Top Rated Credit Repair

Grapevine, Texas

Five star reviews

With thousands of happy clients on Google, Facebook, TrustPilot, and more, you will not find a stronger reputation. See how we are different!

Customized Plan

We don't just send out dispute letters like other companies. We customize our approach with personalized audits for maximum results.

One on One

You'll work with the same credit expert for the duration of the program. They will update you, coach you, and answer your questions.

Attorney Managed

Our attorney-managed, 4-round process is personalized for each client by an Investigative Research team, all at a reasonable cost.

Schedule your Free Consultation & Analysis

We protect your privacy. Your information is not shared with third parties.

By submitting this form, you agree to receive texts from White Jacobs and Associates. Ongoing communication before, during, and after the program will be initiated by our credit analysts and their assistants. Msg & data rates may apply. Msg frequency varies. Unsubscribe at any time by replying STOP or clicking the unsubscribe link (where available). Privacy Policy

Meet the team

How We're Different

See what our customers are sayingWe can help with...

- Charge-Offs

- Collections

- Bankruptcy

- Late Payments

- Repossessions

- Foreclosures

- Student Loans

- Dispute Code Removal

- Credit Coaching

- Re-establishing Credit

- Debt Settlement

In the last few years, the economic situation of Grapevine, TX had been steadily improving. People are buying homes and making other big financial moves. Unfortunately, a large part of the economy is uncertain and personal events can sometimes cause unexpected financial struggles. It happens to all of us. You need to get your financial situation in order as quickly as you can. The best and fastest Grapevine credit repair is done by White, Jacobs and Associates.

The longer you wait for credit repair services, the bigger the negative impact will be on your finances. We heard it through the grapevine, as you have probably, that the next few years may be tough. But, you may have had some tough years in the past. You no longer have time to use less-effective traditional credit repair services. They take too long and are largely a waste of time. We offer you an aggressive alternative.

White, Jacobs and Associates Is Not a Standard Repair Company

While traditional credit repair tactics have their place, they are only a fragment of what we do. We intend to improve your score as quickly as possible. If our whole purpose was to send generic dispute letters and hope for the best, as the other companies do, we would tell you to do it yourself and save some money.

