Top Rated Credit Repair

Eugene, Oregon

Five star reviews

With thousands of happy clients on Google, Facebook, TrustPilot, and more, you will not find a stronger reputation. See how we are different!

Customized Plan

We don't just send out dispute letters like other companies. We customize our approach with personalized audits for maximum results.

One on One

You'll work with the same credit expert for the duration of the program. They will update you, coach you, and answer your questions.

Attorney Managed

Our attorney-managed, 4-round process is personalized for each client by an Investigative Research team, all at a reasonable cost.

Schedule your Free Consultation & Analysis

We protect your privacy. Your information is not shared with third parties.

By submitting this form, you agree to receive texts from White Jacobs and Associates. Ongoing communication before, during, and after the program will be initiated by our credit analysts and their assistants. Msg & data rates may apply. Msg frequency varies. Unsubscribe at any time by replying STOP or clicking the unsubscribe link (where available). Privacy Policy

Meet the team

We can help with...

- Charge-Offs

- Collections

- Bankruptcy

- Late Payments

- Repossessions

- Foreclosures

- Student Loans

- Dispute Code Removal

- Credit Coaching

- Re-establishing Credit

- Debt Settlement

Putting the turbulent pandemic-impacted economy aside, Eugene, Oregon has seen a surge in housing demand in the last few years. In such a risingly competitive real estate market, you don’t want to fall behind because of your credit score. White, Jacobs and Associates offers you the credit repair in Eugene that you deserve.

And where there’s talk about buying or renting a house, there is talk of leasing or buying a car. All of these decisions are heavily impacted by our credit reports. So, our mission is to restore your buying power and help you live to your fullest financial potential.

