Top Rated Credit Repair

Fort Worth, Texas

Five star reviews

With thousands of happy clients on Google, Facebook, TrustPilot, and more, you will not find a stronger reputation. See how we are different!

Customized Plan

We don't just send out dispute letters like other companies. We customize our approach with personalized audits for maximum results.

One on One

You'll work with the same credit expert for the duration of the program. They will update you, coach you, and answer your questions.

Attorney Managed

Our attorney-managed, 4-round process is personalized for each client by an Investigative Research team, all at a reasonable cost.

Schedule your Free Consultation & Analysis

We protect your privacy. Your information is not shared with third parties.

By submitting this form, you agree to receive texts from White Jacobs and Associates. Ongoing communication before, during, and after the program will be initiated by our credit analysts and their assistants. Msg & data rates may apply. Msg frequency varies. Unsubscribe at any time by replying STOP or clicking the unsubscribe link (where available). Privacy Policy

Meet the team

How We're Different

See what our customers are sayingWe can help with...

- Charge-Offs

- Collections

- Bankruptcy

- Late Payments

- Repossessions

- Foreclosures

- Student Loans

- Dispute Code Removal

- Credit Coaching

- Re-establishing Credit

- Debt Settlement

Fort Worth Credit Repair

Do you need to get approved for a mortgage, refinance, loan, etc., but can’t because there seems to be something wrong with your credit rating? Don’t worry. If you’re in the area, White, Jacobs & Associates (WJA) offers the credit repair Fort Worth deserves – we will do the messy work of engaging with the credit bureaus and directly with your creditors.

We have a strong reputation (just check out our reviews online) and a unique 4-round process that goes way beyond traditional methods of credit repair. Monthly disputes are NOT what we do (because you can do that yourself). Leave those traditional methods to the other guys.

How Is My Score Calculated?

In short, the three main credit bureaus (Experian, TransUnion, and Equifax) compile reports regarding your credit history. They include all of your financial history within the last 10 years. Based on the reports, you get assigned a numerical value, which is your credit score – you can look at it as how trustworthy they think you are to repay the money you borrow.

