Top Rated Credit Repair

Frisco, Texas

Five star reviews

With thousands of happy clients on Google, Facebook, TrustPilot, and more, you will not find a stronger reputation. See how we are different!

Customized Plan

We don't just send out dispute letters like other companies. We customize our approach with personalized audits for maximum results.

One on One

You'll work with the same credit expert for the duration of the program. They will update you, coach you, and answer your questions.

Attorney Managed

Our attorney-managed, 4-round process is personalized for each client by an Investigative Research team, all at a reasonable cost.

Schedule your Free Consultation & Analysis

We protect your privacy. Your information is not shared with third parties.

By submitting this form, you agree to receive texts from White Jacobs and Associates. Ongoing communication before, during, and after the program will be initiated by our credit analysts and their assistants. Msg & data rates may apply. Msg frequency varies. Unsubscribe at any time by replying STOP or clicking the unsubscribe link (where available). Privacy Policy

Meet the team

How We're Different

See what our customers are sayingWe can help with...

- Charge-Offs

- Collections

- Bankruptcy

- Late Payments

- Repossessions

- Foreclosures

- Student Loans

- Dispute Code Removal

- Credit Coaching

- Re-establishing Credit

- Debt Settlement

CREDIT REPAIR FRISCO, TX – Aggressive, Customized, One-on-One.

The city of Frisco, Texas, is a picture of progress, but these days, your credit score certainly isn’t. Tons of companies are offering you traditional credit repair in Frisco but beware. The “100-bucks-a-month” scams are designed for profit, not enduring results. At White, Jacobs & Associates (WJA), we provide our clients with an aggressive alternative to traditional credit repair. We do this with our unique program that’s engineered for your financial progress in a short period of time.

We’re not sending out automated dispute letters like other Frisco credit repair companies. These “services” are out to take your money month after month. With our aggressive 4-round system, creditors are audited. We request that each validate that they are permitted to report items on your credit report. It’s an intense program. And it requires diligent credit analysts, an investigative research (IR) team, and an attorney who manages the process. We have all three.

CREDIT IS YOUR BUYING POWER for HOME APPROVAL, CARS, AND MORE

If a bad credit score is keeping you from approval on a refinance, a home or mortgage, or another large purchase, it’s no surprise. Poor credit will even limit your ability to secure good interest rates on credit cards, loans, and a variety of other financial investments. When you study what seems to be a small increase in interest rates, you’ll discover how costly bad credit really is. You’re paying thousands of dollars more in the long-haul.

WJA’s 4-round process takes 6 months max, but it’s common to see clients complete the program in 3 months. They begin seeing results as soon as 45-60 days with our system. If you’re curious about what you can expect based on your current situation, give us a call. Our credit analysts present a strategy and set a realistic time frame. And this credit review and consultation come at no cost to you.

AVERAGE CREDIT REPAIR VS EXCEPTIONAL CREDIT REPAIR

Perform a quick Google search, and you’ll find yourself staring at hundreds of credit repair companies that are mishandling their clients’ cases. Basically, they’re generating generic, fill-in-the-blank dispute letters and sending those automated responses out on your behalf. And they’re taking their sweet time. Every month, they get to charge you, so what’s the rush? Consider that. They have no sense of urgency because the longer you’re with them, the more monthly fees they can collect. They’re rackets. They absolutely DO NOT audit creditors the way we do in our 3rd and 4th rounds.

Credit restoration is no simple matter. But with the WJA investigative research team, your journey to better credit doesn’t have to be so complicated. This experienced team responds with precision, tailored-to-you documents, and specific requests that make a difference. We have the resources that other companies do not. And we are experienced with the “stall tactics” used on consumers. Think about this before you hand over the future of your credit to those ill-equipped, traditional companies.

CREDIT REPAIR PROCESS IN FRISCO WITH EFFICACY. NEXT LEVEL RESULTS.

Let us explain how our aggressive alternative to credit repair works:

1. You are partnered with a personal credit analyst who is then with you every step of the program.

2. An investigative research team carefully crafts customized responses during 4 rounds of audits.

3. When we receive responses from creditors and bureaus, we review and craft the subsequent letter with increased pressure. Teamwork is critical. That’s why we ask that you send in all correspondence to our office during the program.

Believe us when we say that this kind of customization gets the results you’re after. And we make it a matter of urgency because we want to see you in your new home, new car, or with your new interest rates very soon. We make it our mission to help you get that buying power back.

