Top Rated Credit Repair

Fort Lauderdale, Florida

Five star reviews

With thousands of happy clients on Google, Facebook, TrustPilot, and more, you will not find a stronger reputation. See how we are different!

Customized Plan

We don't just send out dispute letters like other companies. We customize our approach with personalized audits for maximum results.

One on One

You'll work with the same credit expert for the duration of the program. They will update you, coach you, and answer your questions.

Attorney Managed

Our attorney-managed, 4-round process is personalized for each client by an Investigative Research team, all at a reasonable cost.

Schedule your Free Consultation & Analysis

We protect your privacy. Your information is not shared with third parties.

By submitting this form, you agree to receive texts from White Jacobs and Associates. Ongoing communication before, during, and after the program will be initiated by our credit analysts and their assistants. Msg & data rates may apply. Msg frequency varies. Unsubscribe at any time by replying STOP or clicking the unsubscribe link (where available). Privacy Policy

Meet the team

How We're Different

See what our customers are sayingWe can help with...

- Charge-Offs

- Collections

- Bankruptcy

- Late Payments

- Repossessions

- Foreclosures

- Student Loans

- Dispute Code Removal

- Credit Coaching

- Re-establishing Credit

- Debt Settlement

Credit Repair Fort Lauderdale

The population of Florida is booming and Fort Lauderdale is no exception. This expansion provides more opportunities, yes, yet also more competition and an increase in the basic cost of living. Having a bad credit score was never a good situation to be in, but the challenges of the modern era necessitate a good score – which is why White, Jacobs and Associates provides the credit repair Fort Lauderdale deserves.

A good score is of the utmost importance for financial stability. Without it, you will not only be unable to get a large loan, but your interest rates will increase and it can even affect your employment situation. You can get by with a low score, but you will never thrive. On a positive note, your score can be improved dramatically, if done correctly.

We Do Things Differently

The modern era requires modern methods, which is what we specialize in. Regular credit repair companies in Florida charge you monthly fees to send basic dispute letters. This method rarely produces substantial results but they will still try to lure you with cheap pricing.

Once dispute letters hit their limit, they continue with the same while continuing to charge you. You know the saying – insanity is doing the same thing over and over again and expecting a different result? Granted, they are not insane, just inept and don’t care enough to improve. Times are trying enough as they are – if these are the services you are getting, don’t waste your money and do it yourself.

WJA does things differently. We have developed a 4-round process that rests on audits, in-depth investigative research, and a hands-on approach. Once we have researched your situation, we will tell you roughly what you can expect from our services and how long it will take. You won’t pay a dime if we don’t think we can help you. We believe that is the kind of credit repair Fort Lauderdale needs.

How is Credit Score Calculated in Fort Lauderdale, Florida?