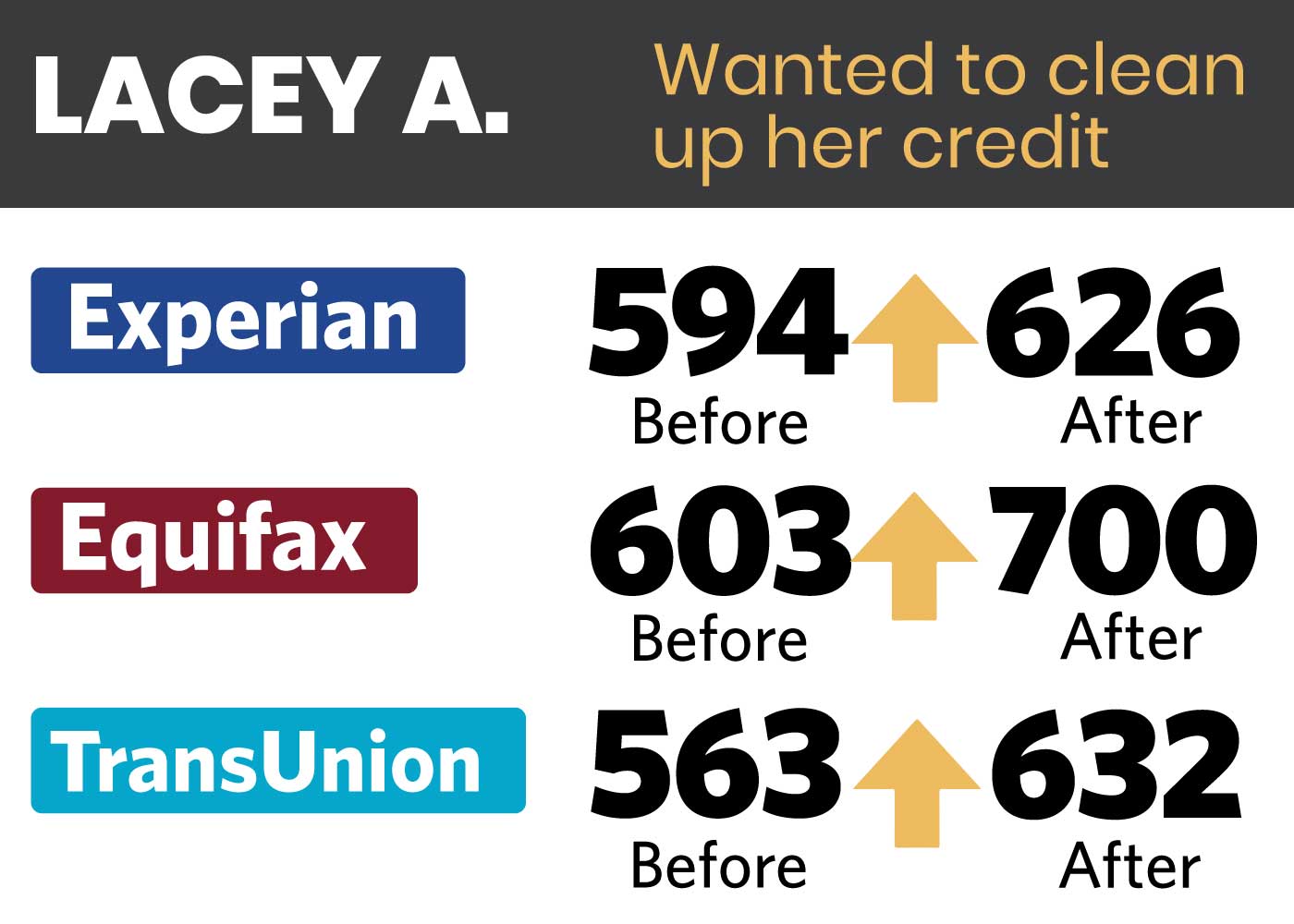

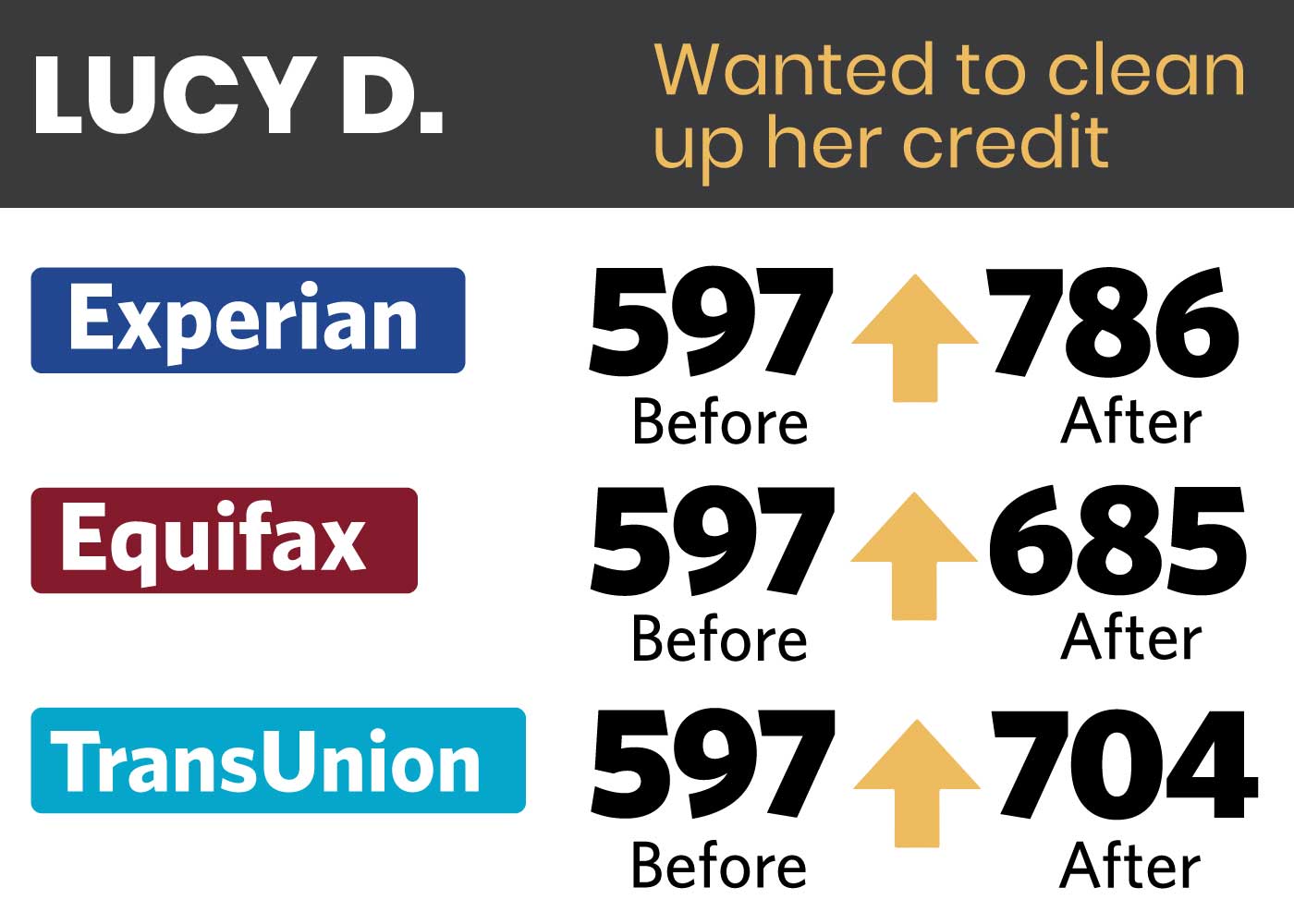

Because there are 3 bureaus, you have 3 credit scores. However, the bureaus don’t get credit information directly from you, but from your creditors, so mistakes or inaccuracies are common. The 3 scores should be similar – if they are not, something is off and we need to find out why. Any credit repair company worth their salt will analyze and compare the 3 scores.