What Do We Mean By Credit Repair

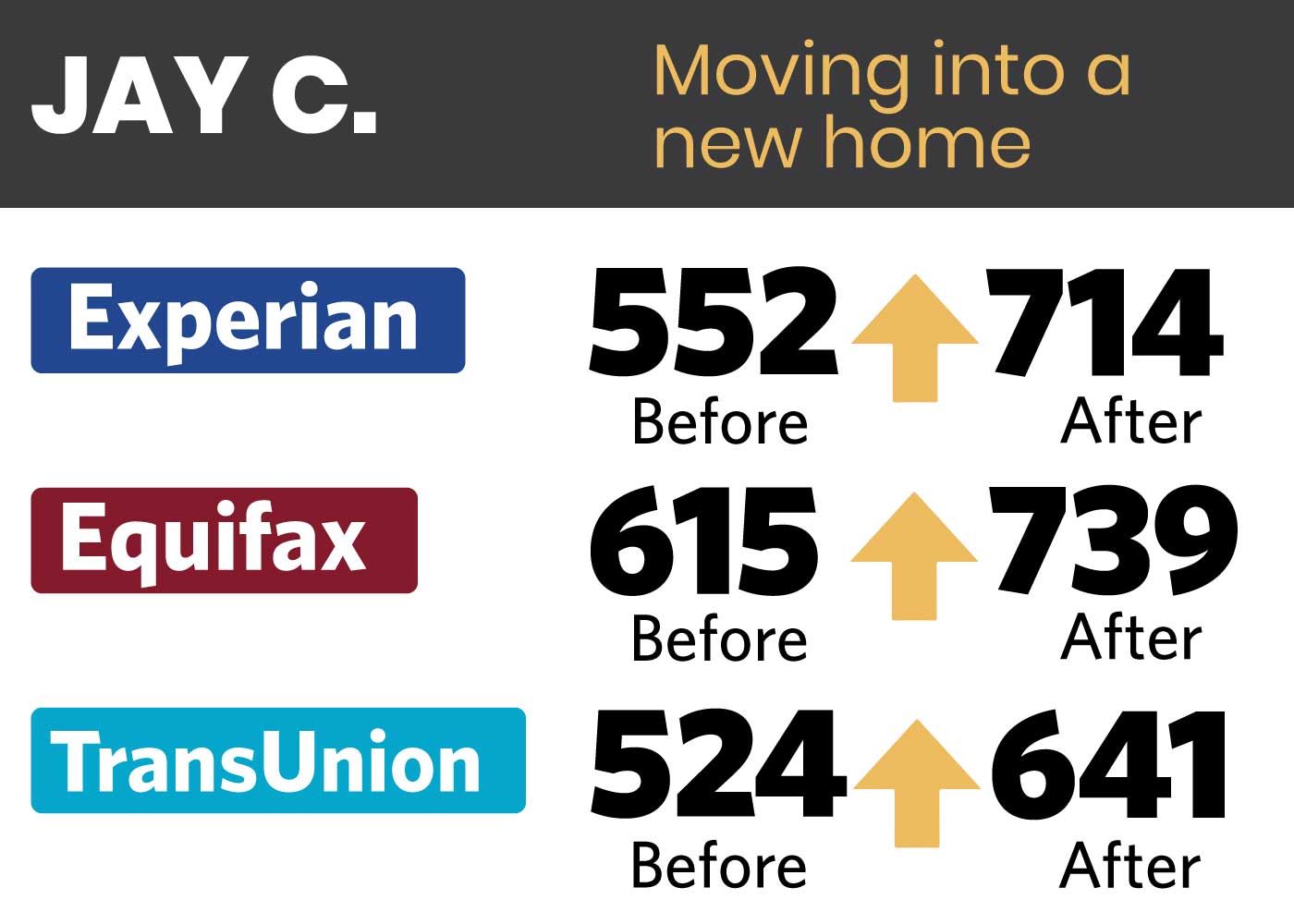

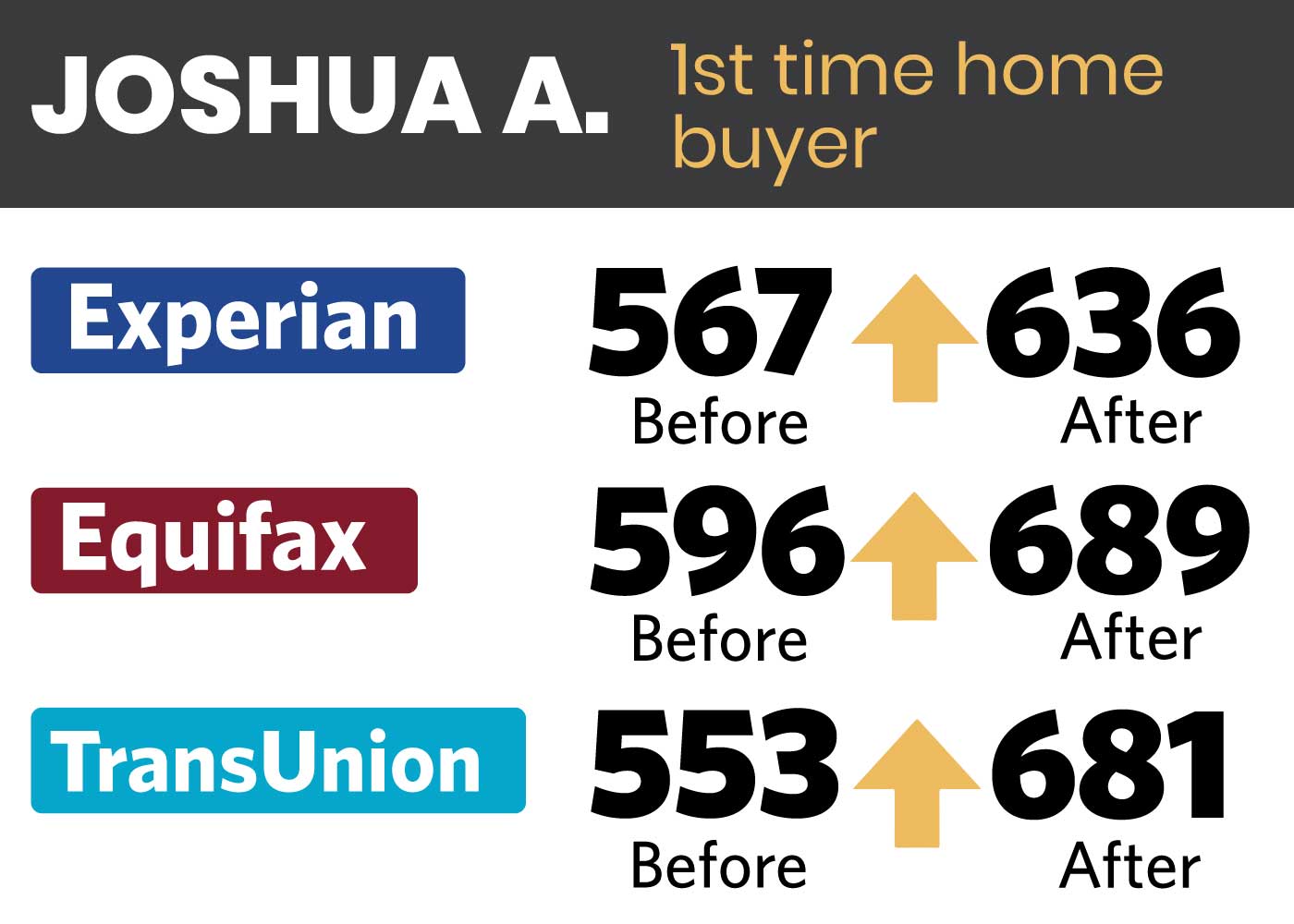

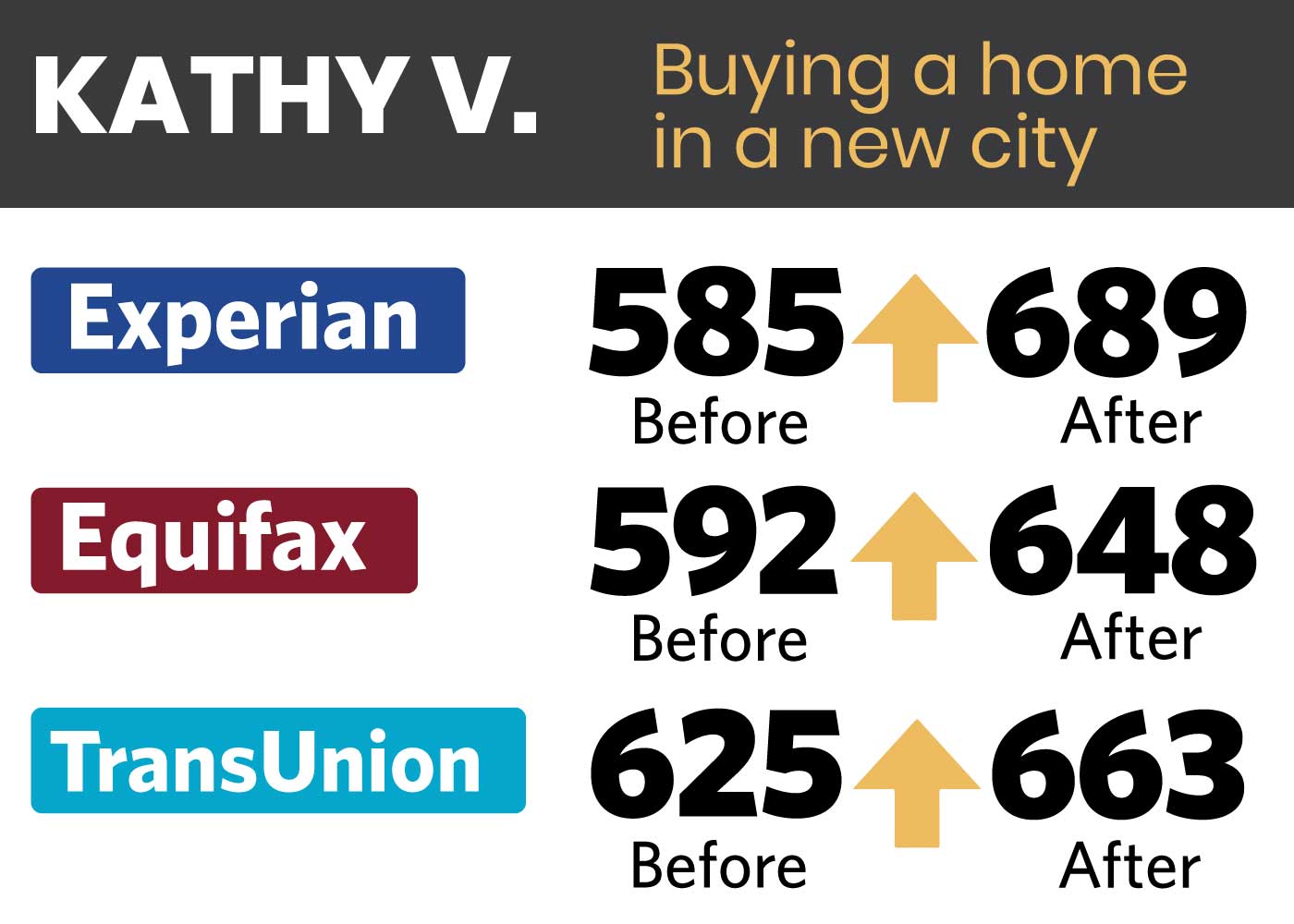

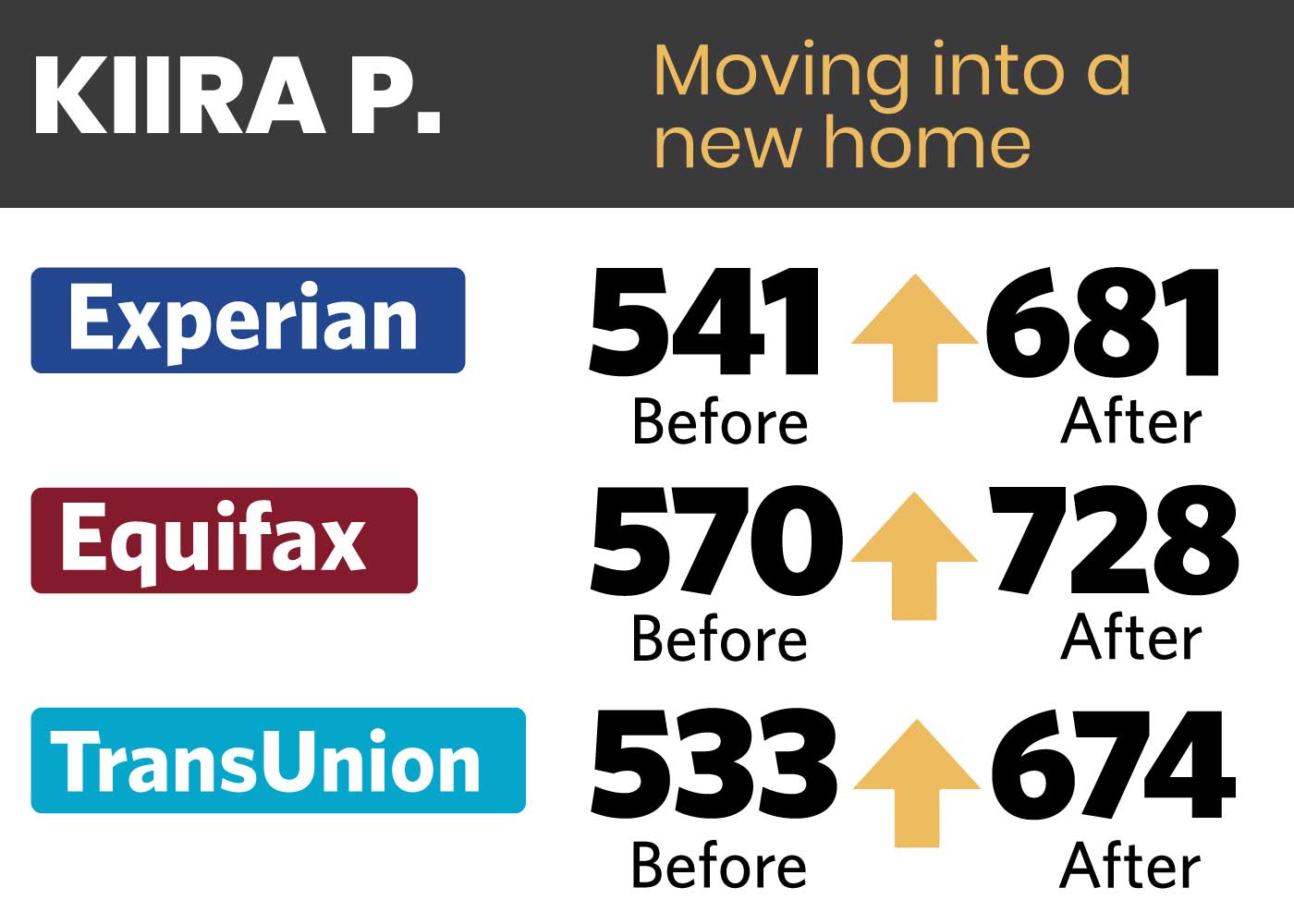

Credit repair consists of adding positive credit to your credit reports, while removing negative entries that lower your credit score. That leads to a higher credit score, which ranges from 300 to 850.

What is listed in your credit report? Your student loans, late payments, credit card history, bankruptcies – all of these things show up in the report. This data is gathered from three credit bureaus, called Equifax, Experian, and TransUnion. The bureaus are the ones that assign you the aforementioned credit score.

That information gives a picture of your financial responsibility, which is often an important factor to potential employers, landlords and creditors.

What Does a Good Credit Score Mean?

Unfortunately, we are often judged on our financial credibility by the number displayed in our credit report. At WJA, we don’t believe that one past misstep that lowered your score should be telling of your character and responsibility.

But, we live in competitive times, and that is why it’s crucial you receive good credit repair in Eugene, OR. You want to seem reliable to creditors in terms of being able to repay a loan. A higher credit score brings you closer to borrowing for that mortgage, settling a debt, and removing dispute codes in a shorter time.

For instance, if you have a credit score of more than 660, most creditors won’t have a problem with loaning you money. But here’s the catch – interest rates also depend on your credit score. And creditors don’t want you to have high scores.

Why? Well, even though they want to know you will be paying them back, they also want to charge you as much as possible. That is why traditional dispute letters don’t do much – the creditors’ goals aren’t really to improve your score.

White, Jacobs and Associates knows that you need a healthy credit score in order to get a chance at fair opportunities for loans, interest rates, renting properties, and jobs.