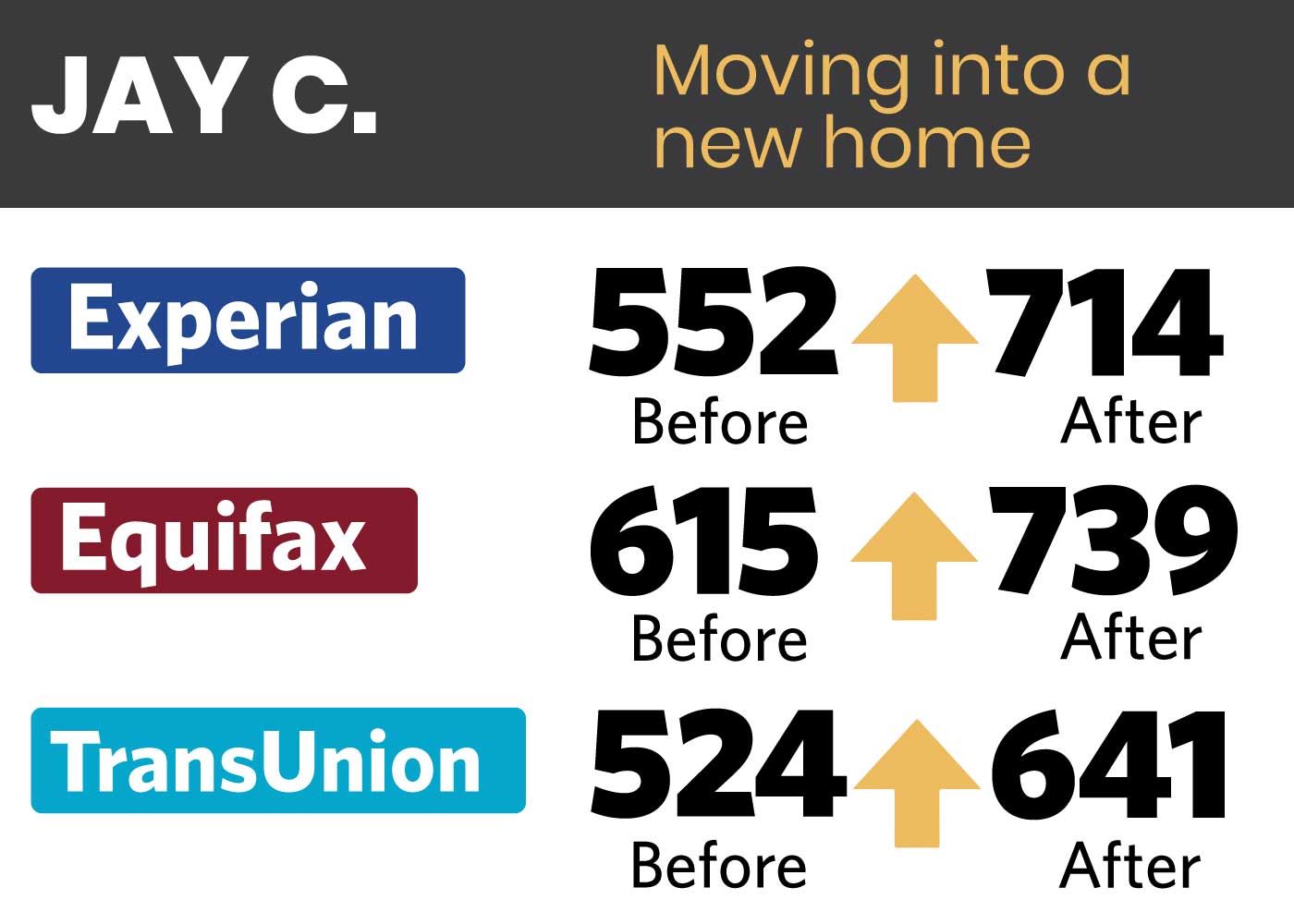

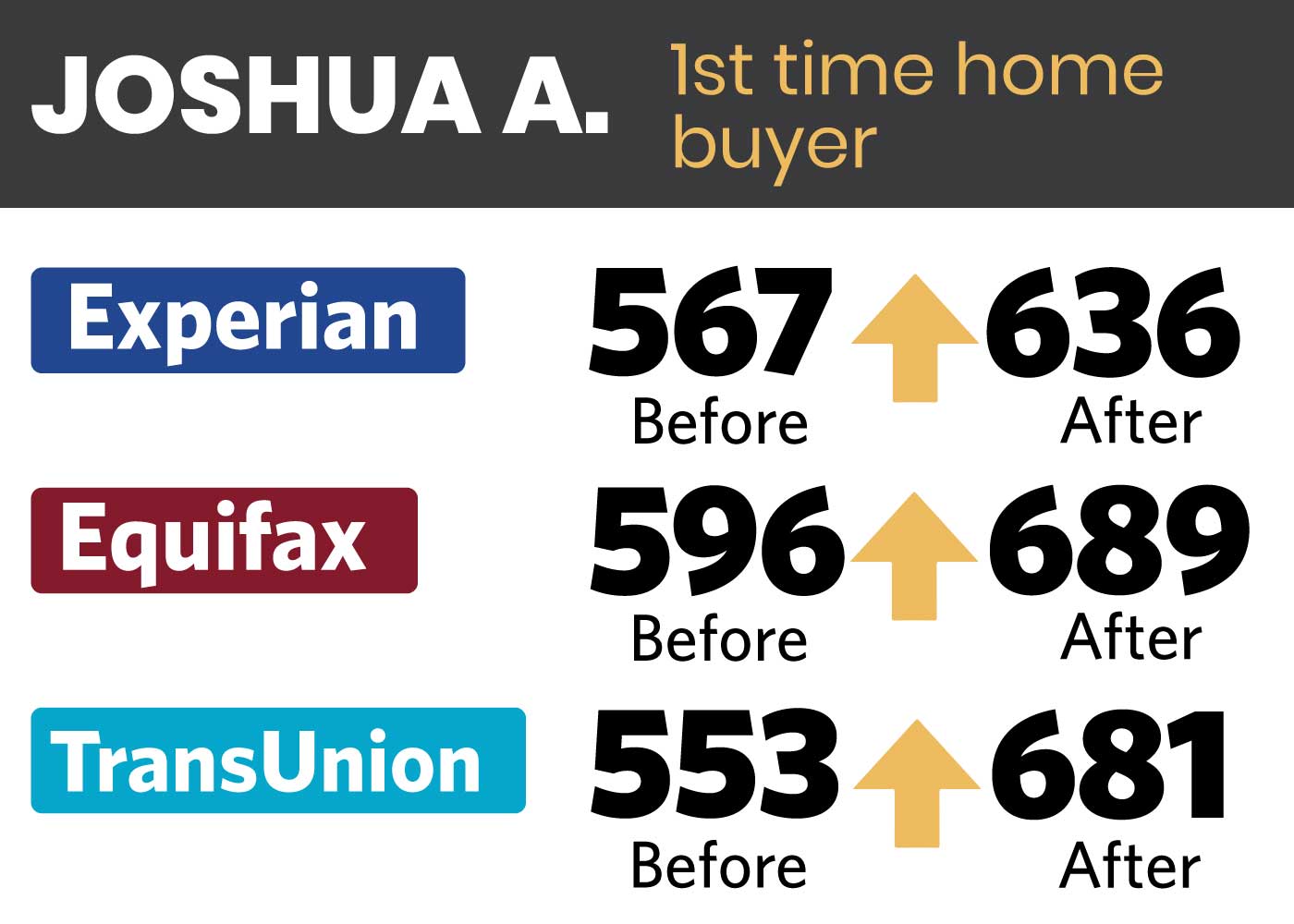

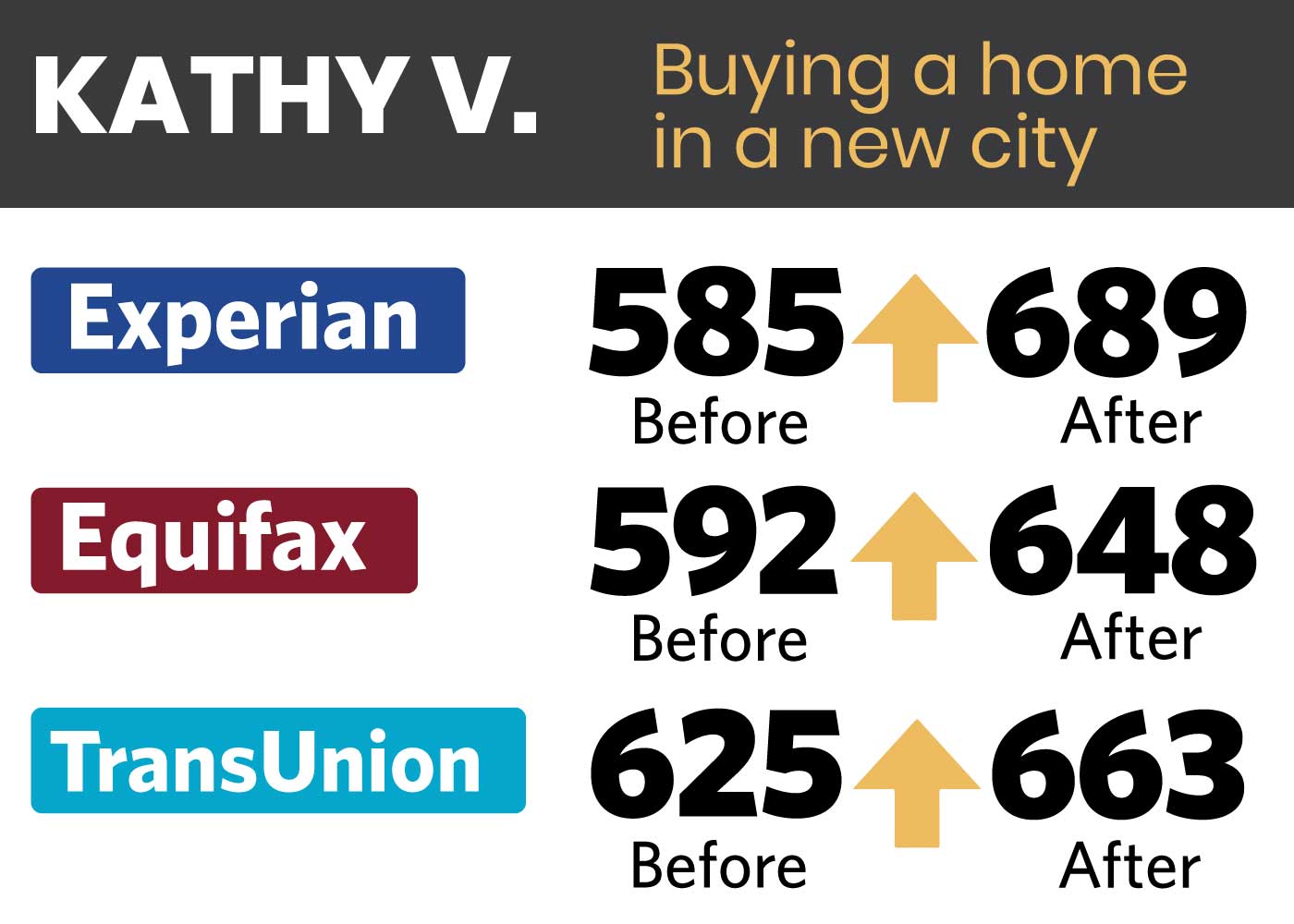

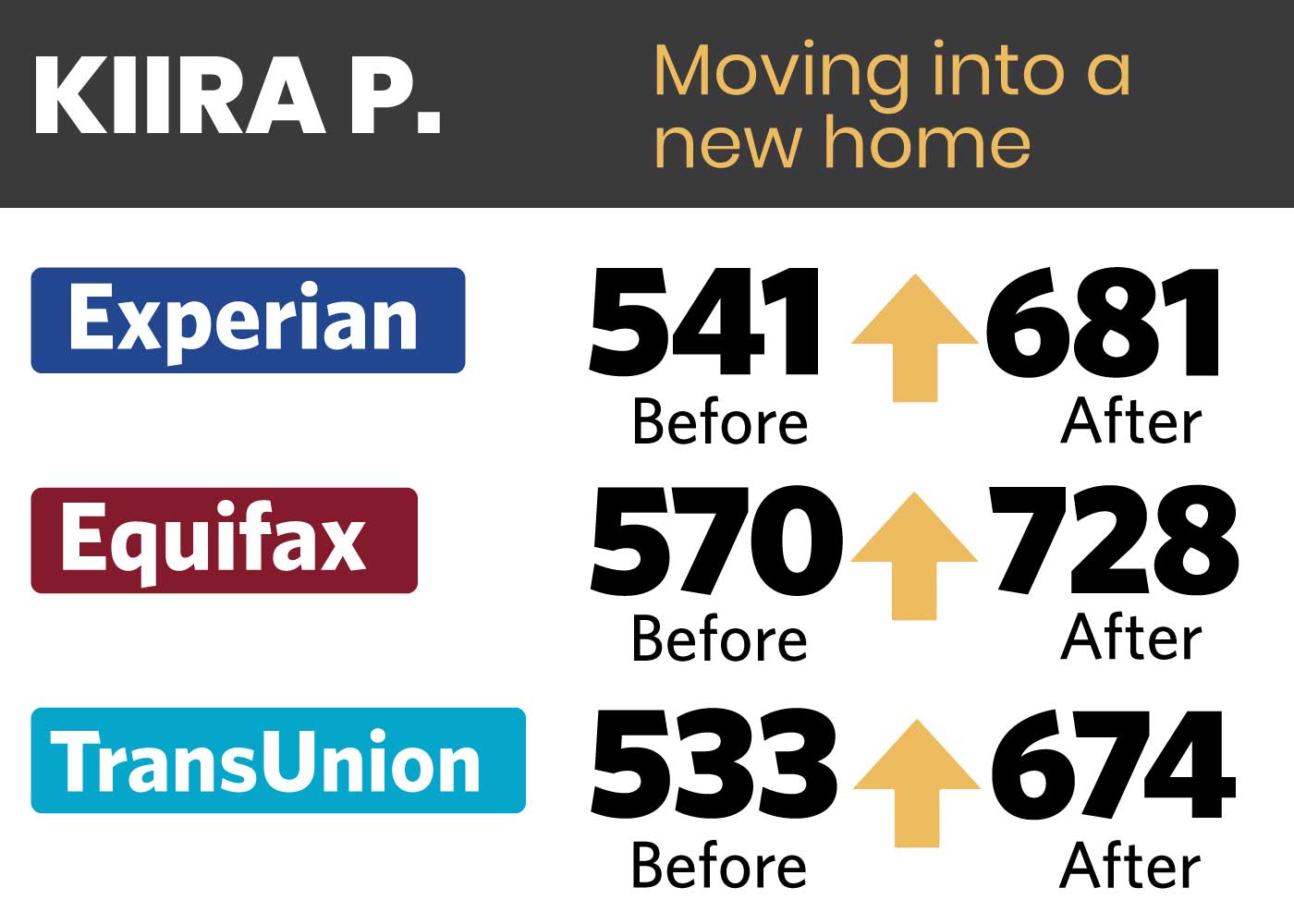

The math itself can be a little messy, but the process is not. Your important financial interactions are reported to the three main credit bureaus – Equifax, Experian, and TransUnion – which compile them in a credit report each. The reports may vary a little, but not substantially.

Based on the items in your reports (both good items and bad ones), your credit score is calculated using one of the two main models – FICO Score and VantageScore. They both range from 300 to 850, with 850 being the best possible score and 300 the worst.

Which Items Cause a Bad Score?

At WJA we have seen everything that can cause a bad score: charge offs, medical collections, late payments, foreclosures, bankruptcies, collections, fraud, etc.; anything that can be interpreted as you not being reliable to pay back the money you borrow can hurt your score.

Even applying for too many loans in a short time period hurts your credit score. On top of that, E-Oscar (the software system creditors and credit bureaus use to communicate) is often unreliable and can mistakenly enter negative items into your credit report.