If we decide you’re a good fit for the WJA program, we’ll use consumer credit laws to remove negative/inaccurate items from your credit report. Such laws include (but certainly aren’t limited to): the Fair Credit Reporting Act (FCRA), Fair Credit Billing Act (FCBA), Fair Debt Collection Practices Act (FDCPA), Fair and Accurate Credit Transactions Act (FACTA), and HIPPA laws.

Here’s the deal. There are two methods that go into raising credit. First, you must delete those derogatory marks on your report. Second, you must add positive tradelines to your profile. WJA knows exactly how to handle the deletions, and we’ll coach you in building credit by adding

positive credit. We’ve increased scores before, and we’ll do it again for you. And we do it the healthy, right way. These changes to your score are going to last.

WHEN IS THE LAST TIME YOU LOOKED AT YOUR CREDIT REPORT?

Though average credit scores lie between 600 and 750, scores below 700 can harm your chances of being able to make big purchases like home and auto. You can find lenders and creditors willing to work with lower credit scores (below 700, 600, and even 500), but be assured that the rates will be high. With good credit, you can avoid these costly complications.

General collections, medical collections, late payments, charge-offs (delinquent accounts), student loan issues, bankruptcies, repossessions, foreclosures, identify theft – we understand. We’ve seen it all. And we help with all types of items that are being reported on your credit.

NO THANKS…I CAN FIX MY OWN CREDIT.

It’ll take time. We’re talking years potentially. More than likely, you want to make some financial moves quickly. People are mistaken to think that paying bills on time and taking care of collections actually delete these negative items from your report. You’ll need a credit expert to guide you through the rather tedious credit restoration process.

And to be honest, sources like Credit Karma aren’t always accurate. People want to trust these quick, easy, free resources. But they’re often unreliable. WJA will pull a FICO tri-merge report and examine credit items that are reporting with the Equifax, TransUnion, and Experian bureaus.

THE SOONER YOU START, THE SOONER YOU’ll START SEEING RESULTS

Right from the start, you’ll hear the voice of a WJA professional credit analyst. They’ll hear your story, provide a game plan, and guide you through the entire program. It’s a personal, customized system. You’re their client, and they care about you and your goals. Seek the help you need. More than likely, creditors have stopped listening, and you need more than those generic “dispute services” can offer. Partner with us – passionate analysts, an investigative research team, and our unique 4-round process – because 99% of credit repair companies are getting it wrong. White, Jacobs & Associates understands Frisco credit repair. We believe in you and all you can achieve with improved credit.

What makes us better? It’s no secret. It’s our process. Learn more about it here.

We believe in getting your buying power back. Click here to see our mission.