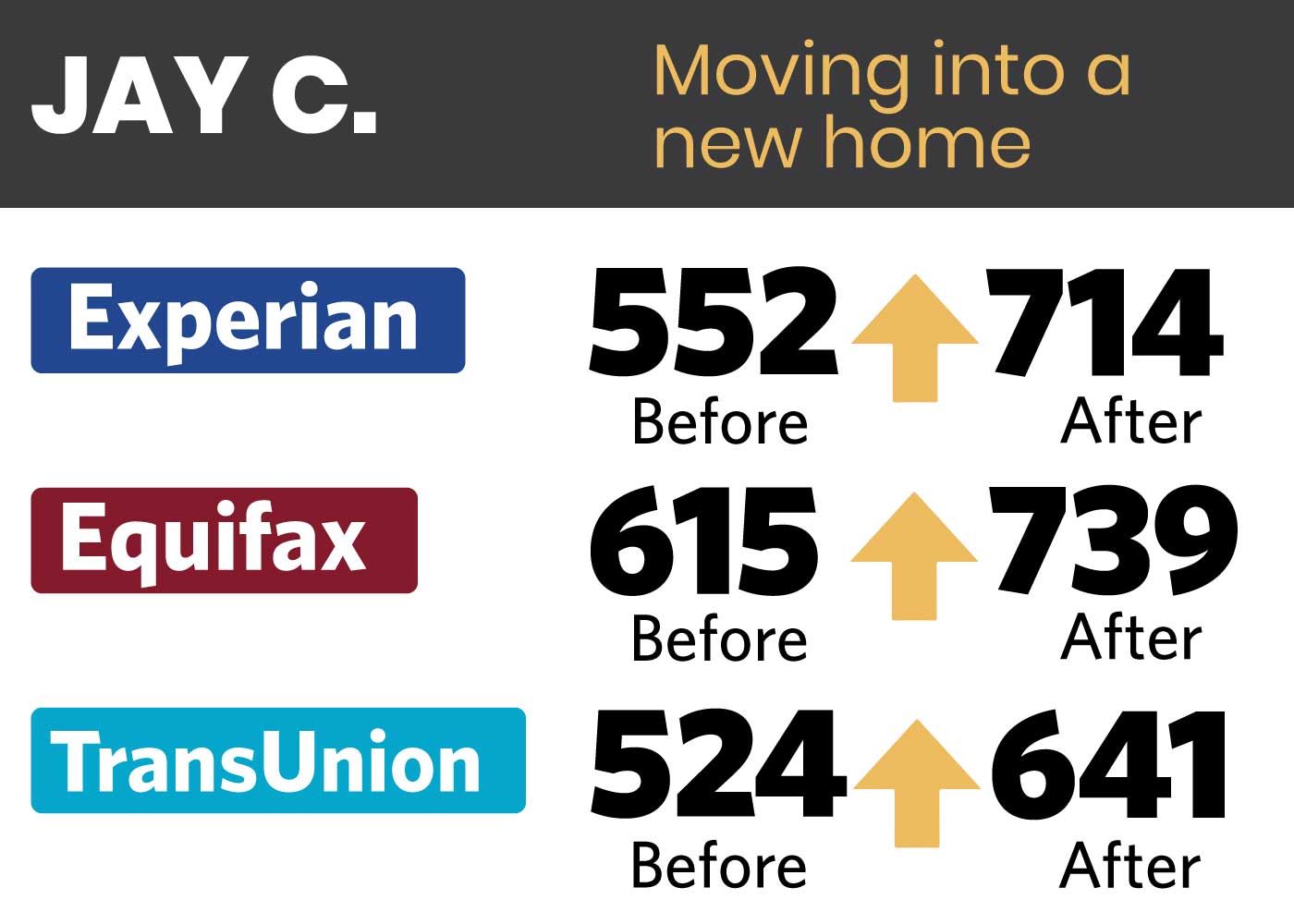

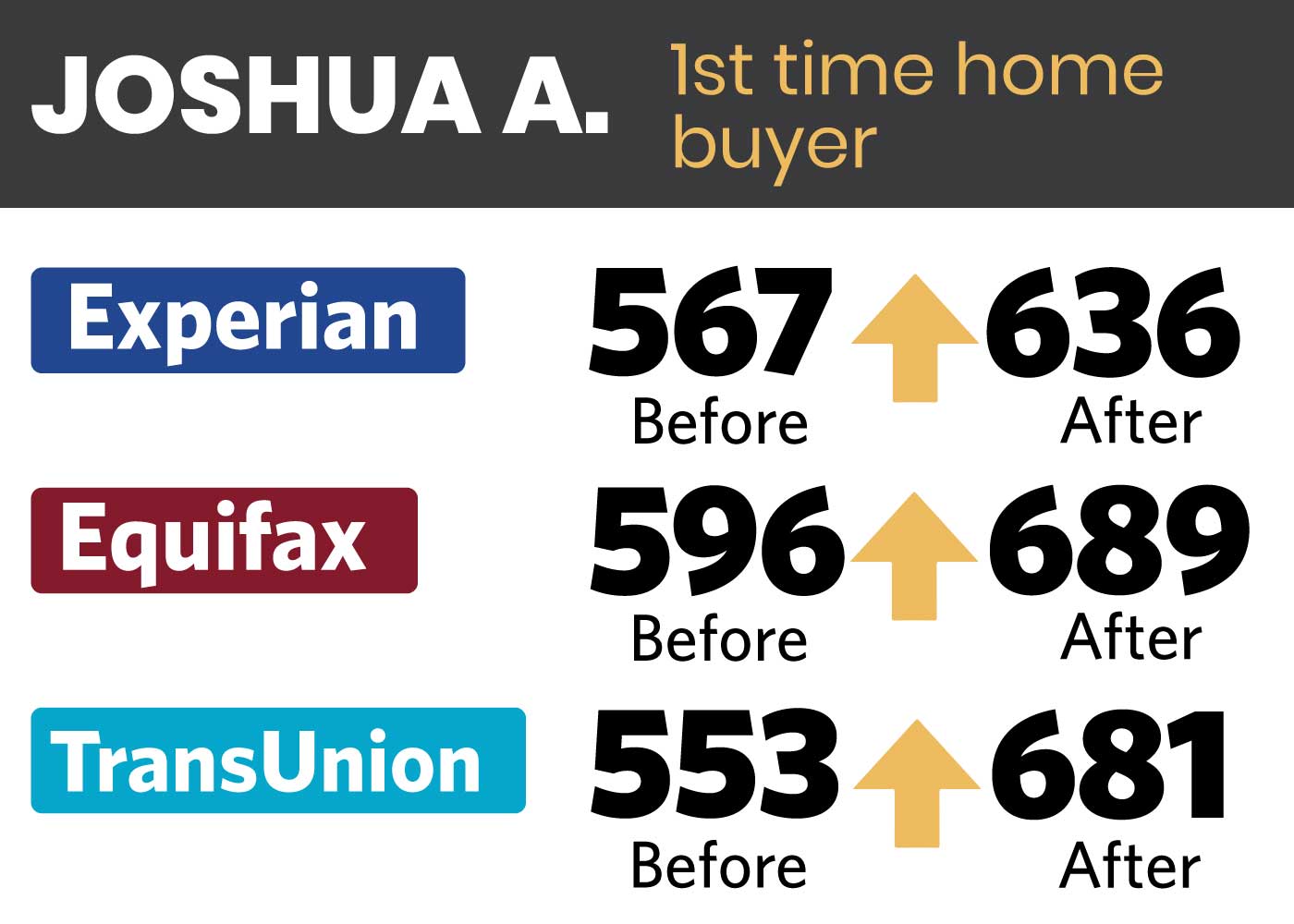