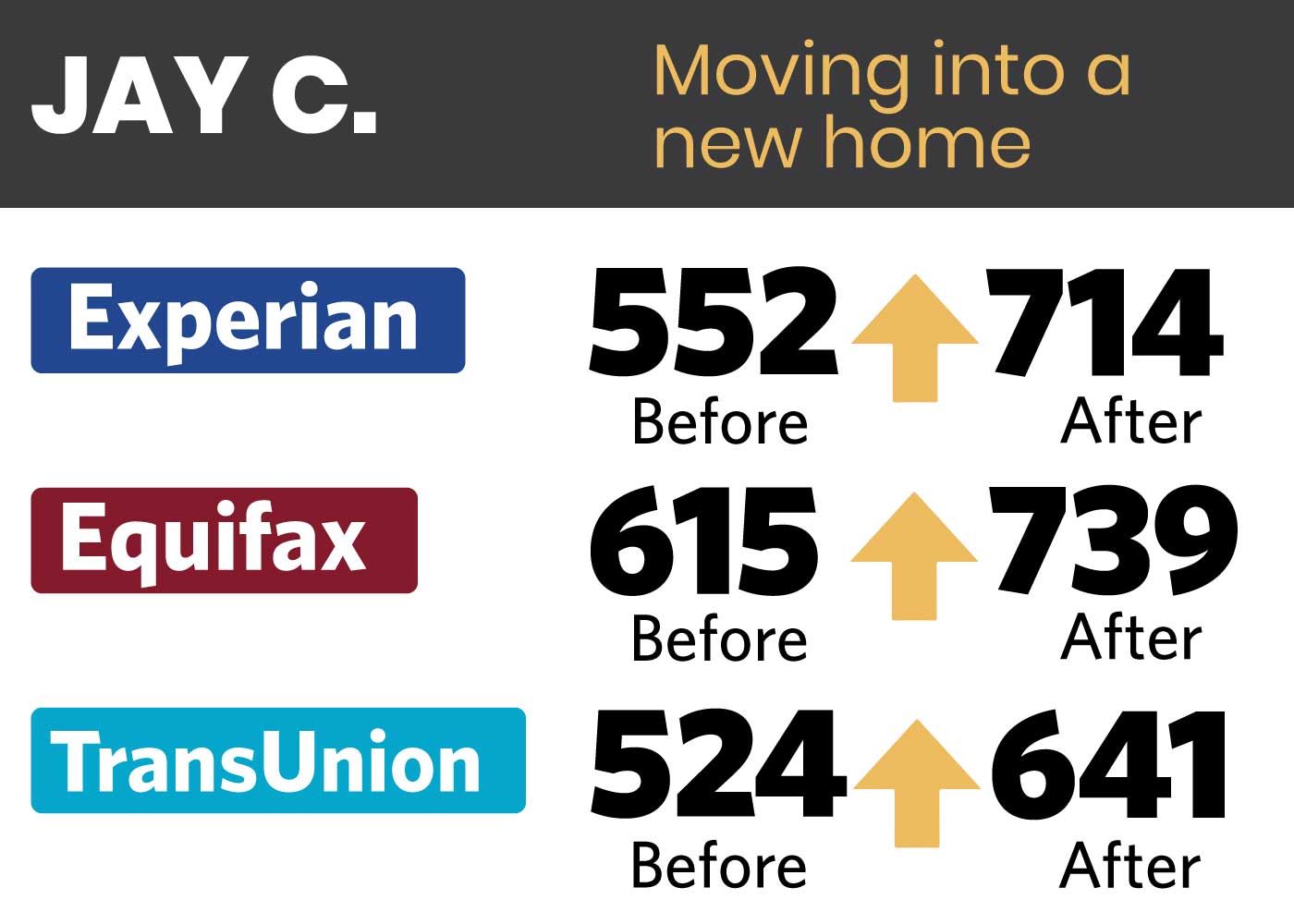

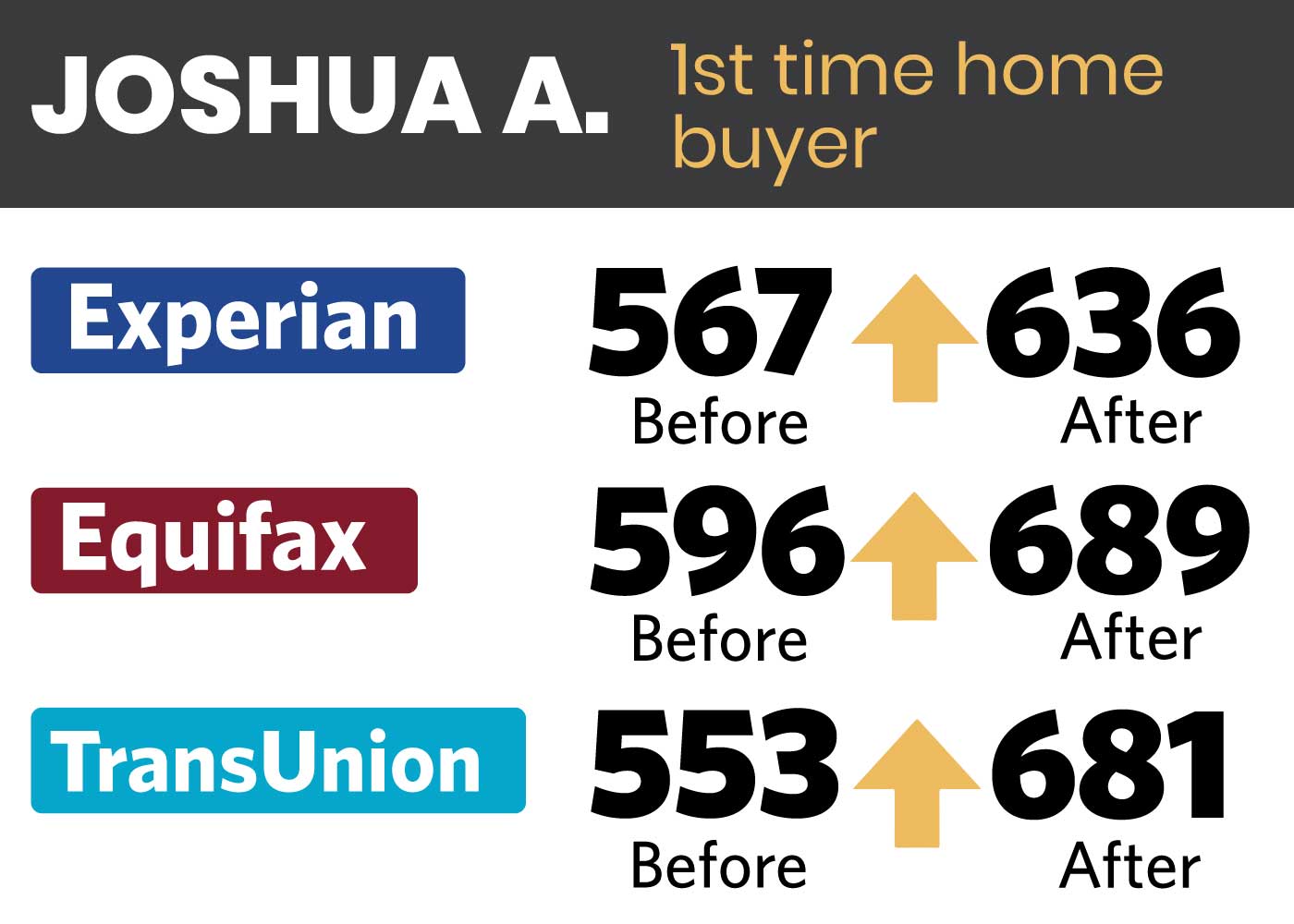

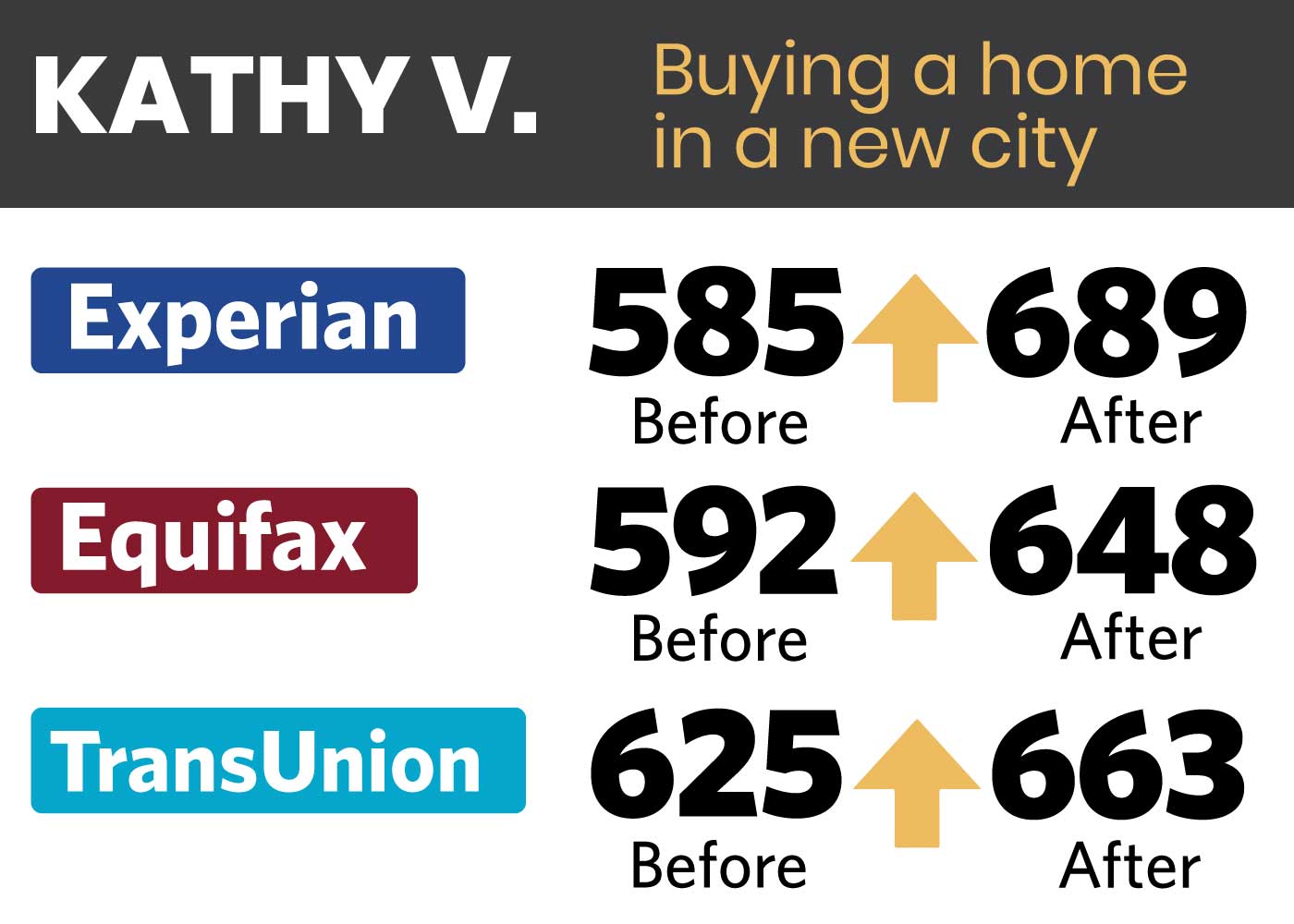

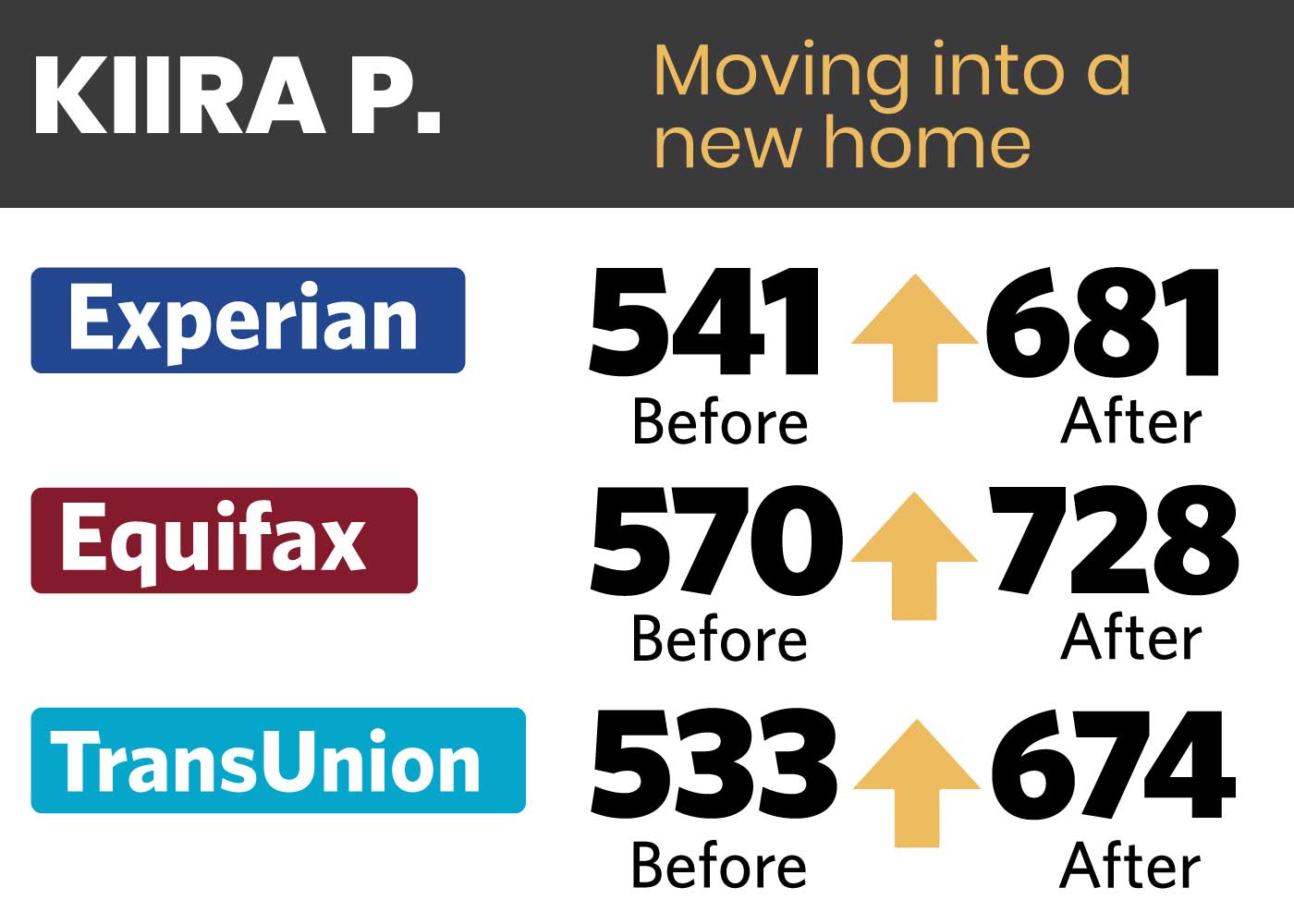

WJA offers aggressive credit repair services, backed by a unique 4-round process and credit improvement expertise. Our methods, combined with our Investigative Research (IR) Team, are what makes us the credit repair Grapevine deserves. Just ask any of the thousands of clients we’ve served. Our reputation speaks for itself.