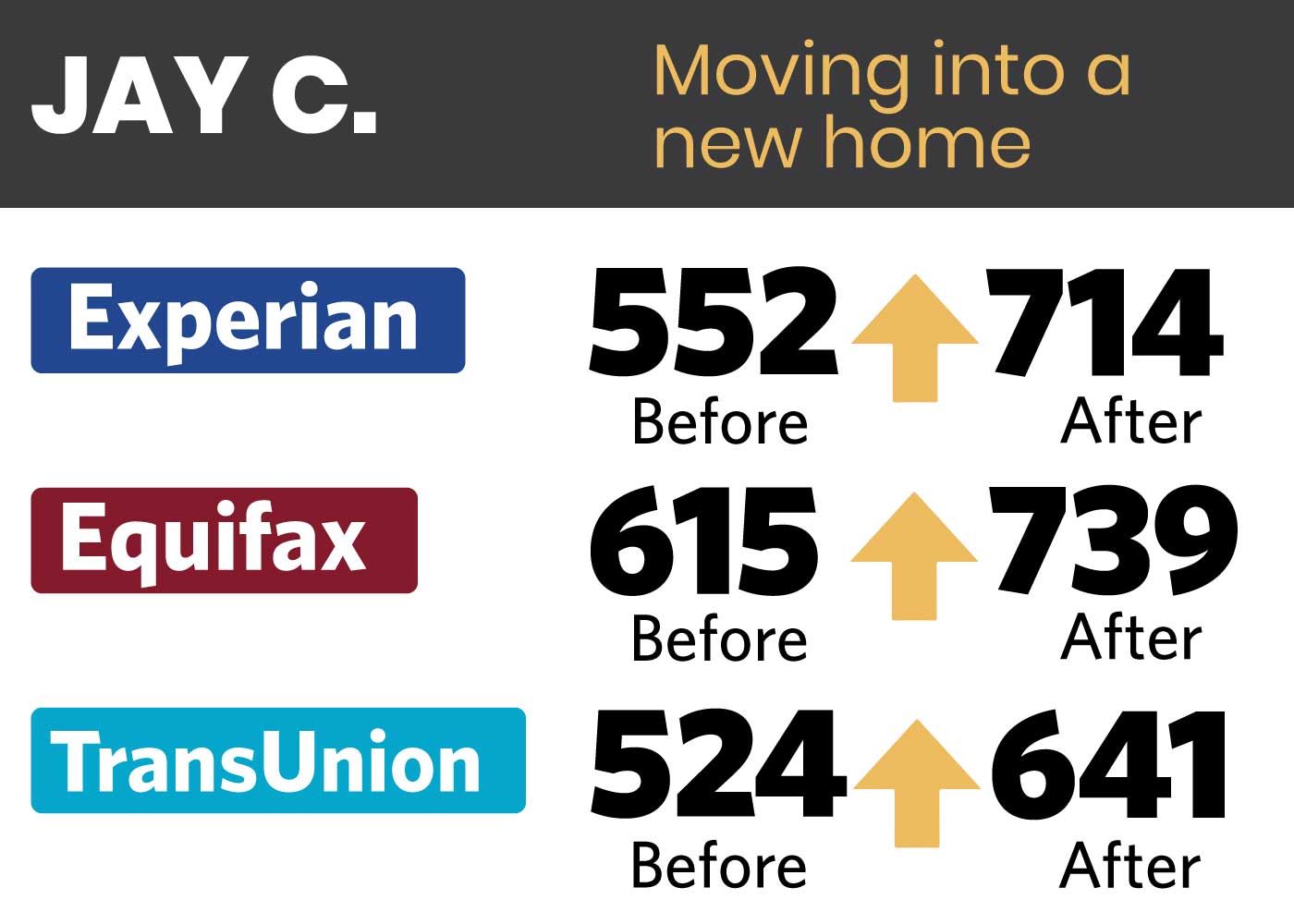

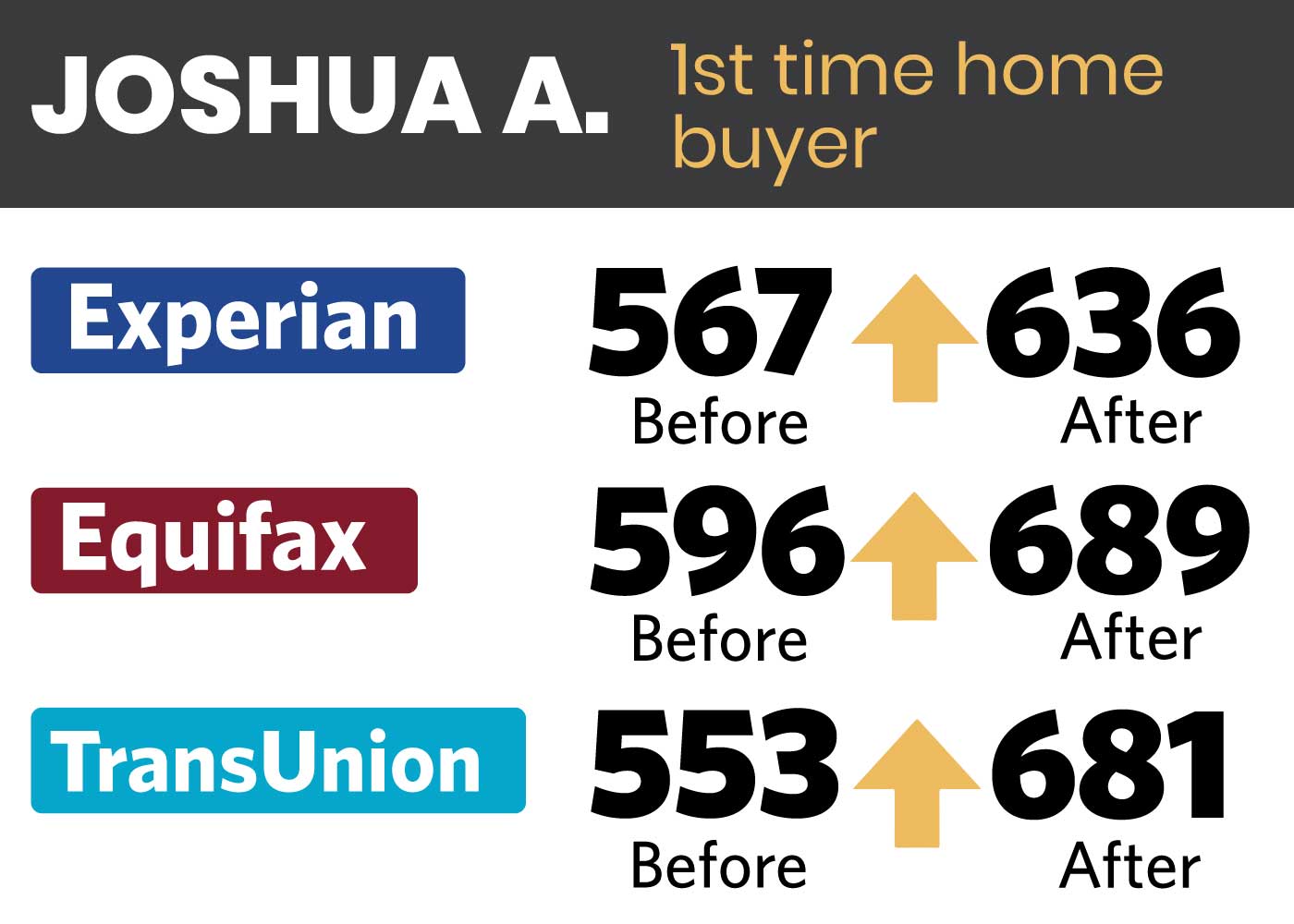