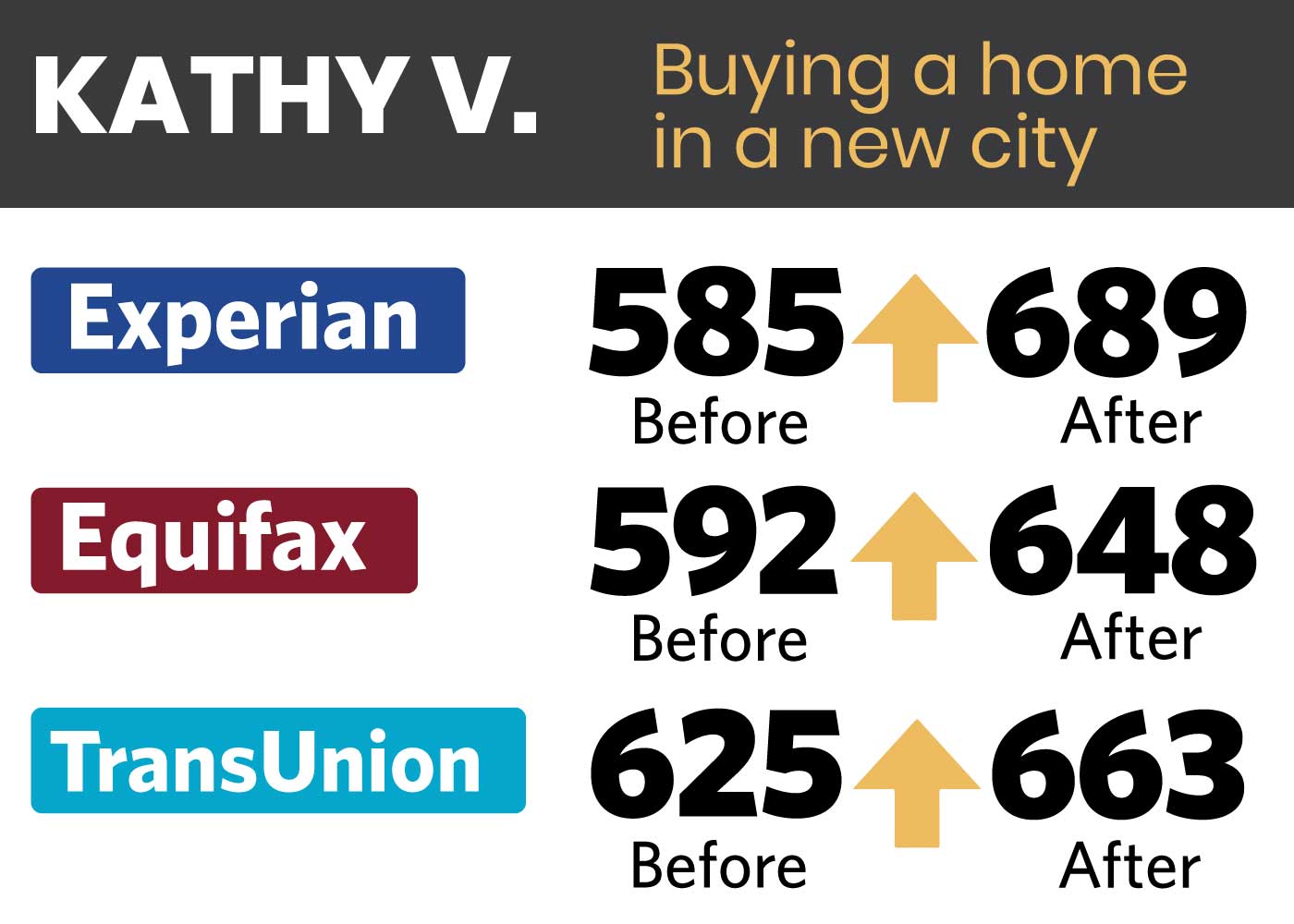