How Your Credit Score Affects Your Financial Life

Your credit score impacts every facet of your life. Most people know that it affects their ability to get a loan, which is true. However, it also determines the interest rates you get on loans and your ability to rent a home – yes, landlords can access your credit report. Even your potential employers may ask to see your credit file, although you need to give them permission to do so.

As you can tell, your financial life can be severely impacted by a poor credit score. Imagine you can get a loan, but instead of a 6% interest rate on a long-term loan, you are forced to get a 7% one. Over the long run, that’s tens of thousands of dollars. Even a few points higher on your credit score can make the difference between being approved with a decent rate instead of being denied or getting a poor rate.

What Items Impact Your Credit Score

Your credit report shows positive and negative entries. Responsible management of revolving credit (your credit cards and credit lines), paying off your bills on time, the length of your credit history, etc. all impact your credit positively.

Bad entries can be anything from late payments, collections, charge-offs, student loan late payments, repossessions, bankruptcies, the way you use your credit cards – anything that potential lenders perceive as a risk factor that you won’t repay your loans.

At WJA we have seen everything that can negatively impact your credit scores and know how to deal with it. You must understand that lenders don’t want you to have a very good score. They want you to repay them, but repay them with as much interest as they can get. That is why experienced credit repair requires an aggressive approach.

The WJA Grapevine Credit Repair Process

We take a two-pronged approach – removing bad entries and adding positive ones. Once you hire us, we will assign you a personal credit analyst. They will investigate your credit report and come up with a custom game plan to improve your score. We decide which tactics will have the most impact on your credit score and what negative items we will go for first. In the meantime, you will receive counseling on how to add positive credit. Outside of counseling, our process has 4 stages.

In the first stage, we start disputing any negative entries. This takes a few weeks and this phase is mostly geared to see what kind of responses we get from the bureaus and creditors. During this stage in the process, we ask that you send over any postal mail that is sent to you. Your creditors will start contacting you and you should forward anything they have to say to us. We will analyze their responses, notate which items were removed, and initiate the second round.

In the second round, we start specific disputes and audits. Federal and state laws require your creditors and collection agencies to show proof that they have the right to report the items to the credit bureaus. We will press them to show us their proof. Often, they can’t and thus are obligated to remove them. That is the power of audits over disputes.

Stubborn creditors may still refuse to delete negative entries from your report, so in the third round we continue to increase the pressure utilizing ourInvestigative Research team. Dispute letters have their purpose, but they are only the beginning with us. Other credit repair companies stop there and don’t get results. Our IR Team will audit your creditors and credit bureaus, and use all applicable laws to protect your rights.

In the fourth round, we go after any negative entries that remain. The software system the creditors and bureaus use is far from perfect, and often causes miscommunication. We will force them to verify all the information they have on you. By the end of your process, you should see your score improve based on the expectations we set in our initial consultation (which is free).

How Quickly Will I See My Score Improve?

Each person’s credit report is unique, so we need to analyze it before we give you an exact time frame. Many of our clients see their credit scores improve within the first 45 to 60 days of starting the program. The maximum length of our credit repair services is 6 months. If we can’t improve your score, we won’t string you along and have you pay us monthly fees to do nothing. We’ll let you know upfront if you’re a good candidate.

Is Credit Repair Legal in Texas?

The answer is a resounding yes. We are an experienced credit repair company and our legal staff would never do anything to put you in jeopardy. The Fair Credit Reporting Act (FCRA), Fair Debt Collection Practices Act (FDCPA), Fair Credit Billing Act (FCBA), Fair and Accurate Credit Transactions Act (FACTA), and HIPPA laws regulate everything regarding credit scores, and our investigative research team members know the ins-and-outs of the laws.

Why is WJA Different Than Other Repair Companies?

We tell you how it is. WJA won’t sugar-coat the situation – if you are not a good fit, we will advise on what your other options are. Our mission is to get your buying power back and we will be as aggressive as is needed to do it. You should demand to know what Grapevine credit repair does for you and WJA will keep you informed at every step of the process. Don’t allow the other guys to string you along with niceties and platitudes – insist on results now.

Schedule your Free Consultation & Analysis