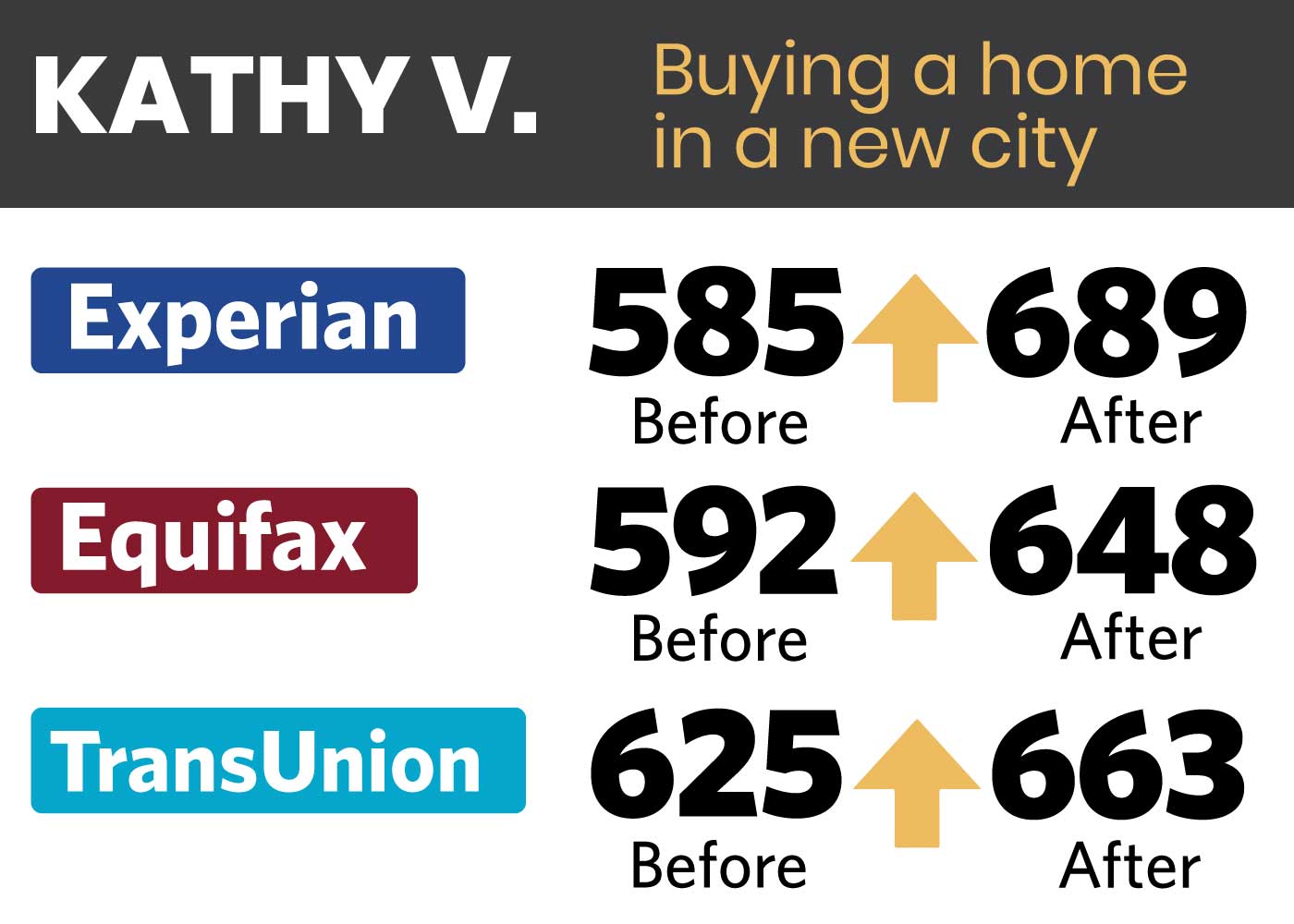