On the other hand, your score can be increased by adding positive credit. However, this doesn’t come naturally to most people and you may need some coaching. For example, most people wouldn’t think that not having any history of taking out loans or not using a credit card could hurt them.

In the eyes of creditors, no credit history simply shows that they cannot gauge how responsible you are, consequently lowering your likelihood to get a good loan. Taking out loans and making regular monthly payments goes a long way to improve your credit rating.

How Can WJA Help?

By tailoring our tactics specifically to your situation and aggressively implementing them. Generic credit restoration won’t get you far. You can think of a credit report as a fingerprint – each person’s is unique, so you need a unique approach. A credit analyst will research your history and analyze your reports so that we can come up with a customized game plan.

You will get counseled on how to add positive credit, while we take care of the negative entries. We will decide which tactics are best for your situation and which items to go for first, for the maximum effect.

Our 4-round process is a succession of specific disputes and audits, based on the analysis of your reports and the responses from the creditors. Each round is more intensive and specific, until our investigative research (IR) team starts contacting your creditors, beginning from the 1st round and reviewing replies from credit bureaus and creditors to respond with increasing pressure in subsequent rounds.

You may have noticed we stress that we do audits. That is because they are an effective way to get results. We don’t ask your creditors to remove inaccurate items from a credit report, we demand they show proof that they can report them. When they can’t, which is common, they are obligated to remove them. With dispute letters, they are the ones interpreting the information. With audits, we are.

Our credit repair Fort Lauderdale process is designed to get the best results in the shortest amount of time. We will employ analysts and credit and investigative experts to give you the services you deserve. If any actions outside of our 4-rounds will be beneficial, we will invest our energy free of charge.

How Long Does Credit Repair Take in Fort Lauderdale?

It depends on who you hire to do credit repair in Fort Lauderdale. With us, never longer than 6 months, while most of our clients start seeing results within 45-60 days. The other credit repair companies in Fort Lauderdale have no issue in charging you for years with little to no results.

Here is a free tip that can save you a lot of money – always ask for a time estimate. If a credit repair company won’t give you one, ask yourself why? Credit experts should be able to know what credit repair services they can offer and how long it should take. With us, you’ll know.

You Know Where You Stand With WJA

At White, Jacobs and Associates we won’t lead you along. After we have analyzed your reports, you will know exactly how we can help and when you can expect to see improvements. You will be asked to assist at every step of the process. Mainly, we will need you to forward any correspondence you receive to our office. Teamwork is key. That is the type of credit repair Fort Lauderdale needs. Schedule a free consultation if you are still on the fence. We stand behind our words and are not afraid to prove it.

Schedule your Free Consultation & Analysis