How WJA Hikes Up Your Credit Score

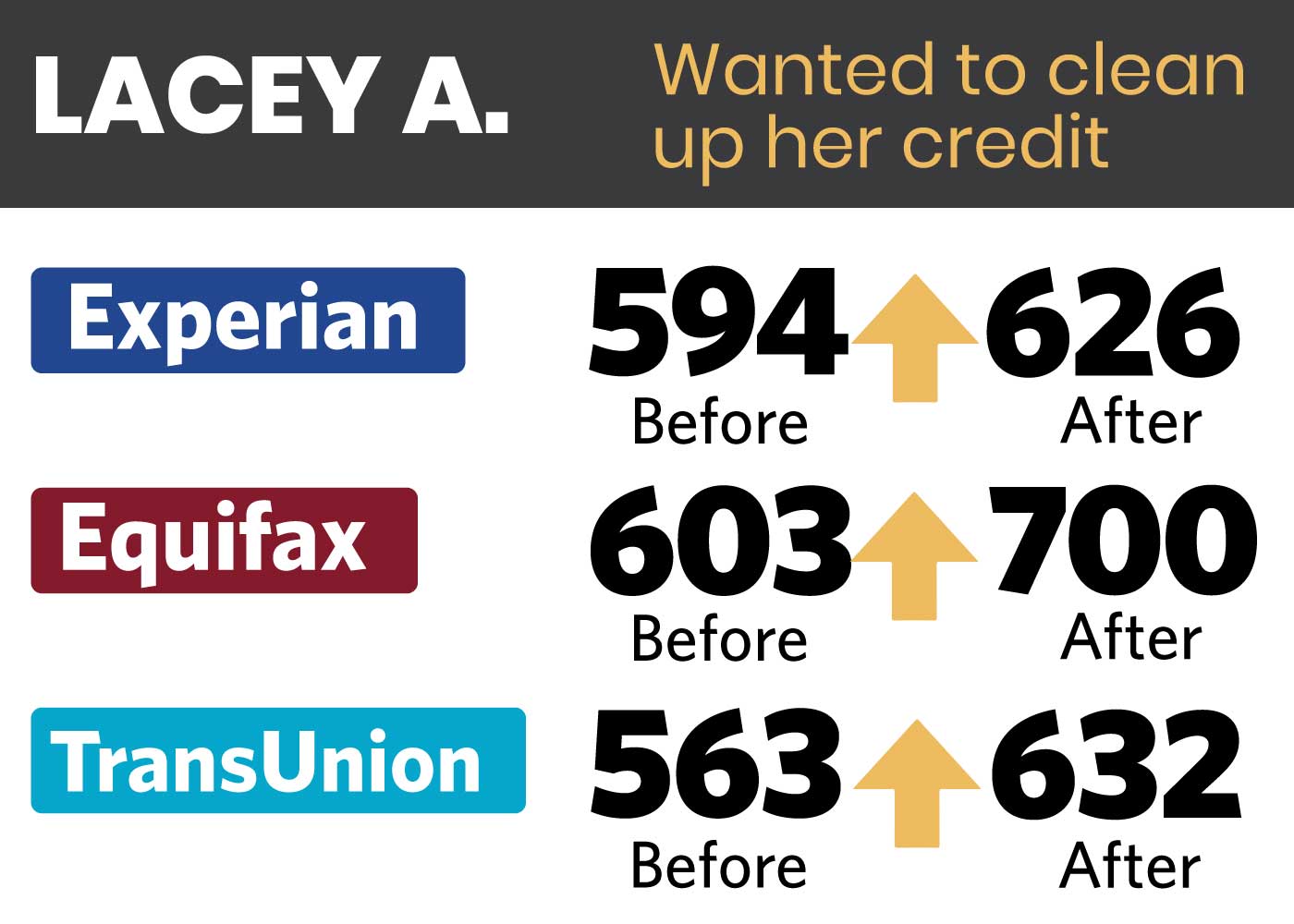

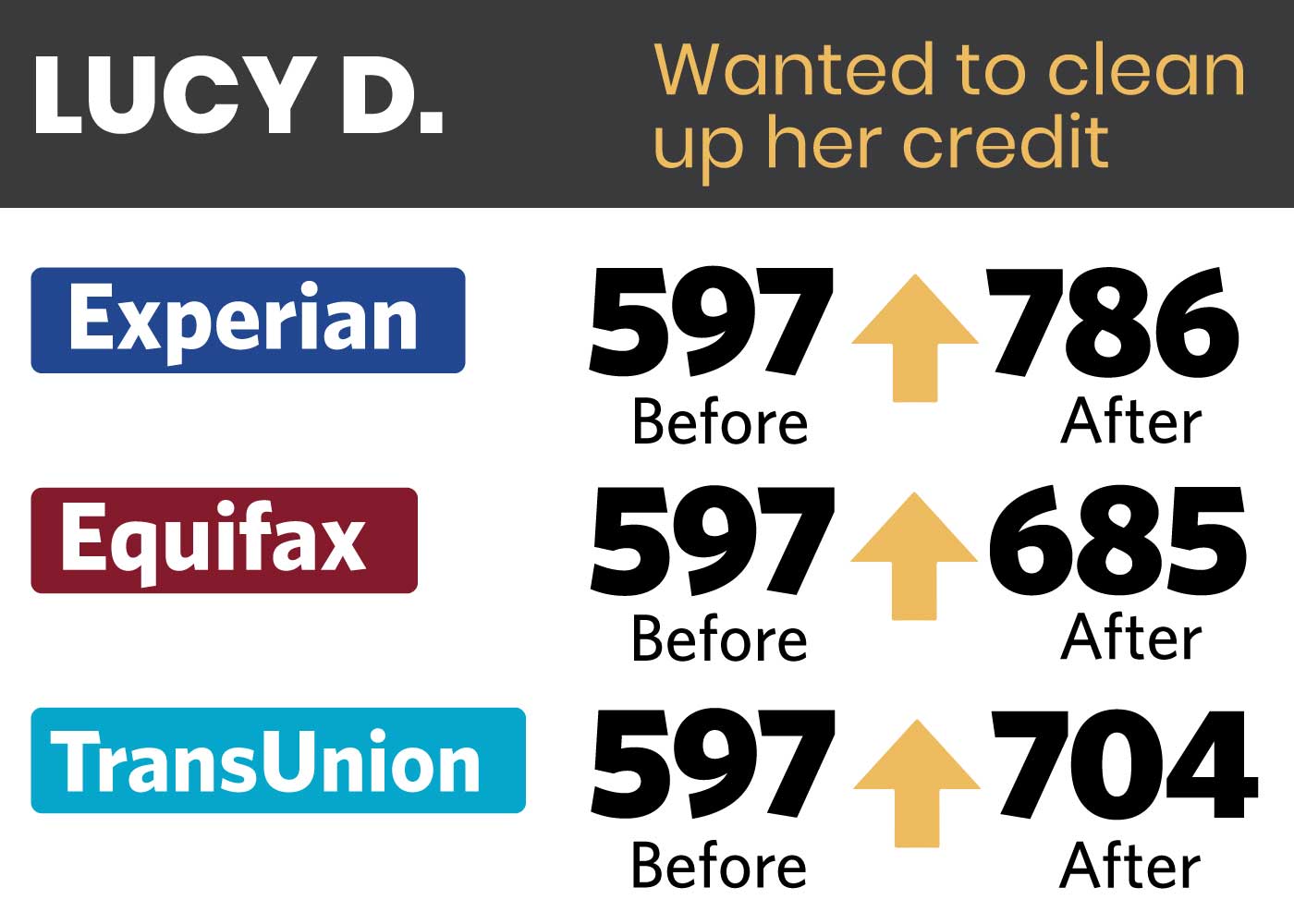

WJA’s process of credit repair in Eugene begins with a deep dive into your credit records. We work with a team of professionals, and one of them is assigned to you as your personal credit expert. Their role is letting you know if WJA is able to help you at all. While some credit repair companies knowingly take on cases they cannot help, we play a different game – one of fairness and transparency. If your credit is beyond repair, we let you know this from the start.

After you pass the assessment, we develop your customized credit repair plan. This is the first step of our aggressive and alternative 4-round approach for improving your credit health. During it, we send out written communication (we avoid using online methods on purpose) and diligently pursue creditors and bureaus for answers regarding the negative items on your report.

We don’t send out these dispute letters in a pro forma fashion – we audit creditors and bureaus, demanding that they verify all the information they have on you, and show us the proof. If they can’t do this, they are legally obliged to remove the negative entries.

In the meantime, we educate you on adding positive credit to build your credit as the negative items come off. By doing this, we aim to improve your credit situation in a twofold manner – removing negative and adding positive.

As the responses from creditors and bureaus come rolling back in, we begin analyzing them. This is where our Investigative Research (IR) team shines the most – they use their expertise in responding to the stall tactics and continue applying steady pressure.

One of the tactics we employ when communicating with creditors and bureaus is challenging their electronic system. We remind them that such programs are prone to mistakes, and we pressure them to correct any remaining negative items in your credit report.

How Long Does Credit Repair in Eugene Take?

You may start getting calls from creditors a month or two into our process (don’t fall for their tactics – ask them to send all communication via postal mail). As you start receiving responses in the mail, we ask that you send that correspondence to us so that our Investigative Research team can use that to craft the next round of responses. Most of our clients begin to see improvement in their credit score within 45-60 days.

Whichever your situation is, our process will never take more than 6 months. This is because White, Jacobs and Associates brings together alternative solutions, tradition, diligence and financial expertise into the credit repair arena.

Get Your Free WJA Consultation Now

Confused and don’t know where to begin? Get in touch with us today and get your free consultation. Our credit experts are on hand to assist you and give you all the information you need to begin your journey towards credit repair with WJA.

Schedule your Free Consultation & Analysis