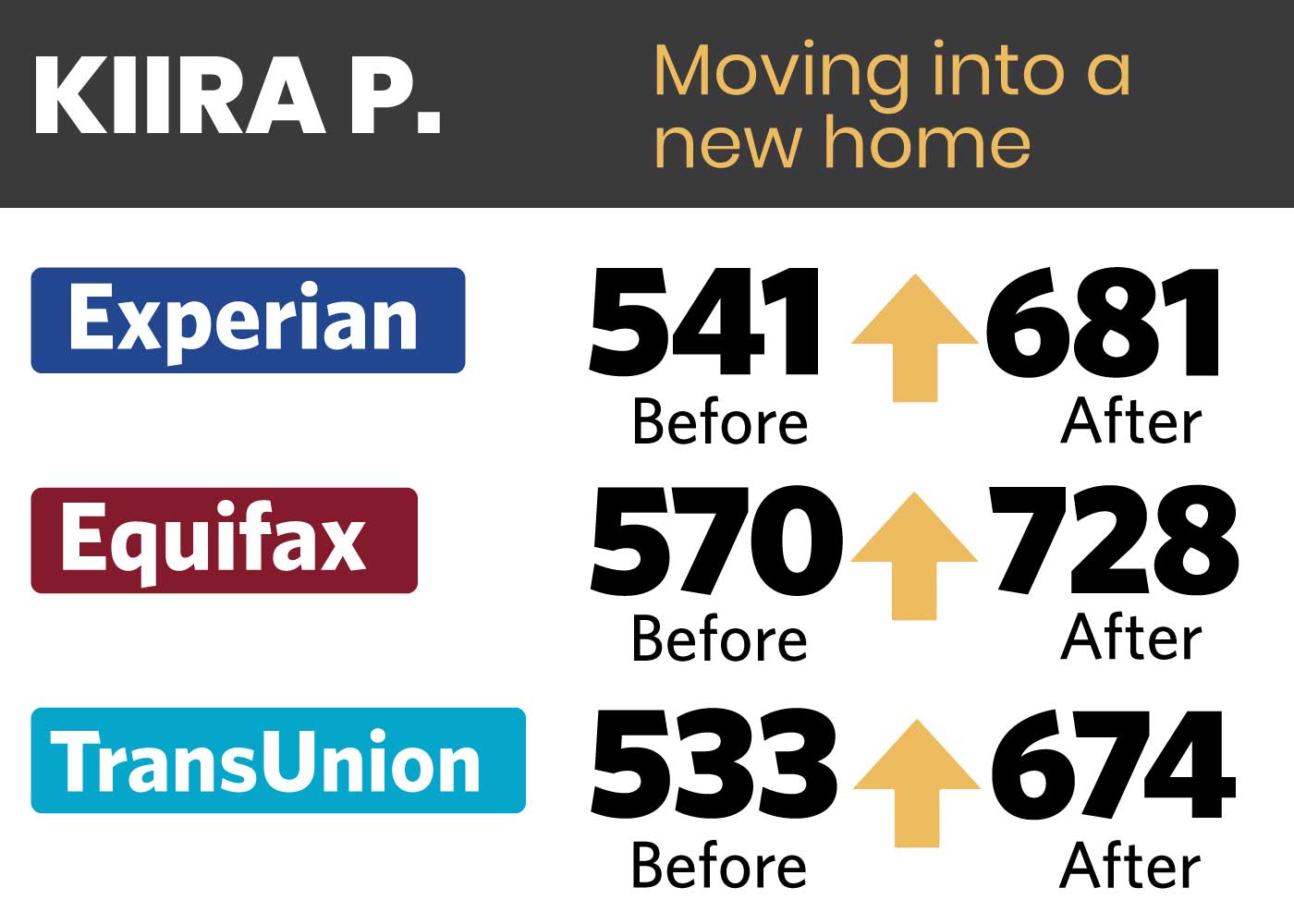

How Do We Raise Your Credit Score?

