Top Rated Credit Repair

Durham, North Carolina

Five star reviews

With thousands of happy clients on Google, Facebook, TrustPilot, and more, you will not find a stronger reputation. See how we are different!

Customized Plan

We don't just send out dispute letters like other companies. We customize our approach with personalized audits for maximum results.

One on One

You'll work with the same credit expert for the duration of the program. They will update you, coach you, and answer your questions.

Attorney Managed

Our attorney-managed, 4-round process is personalized for each client by an Investigative Research team, all at a reasonable cost.

Schedule your Free Consultation & Analysis

We protect your privacy. Your information is not shared with third parties.

By submitting this form, you agree to receive texts from White Jacobs and Associates. Ongoing communication before, during, and after the program will be initiated by our credit analysts and their assistants. Msg & data rates may apply. Msg frequency varies. Unsubscribe at any time by replying STOP or clicking the unsubscribe link (where available). Privacy Policy

Meet the team

We can help with...

- Charge-Offs

- Collections

- Bankruptcy

- Late Payments

- Repossessions

- Foreclosures

- Student Loans

- Dispute Code Removal

- Credit Coaching

- Re-establishing Credit

- Debt Settlement

Maybe you’re thinking about buying or renting a home or taking out a loan for a car. But what if your credit score is holding you back? At WJA, we have the best credit repair Durham has to offer.

Durham, North Carolina, has been hailed by Forbes as one of the best places for business and careers, while Vogue called it ‘North Carolina’s hippest city.’ So we understand if you’re planning a move here or already living there and planning a big financial decision.

What Exactly is Bad Credit?

A bad credit score can happen to anyone. We all make a financial misstep here and there, or maybe we trusted an institution or person we shouldn’t have. Unfortunately, these decisions and situations turn up on our credit report as an unfavorable credit score.

Your credit score tells potential lenders, possible employers, and other important players how much they can trust you finance-wise. There are multiple ways of scoring your financial decisions, and the most common ones are FICO and VantageScore.

The FICO model gives you a grade anywhere from 300 to 850. Good credit means that your credit score is valued at 690 and up. A bad credit score means that you are in the 300-629 range. So it’s evident that every point matters, and you need a good credit repair service by your side in Durham.

But how does lousy credit happen, exactly? A bad credit score is the result of negative items on your credit reports. Your payment history makes up 35% of your overall credit entries when scored with FICO, so it’s possible that you ended up in the negative credit zone due to late payments.

Another reason is high credit utilization. That means that you are not thinking through your credit card usage, maxing it out frequently. That can bring your credit balance close to the limit a lot of the time.

If you lack credit history, it could affect how bureaus and creditors see you since they don’t have enough information on your financial activities to analyze your situation. And if you have ever dealt with collection agencies, prepare to see your credit score take a plunge as a result.

Nursing Your Credit Score Back to Health

Let’s start with the obvious. To improve your credit score, make your payments on time and try not to max out your credit cards a lot. Next, try mixing it up a bit – the more active accounts you have, the better. Such a credit mix should consist of different kinds – car loans, revolving credit, student loans, and so on. Lenders look more favorably to those who have more than one account.

But there is only so much you can do alone. Credit repair agencies aim to help clients improve their credit scores by removing negative entries from credit reports. Negative items can show up on your credit report for seven years, like the collection accounts we mentioned earlier. Why wait all that time and potentially miss out on some life-changing opportunities like dream jobs, house buying, or studying at a college you always wanted to?