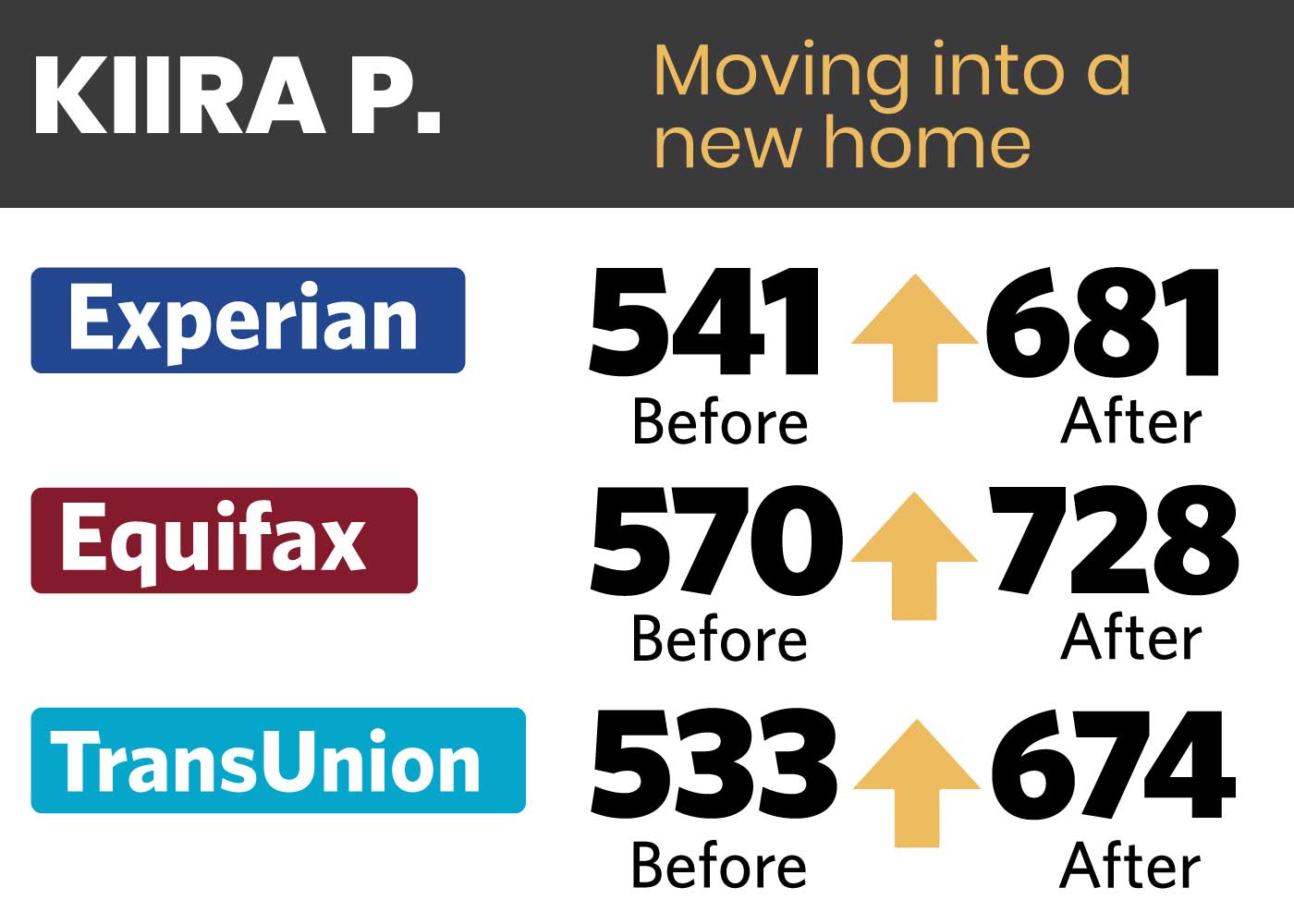

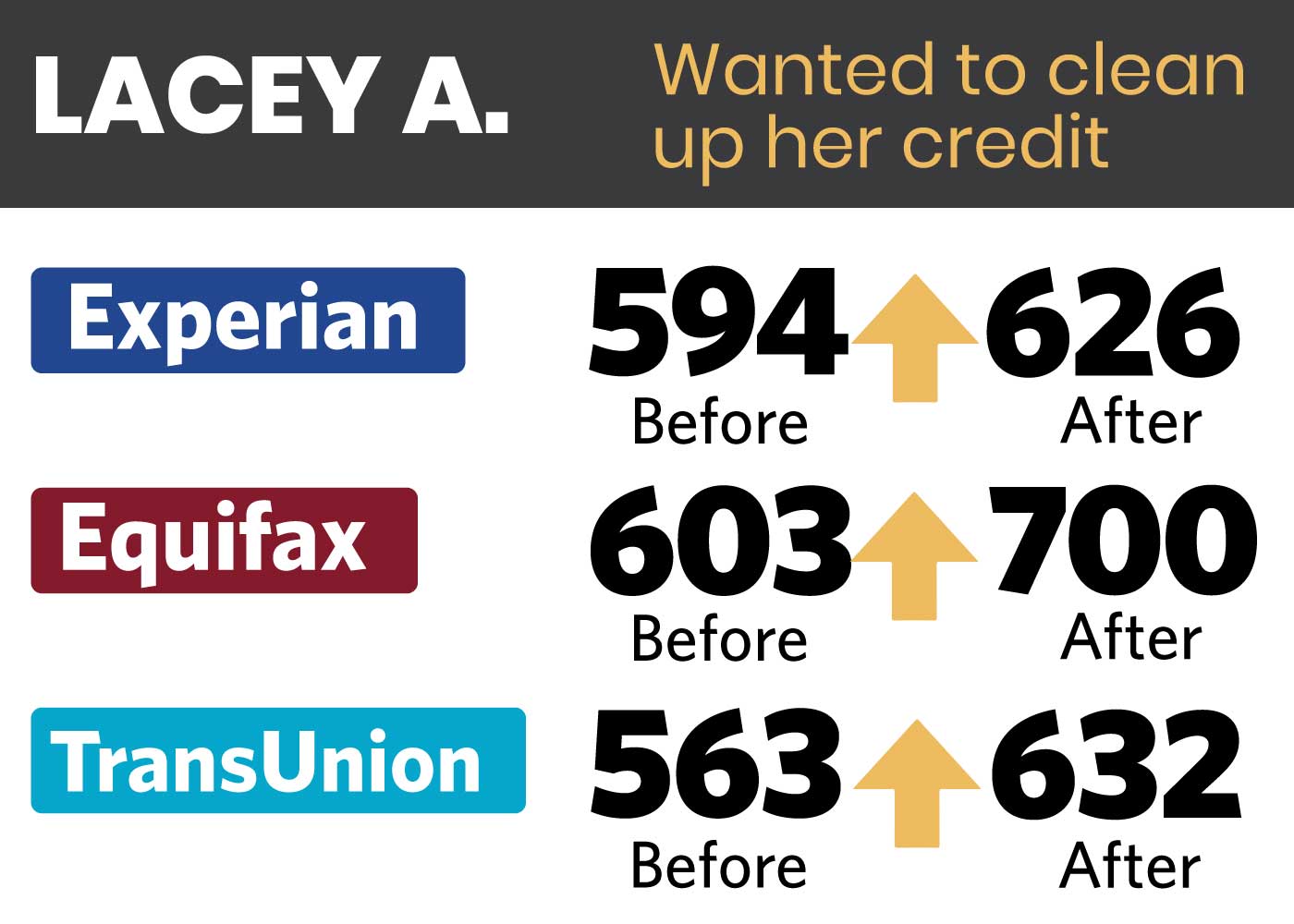

