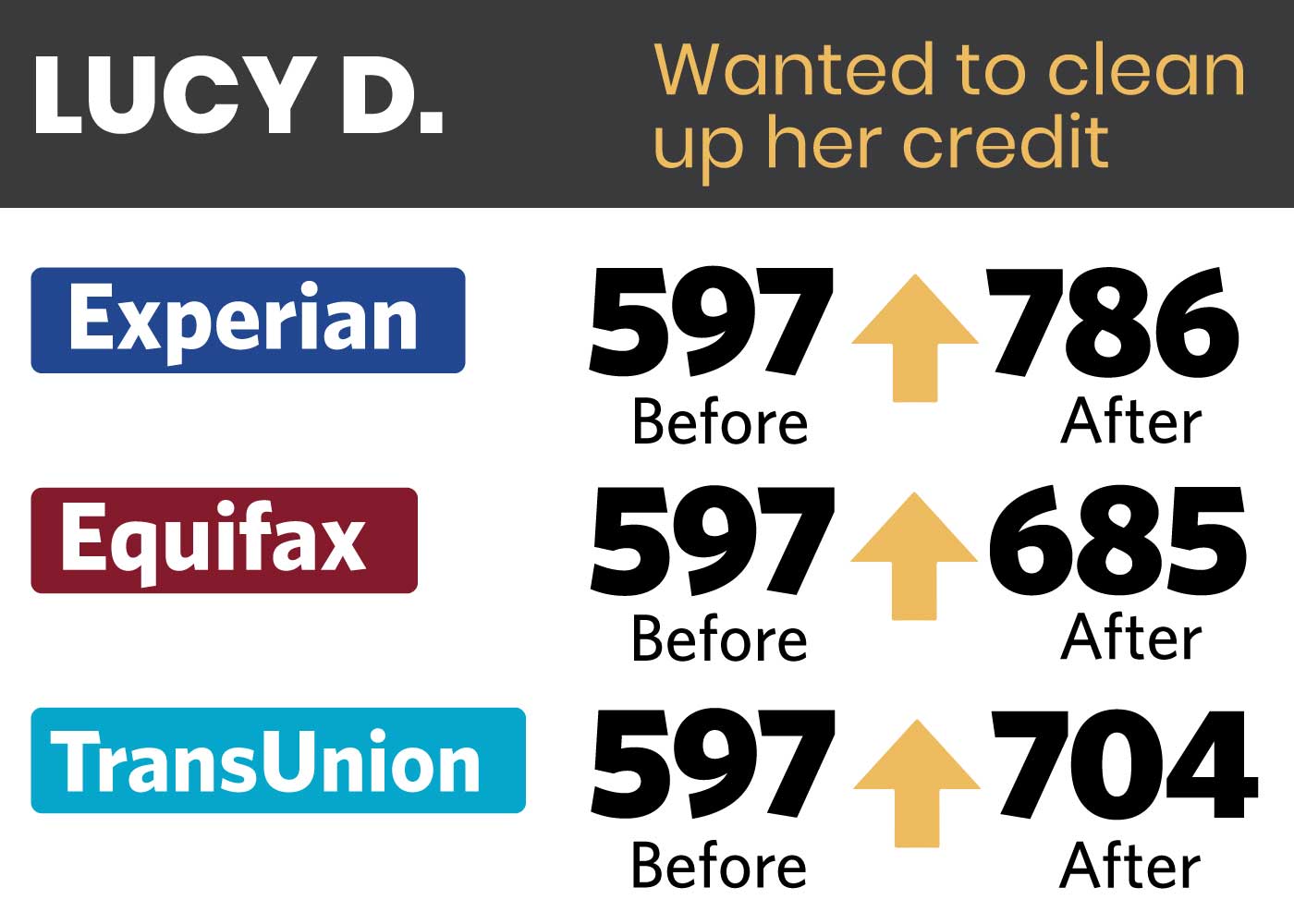

Be on the lookout for the credit reports from all three credit bureaus – Experian, Equifax, and TransUnion. Typically, our clients start seeing results within 45-60 days of hiring us. At most, the entire process takes 6 months, which is lots better than staying on a month-to-month program indefinitely.

Our investigative research team gets involved early on. They know all the “stall tactics” used by the bureaus and creditors. They’ll apply increased pressure during subsequent rounds. If there’s a unique situation to be addressed, our investigative research team will craft letters in response. That’s what our 2nd, 3rd and 4th steps are all about – a firm, no-nonsense approach. We realized that there’s nothing better than credit repair with combined experience of 30+ years.

Is Credit Repair Legal in Lafayette, LA?

Credit repair is 100% legal and regulated. It is the right of every US citizen to approach a credit repair company and hire their services. What’s not entirely regulated are the methods that companies use to achieve results. The Credit Repair Organizations Act (CROA) organizes this industry.

How to Avoid Credit Repair Scams

Some credit repair companies are simply ineffective and that’s all there is to it. On the other hand, some are straight up scams. You need to know how to spot those in order to avoid being taken for a ride.

Credit repair scammers all follow the same pattern. They often pressure clients into signing up for a program without even performing a thorough review of a tri-merge credit report. No credit repair company should ever promise a specific result without a detailed dive into the relevant accounts on a client’s report. That’s one of the first steps you’ll do with a credit analyst during the consultation.

Another red flag is the company asking you to dispute all items on your credit report, regardless of how accurate it is. That’s not advice you should follow. In fact, you could have done that yourself (don’t), without paying some scammer to tell you that.

CROA dictates that credit repair companies must explain your rights to you. They must inform you about all the actions you can take yourself for free. As mentioned above, you don’t really need a company to just send disputes. You can do that on your own.

Familiarize yourself with CROA before hiring a credit repair company.

It’s Time to Get Your Buying Power Back

That’s what WJA is all about. We’re just as sick and tired of inefficient amateurs as you are. Our mission is to provide the kind of credit repair service that our community in Lafayette deserves. Talk to one of our credit analysts and get on the path to more buying power.

Schedule your Free Consultation & Analysis