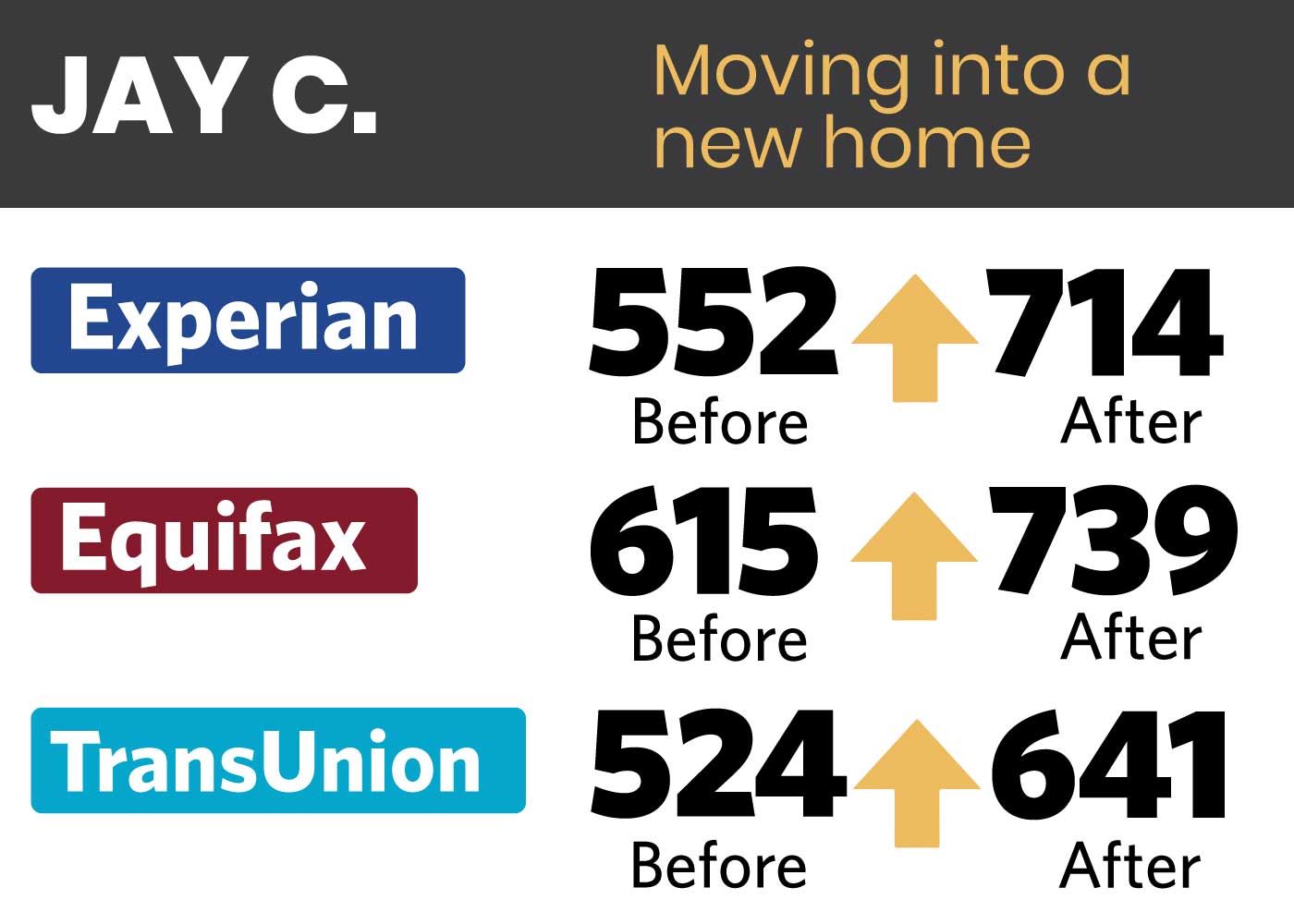

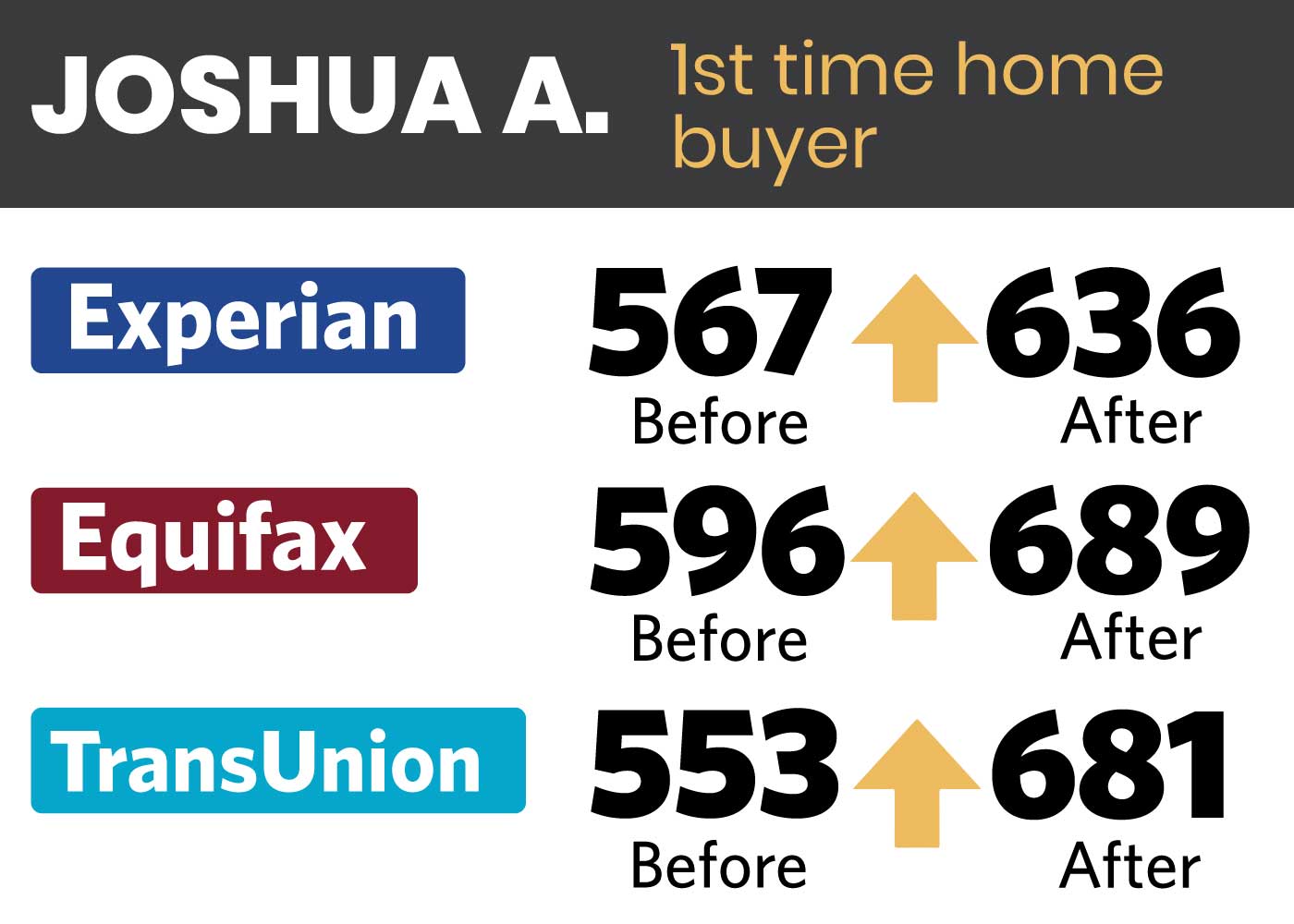

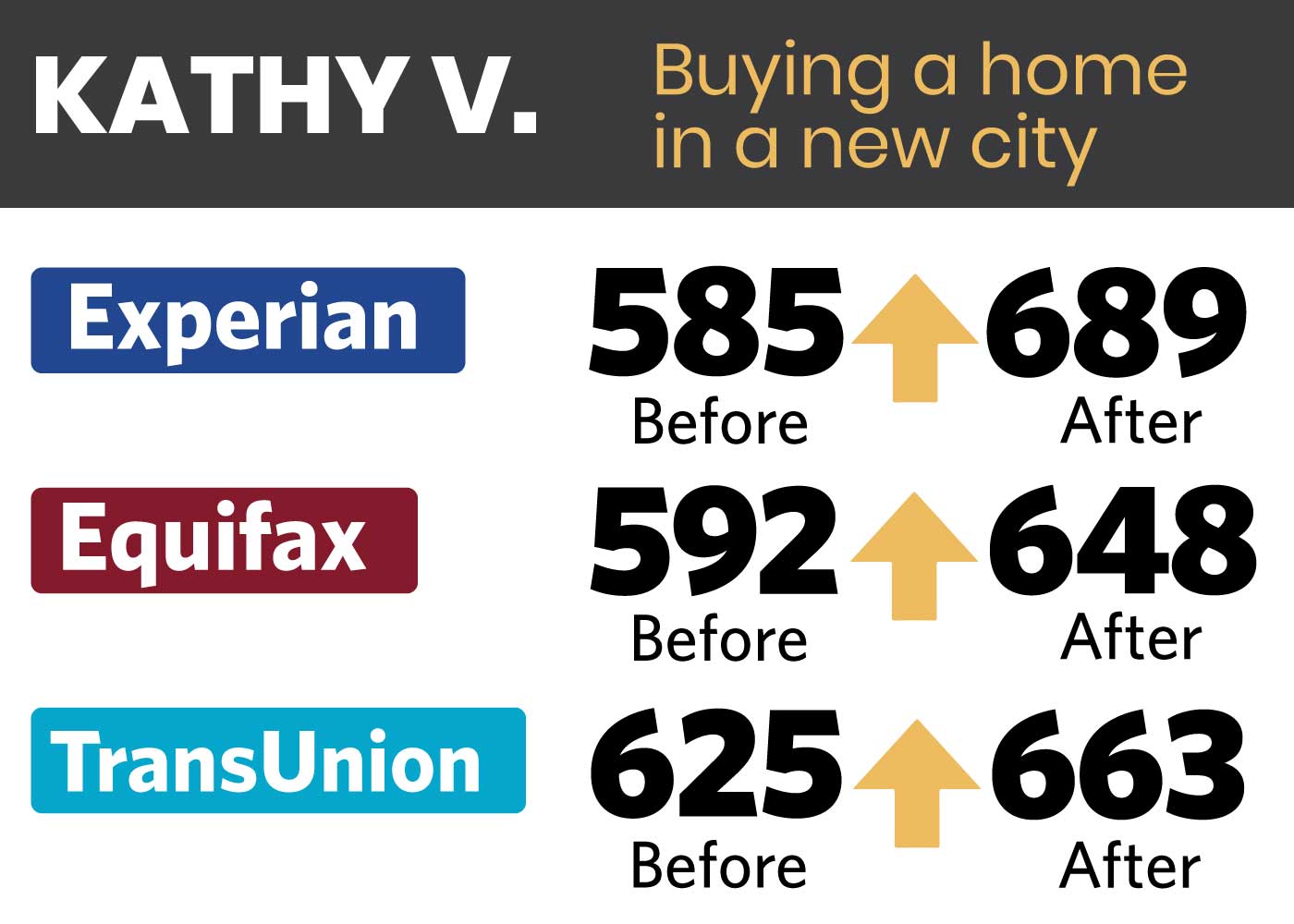

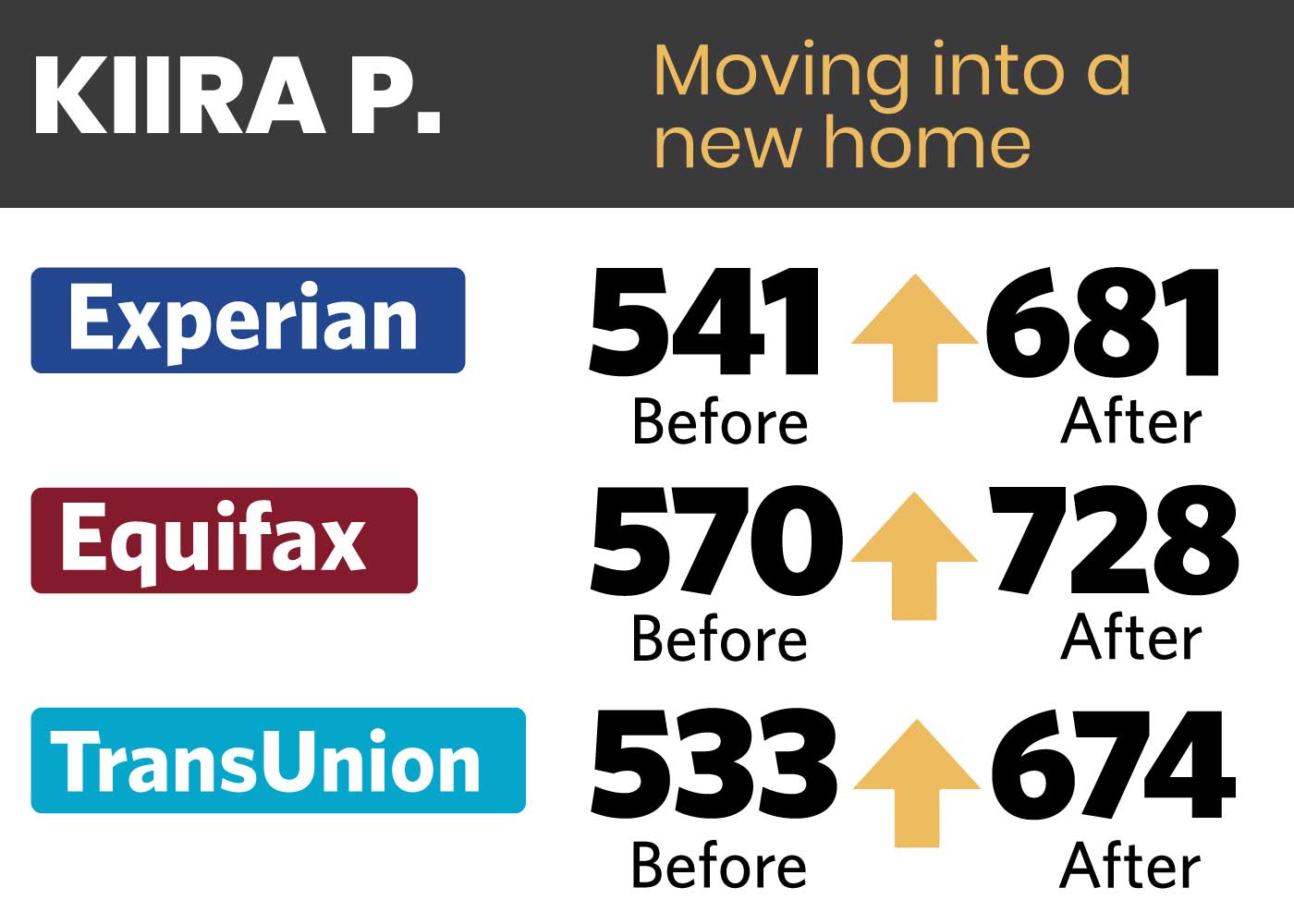

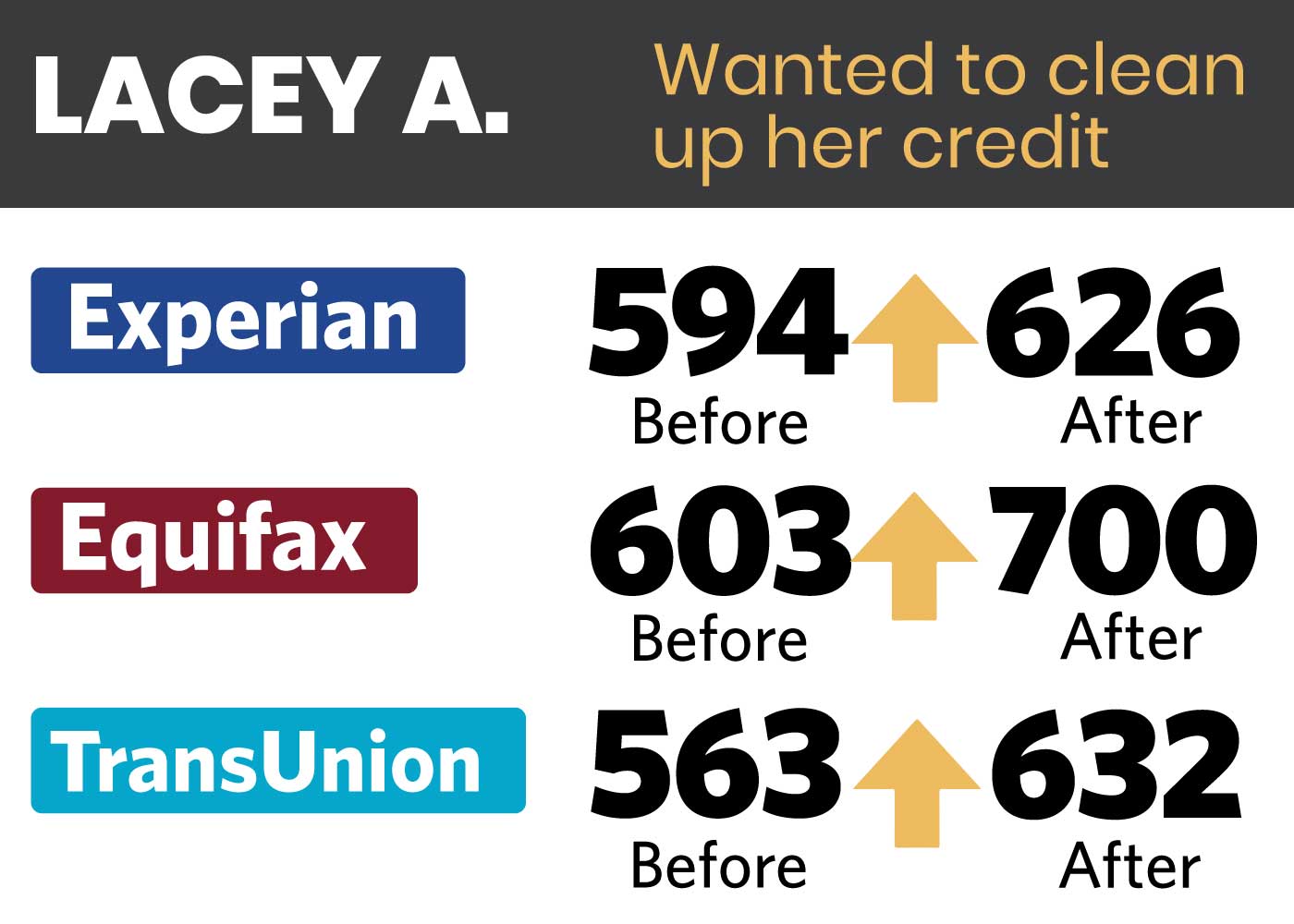

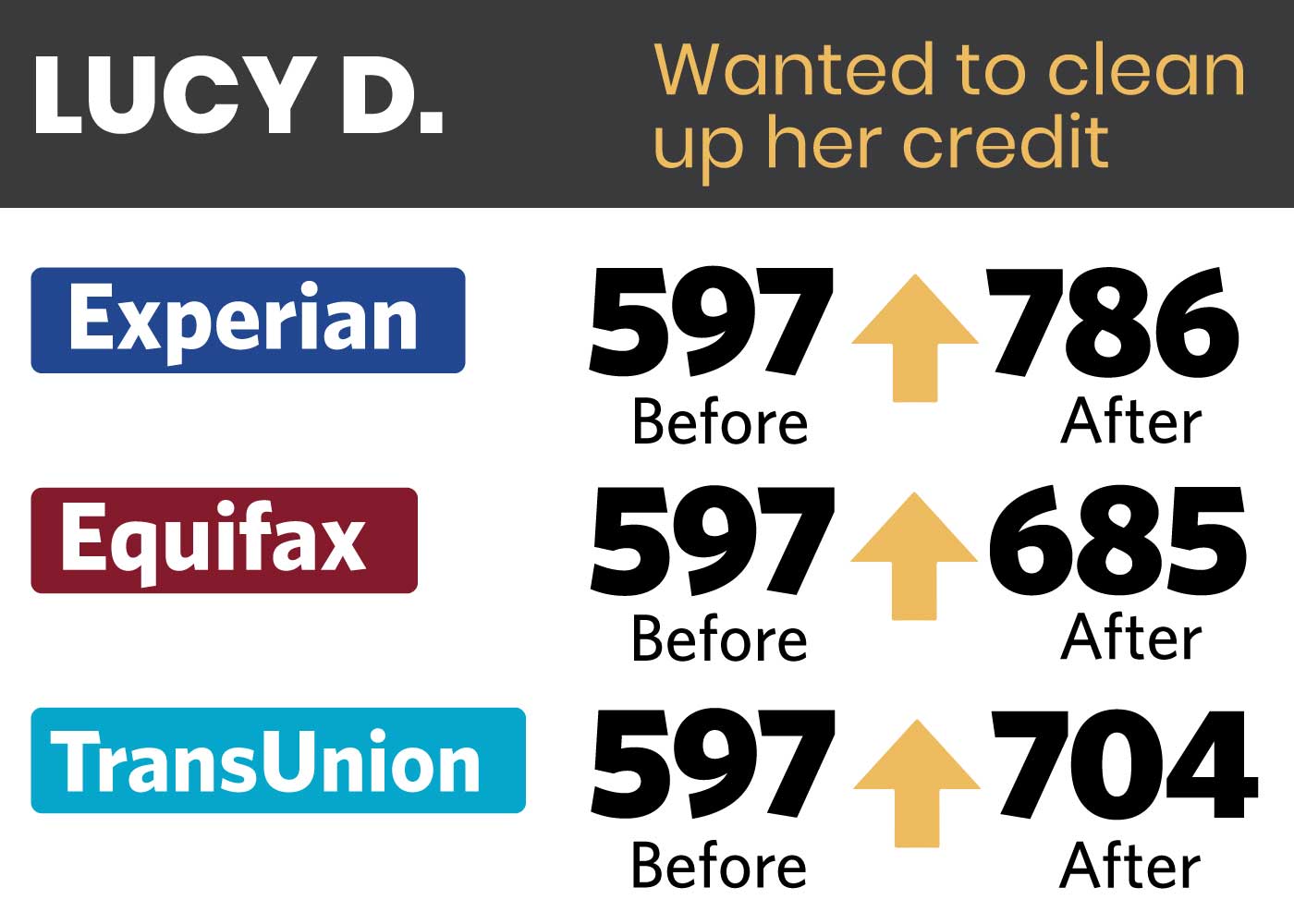

Our credit repair in Durham can be your sidekick in the mission to improve your credit. At WJA, we employ credit repair analysts and investigative researchers that go over each detail in your report. And we don’t