We leverage laws that protect you, the consumer, from unfair reporting. These include the Fair Credit Reporting Act (FCRA), Fair Debt Collection Practices Act (FDCPA), Fair Credit Billing Act (FCBA), Fair and Accurate Credit Transactions Act (FACTA), and HIPPA laws. In accordance with the laws, no outdated, incomplete, or inaccurate information can affect your score.

We work to remove the negative/inaccurate items on your credit report – such as collections, late payments, delinquent accounts (charge-offs), repossessions, bankruptcies, foreclosures, and fraud. We do this by initiating custom disputes with the credit bureaus (Experian, TransUnion, Equifax). More importantly – WJA audits your creditors, backed by our investigative research team.

We Do Credit Repair Fort Worth Differently Than 95% of Credit Companies

Most companies send generic, automated dispute letters on a monthly basis and charge an on-going fee (potentially for years). You could do this yourself! They DO NOT have any urgency to get results. Think about it. The longer you stay in their program, the more money they make!

They DO NOT audit creditors. Credit is complex. Using our investigative research team – we quickly assess the best way to respond to get results. They DO NOT utilize an investigative research team.

They DO NOT pair you with a credit analyst for the whole process. In contrast, WJA pairs you with your personal credit expert and the program lasts a maximum of 6 months, although clients typically start to see results in the first 45-60 days.

Right from the start, we go after all the relevant items on your credit report. Once we start receiving responses from the bureaus and the creditors – we customize our responses for subsequent rounds with our investigative research team. Read more about our process right here.

Two Ways to Raise Credit Scores. We Use Both

In addition to working on deleting negative/inaccurate items from your report, we also help you build positive credit if needed. We leverage 3rd party resources (which we coach you on) to add positive trade-lines to your report. It’s a significant piece of the credit puzzle.

Can You Do Credit Repair in Fort Worth on Your Own?

As we have stated, yes. In certain cases, you are better off on your own instead of wasting money on inept companies. If the best credit repair Fort Worth provides is sending dispute letters over and over again, it would be a shame if you were charged anything.

However, your creditors and the bureaus are bureaucratic leviathans and it can be hard to get through to them. They need to know you have the backing of professionals who are willing to take assertive actions to acknowledge you. On your own, you may be able to remove obvious inaccurate information, but it will take time and won’t be as effective. At WJA, we analyze your reports and go after every item possible to improve your score.

Your Financial Situation is Unique. We’d Like to Hear It

It happens to everyone. You may have had a series of unfortunate events or a single devastating blow – a death in the family, job loss, medical emergency, student loan debt, bad financial advice, identity theft, general debt, or even incorrect profile information at the credit bureau level.

It’s not uncommon. Many of us have gone through one or more of these situations.

And maybe it really didn’t matter that your credit score was low until you decided to apply for a home, a vehicle, a credit card, or employment. You were either turned down, or you could only qualify for a high interest rate.

That’s when it really hurts. And that’s where our mission comes from.

Let’s Get a Little Technical. How Does an Item Get Removed From Your Credit Report?

If the credit bureaus or creditor cannot verify or prove an item of debt in your credit history, then that item has to be deleted from your report. Also, if certain letters are not answered within the time limit set by law, then the items specified therein have to be removed, in turn improving your credit scores.

Unfortunately, credit bureaus have been known to routinely disregard dispute letters, especially if sent directly by consumers. In most cases, our escalated anti-stall-tactic letters, crafted with years of experience, elicit a response from the rating agencies or the creditors.

Disputed or audited items that are successfully deleted from your credit history should be reflected in your new credit rating report, increasing your score. In any event, credit repair is a time-consuming step-by-step and item-by-item process that requires patience, persistence, and determination. That’s why we have an entire investigative research team dedicated to reviewing your information.

A No-Cost Credit Review & Consultation

The best things in life are free. It won’t cost you a dime to speak with one of our experts about your situation. We’re upfront about the results you can expect from our program. If we don’t think you’re a good fit and our methods can’t improve your score, we’ll tell you. We have an amazing word-of-mouth reputation, and we plan to keep it that way. The last thing we want is a disappointed client. Why not reach out to us today?

Local Resources: Consumer Laws

- FCRA (Fair Credit Reporting Act)

- FDCPA (Fair Debt Collection Practices Act)

- FACTA (Fair and Accurate Credit Transaction Act)

- HIPAA (Health Information Portability and Accountability Act)

- E OSCAR (Online Solution for Complete and Accurate Reporting)

Schedule your Free Consultation & Analysis