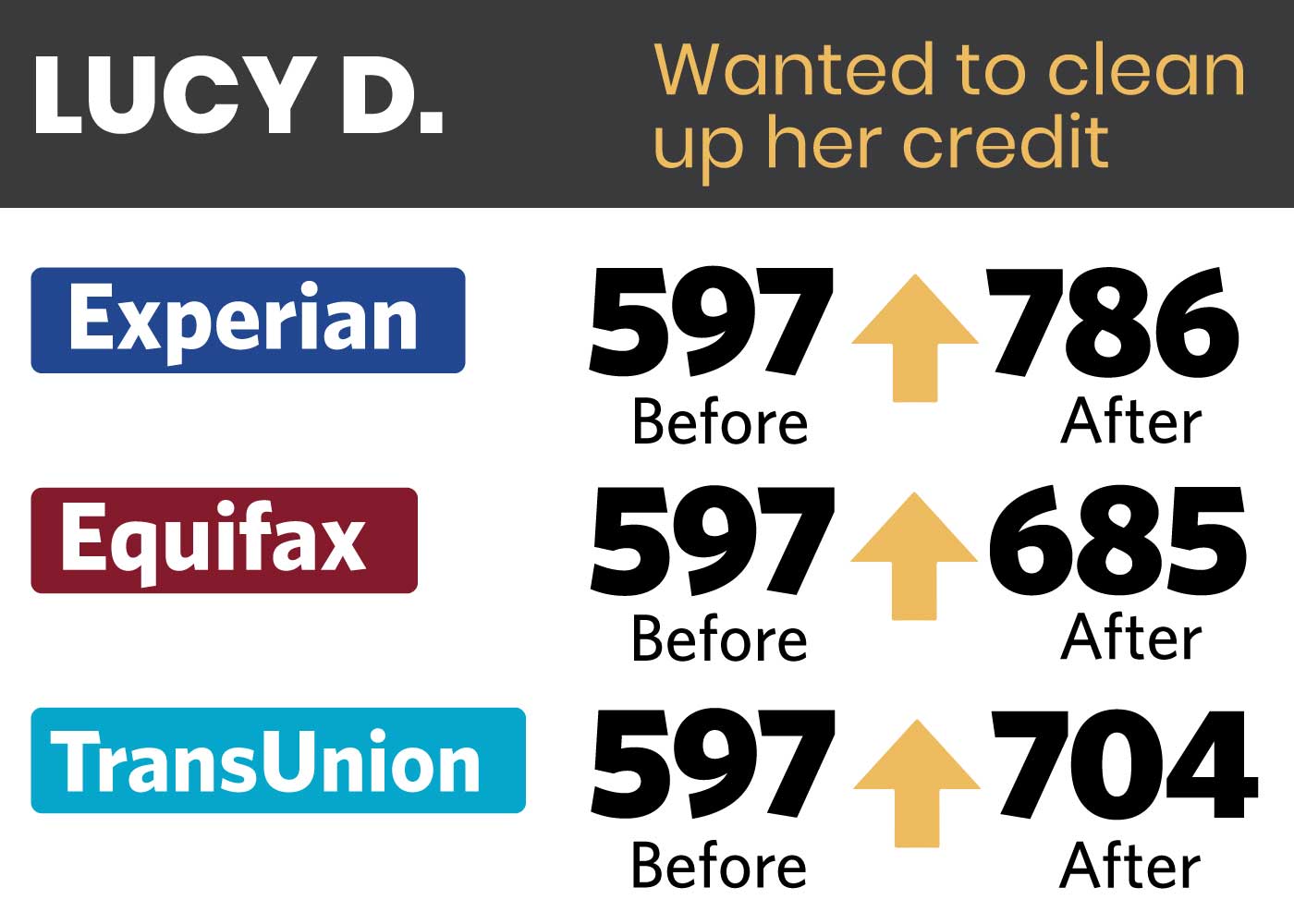

Our past clients have spoken. See client results & testimonials too.

Schedule your Free Consultation & Analysis