just skim the surface – we contact and pursue creditors and bureaus who are responsible for questionable negative entries in your account. And we keep breathing down their necks until we’ve exhausted every option.

The White, Jacobs and Associates Credit Repair Method

Some credit repair companies in Durham offer instant results. By this, they usually mean that they take your hard-earned money, send out some disputes, and that’s it. That’s how far they go, and your credit score stays basically the same.

But at WJA, we do things differently. Where others use these traditional and scarce methods, we use an aggressive and alternative approach.

Our team has years of experience in credit repair in Durham. WJA’s services are backed by an investigative research (IR) team that put in the time to dive deep into each credit report to determine how to approach the creditors and bureaus that played a role in lowering your score. We don’t just send out formulaic dispute letters. We pursue financial players with customized letters and audits where it’s needed.

That way, we remove negative entries from your credit report, bringing your credit score up and getting your buying power back.

How Much Time Does Credit Repair Cost and Take?

Countless credit repair companies stretch out their process just to profit as much as they can from their clients. Their investigations go on for years while they bill you around $100 a month.

At WJA, we start by giving you a free consultation with our credit repair specialist. They assess your situation and tell you if we’re able to help your situation. Next, they lay out a blueprint for your credit repair, giving you a timeframe for our process.

While some clients start seeing changes as early as 45-60 days, our process will never take more than six months. That means that starting from today, you are just 180 days away from getting your buying power back.

We’re easy to talk to. We’re transparent. And we set the right expectations about your specific situation.

High-Quality Credit Repair in Durham, NC

If your credit score took a plunge, White, Jacobs and Associates takes a deep dive to bring it back. Contact us today, and let’s start working on getting your life back on track, one credit score entry at a time.

Schedule your Free Consultation & Analysis